Last week’s newsletter hinted that November could be a rollercoaster ride in the interest rate department. But guess what? The thrill ride started early! Rates skyrocketed to kick off the new week, leaving analysts scratching their heads and muttering, “What just happened?”

Some folks blamed election buzz, while others thought traders were getting ready for the big events around the corner. Either way, Monday’s rate hike—over an eighth of a percent in one leap—is the financial equivalent of your alarm clock jumping out of bed without hitting snooze. It’s rare to see such a jump without a big, neon sign pointing to the reason why.

After peaking mid-week, rates took a tiny baby step down. Fingers crossed this means they’re resting here until the next major market shake-up comes along.

Why cross your fingers? Because, in finance, the future likes to keep everyone guessing. But we do know a couple of things:

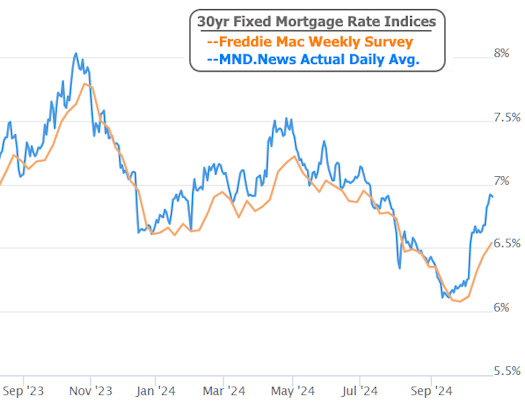

First, rates have gone up a lot more than your nightly news anchor will admit. Weekly reports are showing a rise of around 0.40%, but the actual increase in daily rates? Over 0.70%!

Coming up, we’ve got the jobs report next Friday—a classic volatility trigger. And if that’s not enough excitement, the week after brings an election, followed by a Fed announcement. Get ready for market fireworks, folks! Remember, volatility can go either way, depending on what these big reveals bring.

Highlights from this week’s economic and housing data:

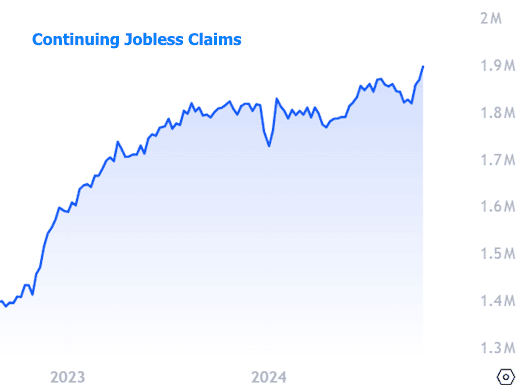

The bond market had its biggest reaction to weekly jobless claims data. Claims came in lower than expected, which pushed yields up. But there’s a twist: “continuing claims” (those filing for unemployment beyond the first week) hit their highest level in years.

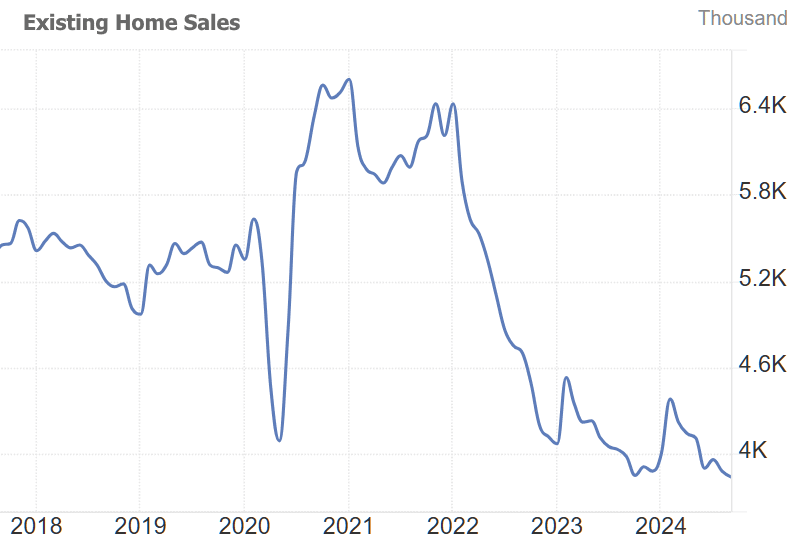

In housing news, Existing Home Sales came in lower than anticipated, sticking around the lowest levels we’ve seen since the Great Financial Crisis (so, you know, no big deal or anything).

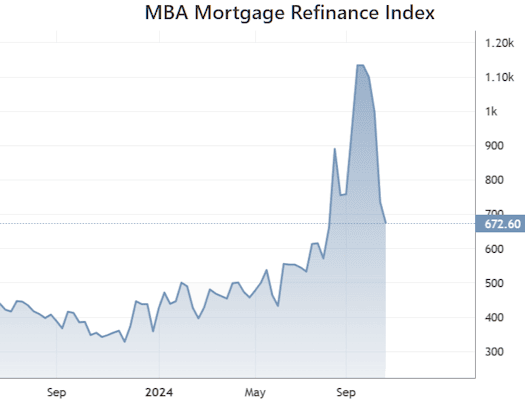

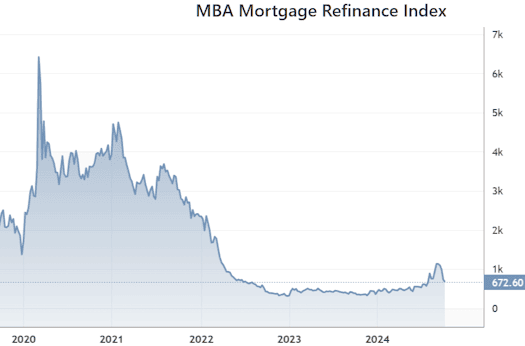

Meanwhile, weekly mortgage application data was making waves in the news last month, thanks to a rate drop in September that got refinancing applications buzzing again. However, October’s rate spike brought that buzz back down in a hurry.

As intense as the chart above might look, it’s all small potatoes in the grand scheme of refinancing. The latest data barely moves the needle compared to past refinance booms.

So, grab some popcorn—these next few weeks will be a show for the books!