The bond market (and therefore interest rates) came into the current week with a bit of a bias. Even after accounting for other variables, there was a predisposition to focus on data that was good for rates and minimize the data that pushed back. At least, that was the case until Friday’s jobs report.

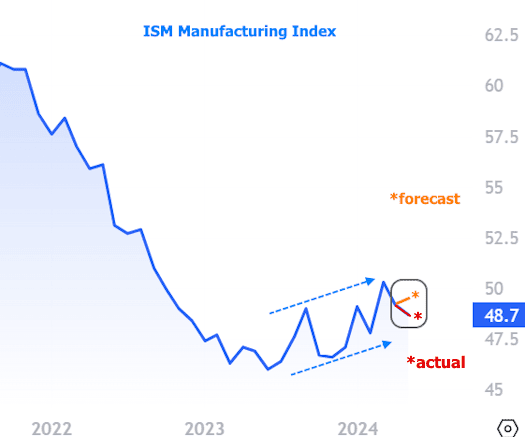

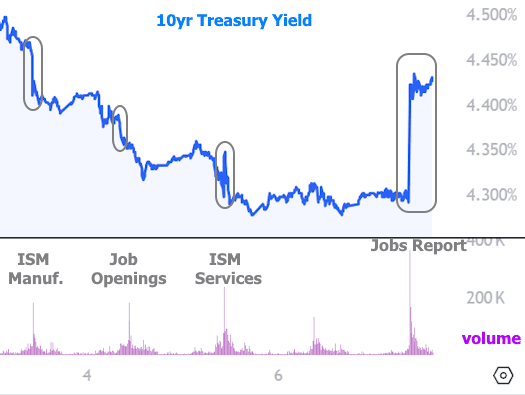

Monday’s most notable report was the Manufacturing PMI (a “purchasing managers index” that generally measures expansion/contraction) published by ISM. It was only slightly weaker than expected (and still well within the prevailing trend, marked by the dotted lines in the chart below), but the bond market reacted as if it were a big victory, with yields falling at the fastest pace in several weeks.

n fact, the size of the reaction to Monday’s ISM data is one of the best reasons to investigate other variables. These could include follow-through momentum from last Friday’s rate-friendly reaction to the PCE inflation data, as well as more esoteric motivations surrounding the change of one calendar month to the next.

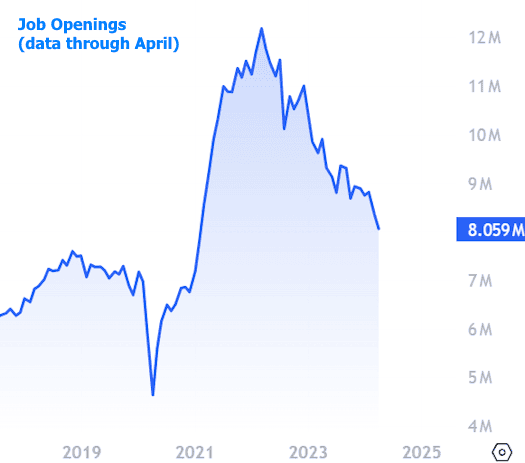

If other variables were a factor, it meant rates could probably endure some economic data that was less than rate-friendly. With Tuesday’s Job Openings numbers coming in lower (i.e., good for rates), it wasn’t until Wednesday that bonds were put to the test.

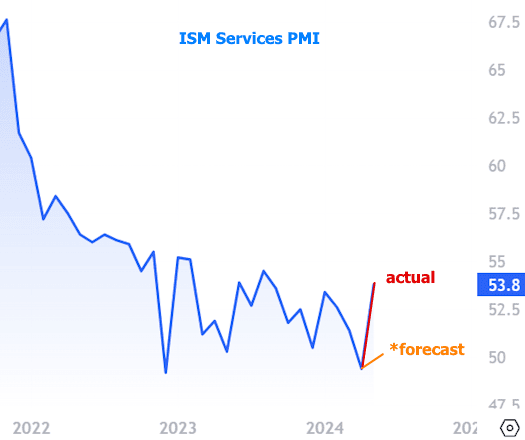

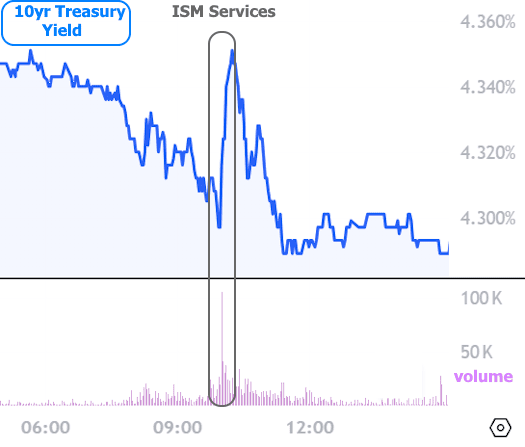

Wednesday brought the service sector version of the ISM PMI data, shockingly titled “Services PMI.” The bond market tends to react to this one more than the manufacturing version, so traders had plenty to consider when the numbers came out much higher than expected (i.e., bad for rates).

Stronger is higher when it comes to economic data’s impact on interest rates, all other things being equal. This was no exception, at least at first.

As seen in the chart above, bond yields (which correlate with interest rate momentum) spiked when the data came out, but then miraculously recovered. It’s hard, if not impossible, to make a case for this recovery by pointing to other aspects of the ISM report. In other words, the bond market was indeed confirming a bit of a predisposition to pay attention to rate-friendly news and minimize the unfriendly news.

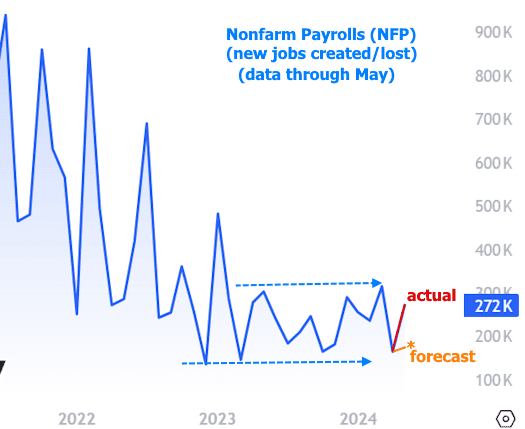

That predisposition was put to the test in a major way with the week’s most significant economic report on Friday. Nonfarm Payrolls (NFP) is the headline component of the Labor Department’s Employment Situation report. There are many reports that pertain to the jobs market, but this one is infinitely more important than the rest. This time around, NFP came in much higher than expected.

While the chart of nonfarm payrolls looks range-bound, and while the job count has been much higher in the past few years, Friday’s result of 272k represented an uncommonly large “beat” versus the median forecast of 185k and a big jump from the previous reading of 165k.

A move like this makes it seem like the labor market is too resilient to offer much help to the inflation problem (more jobs, more money, more spending, etc.). Finally, the bond market had been presented with evidence that it couldn’t ignore.

With that, mortgage rates had their first (and only) motivation of the week to move higher.

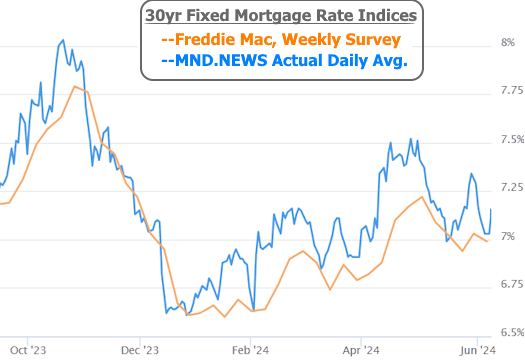

We’ll use a mortgage rate chart to illustrate the silver lining. Specifically, even though rates jumped on Friday, they’re not even halfway back to last week’s highs, let alone the higher highs seen at the end of April. Part of the justification for such resilience is that the bond market will defer to inflation data (and the Fed’s interpretation of it) above all else in deciding how worried to be about impediments to lower rates.

On that note, the timing couldn’t be much more highly charged. Next Tuesday brings the Consumer Price Index (CPI), which is the only economic report on any given month that’s been more of a market mover than the Employment Situation in the current environment. One day later, we’ll get an updated “dot plot” from the Federal Reserve (a chart of each Fed member’s projections for the Fed Funds Rate for the end of the year and the next few years).

The Fed will also be releasing a policy statement, but there’s no chance of a rate cut/hike this time. As such, the market’s reaction to Fed Day will be all about the dots and Fed Chair Powell’s customary press conference that follows 30 minutes later.