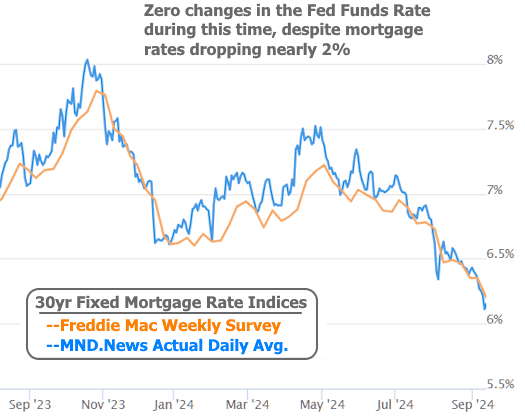

It’s almost a done deal—the Fed is going to cut rates on Wednesday, September 18th. Sounds thrilling, right? Well, don’t get too excited because mortgage rates have already beaten them to the punch and enjoyed the benefits.

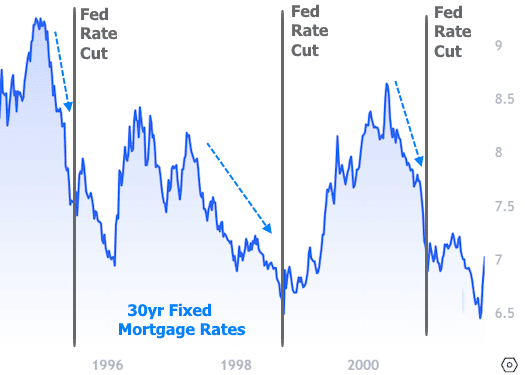

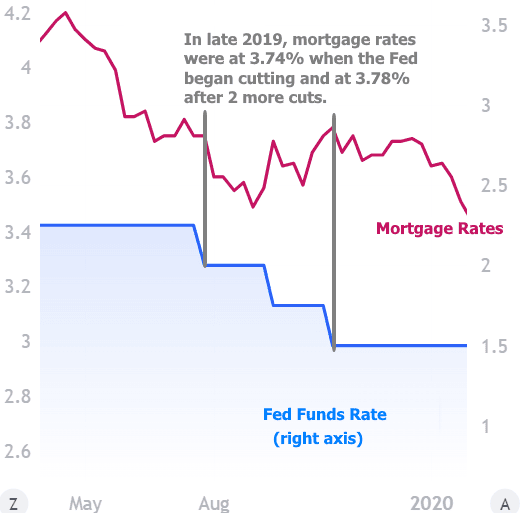

If you’re wondering how this all works, think about the countless times mortgage rates have dropped before the Fed cut rates and then increased right after. Confusing? Stick with me.

If you missed the last couple of newsletters, they’re like the cheat sheets you need to grasp why this happens. They’ll get you up to speed:

- Why You Might Regret Waiting For Better Rates After The Fed Cuts

- Here’s Exactly What a Fed Rate Cut Will Do For Mortgage Rates

But for those of you who’d rather not click around, here’s the quick and dirty version:

- Mortgage rates can change every day, while the Fed only checks in every 6 weeks.

- The Fed basically sends out spoiler alerts on what it’s planning to do.

- Financial markets make bets on how big those rate cuts will be.

- These bets influence other bonds, like the ones tied to mortgage rates.

- So, if the Fed says they’ll cut rates, and the markets are already betting on it, mortgage rates have likely already adjusted.

But wait, there’s more! Fed Day is still worth watching, especially this time, because it’s one of the most unpredictable ones in a while.

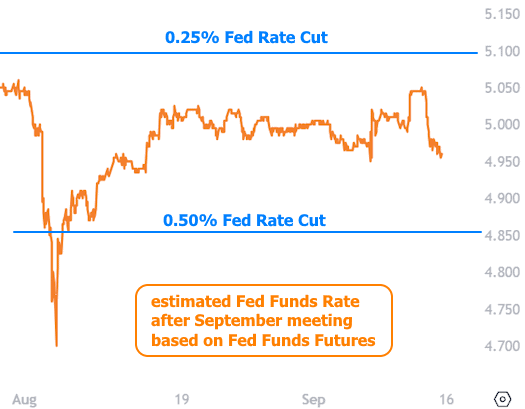

We’ve been talking about the Fed cutting rates, but what we haven’t touched on much is how much they’re going to cut. This time, it’s like flipping a coin between a 0.25% cut and a 0.50% cut. With the market split down the middle, someone’s going to be surprised—and that’s when things can get wild.

Earlier in the week, it didn’t seem like we’d end up in this coin toss, but then a Wall Street Journal article dropped, stirring the pot and making us all rethink our bets.

Now, if the Fed just cuts rates by 0.25%, it could actually make mortgage rates go up. If they cut by 0.50%, we might see the opposite. But here’s the kicker: some investors might think 0.25% isn’t enough, leading to recession fears, which could actually bring mortgage rates down despite the smaller cut.

On the flip side, if the Fed cuts by 0.50%, some investors could panic that it’s too much, fearing inflation or an overheated economy. And guess what? That could push mortgage rates up—even with the bigger cut.

But hold on—the rate cut is just one part of the whole show. At the same time, the Fed drops two other important documents. First, there’s the policy statement with all the juicy details around the rate cut. Then, there’s the SEP (Summary of Economic Projections), which comes with everyone’s favorite: the dot plot. This shows where each Fed member thinks rates should go in the future, and it’s become such a big deal that traders practically cheer when someone mentions “the dots!”

But wait, there’s more! Fed Chair Powell also holds a press conference at 2:30 pm, where he gives us all a chance to dissect his every word and look for hidden clues.

So, to recap, we’ve got:

- The rate cut itself

- The verbiage around the rate cut

- The SEP and its magical dot plot

- Fed Chair Powell’s press conference

Any one of these could send mortgage rates spiraling up or down. What we know for sure is that rates have already priced in something between a 0.25% and 0.50% Fed cut.

So, what’s the takeaway? Expect volatility. And when it comes to Wednesday—and maybe even Thursday—it could be a bumpy ride. There’s an equal chance mortgage rates go up or down, even though we’re expecting a Fed rate cut. But don’t sweat it too much—whatever happens in the short term is unlikely to mess with the bigger trends. Those will depend on the next batch of economic data coming in early October.