‘Tis the season when everything seems to be something it’s not, right? Lenders are chattering about new loan limits, yet they haven’t officially changed. News headlines claim rates dropped this week, but surprise—they’re higher. And, there’s buzz about a massive refi boom, but—spoiler alert—that’s not exactly true either.

Rates

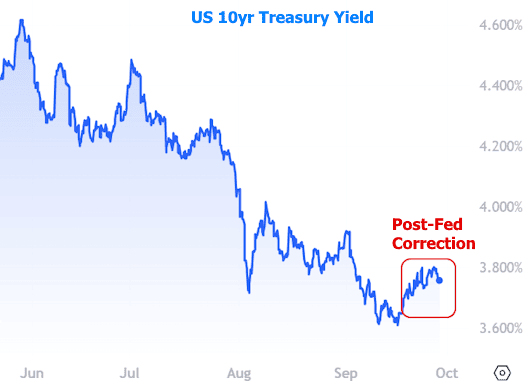

Ah, rates. They’re continuing their slow climb upwards (yes, upwards), though still lingering close enough to long-term lows. This chart of 10-year Treasury yields (a trusty stand-in for longer-term rates like mortgages) perfectly captures all the good vibes we’ve seen in recent months, along with the mild backpedaling that kicked off after last week’s Fed rate cut.

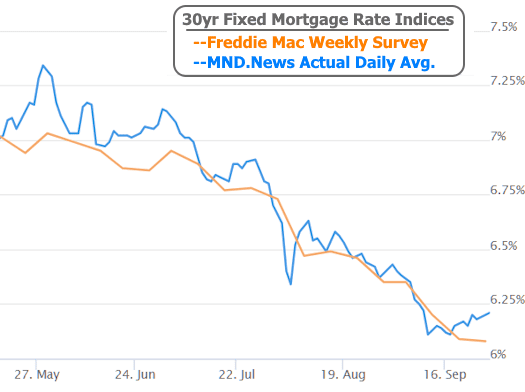

If we zoom in on mortgage rates, the picture looks even milder. In fact, one measure of mortgage rates (Freddie Mac’s weekly survey) was so chill this week that it actually showed LOWER rates.

Unfortunately, Freddie’s numbers aren’t playing nicely with reality this time around. Normally, we can cross-check this with the daily data from MND to smooth out any differences, but not this time, folks. If you want to take a deep dive into this mystery, here you go: Mortgage Rates are 100% NOT Lower This Week.

Loan Limits and Home Prices

Now, for some misdirection that’s much easier to explain. You might see some lenders advertising shiny new conforming loan limits hovering near or above $800k. But wait—official conforming loan limits don’t get announced until late November. So, who’s fibbing here?

No one, actually. Over the past few years, a few lenders have started rolling out their own loan limits a couple of months before the official announcement. They don’t have a crystal ball, but the math is the same every year, and most of the data is already out there.

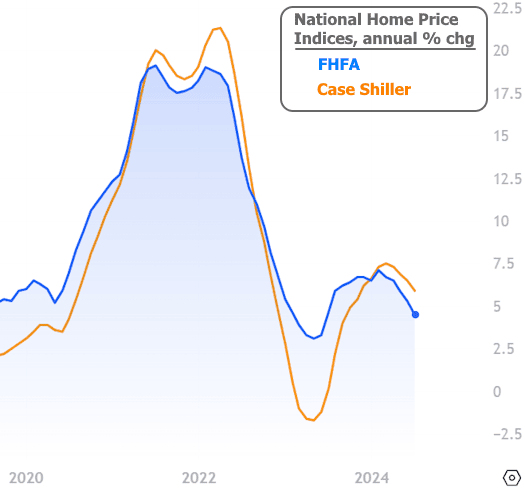

That data comes from the FHFA’s house price index. Technically, it’s the “seasonally adjusted, expanded, quarterly” data set (try saying that three times fast), but it tends to move at the same pace as the FHFA index that hits the news every month. This week, the latest numbers show continued cooling in price appreciation.

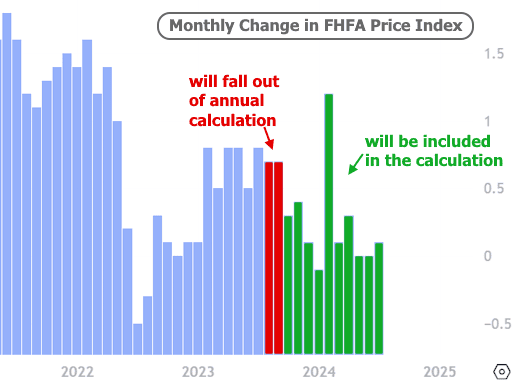

It’s a pretty safe bet that the blue line will still be comfortably above zero in two months. To get a sense of how close these lenders are with their early guesses, we can mix what we already know from the quarterly data with trends from the month-to-month price data. Check out this month-to-month chart:

Long story short, price appreciation has averaged less than half a percent over the past three months. Plus, two of the three highest months will drop out of the annual calculation before the loan limits are set. If this pace keeps up, and we apply it to the quarterly data we already have, the new conforming loan limit would be $800,950. Several lenders have already overshot that number, but expect them to fall in line with the official figure once it’s released in two months.

Refi Boom

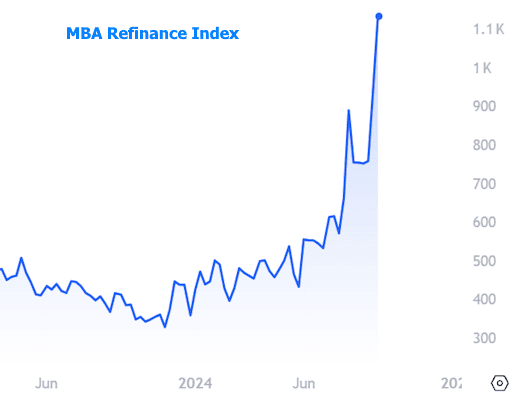

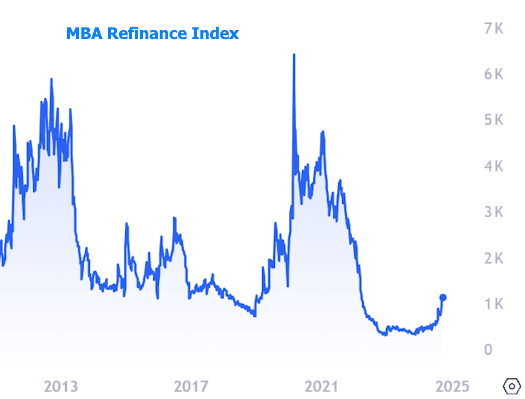

Is there a refi boom or not? Well, that depends on your perspective. We can confirm that this chart of the Mortgage Bankers Association’s refinance index is on point:

And so is this one:

Translation: there’s been a massive jump from rock-bottom levels of refi activity, bringing us back to what would’ve previously been considered the slow lane. Things could definitely pick up from here, but don’t expect any historic highs anytime this decade. Those highs were fueled by opportunities for pretty much every mortgage holder to save money by refinancing. But now that a huge chunk of homeowners are chilling with rates in the 2s and 3s, there’s no reason for them to refinance unless they’re looking to consolidate debt or have other non-mortgage-related motives.

A Final Note

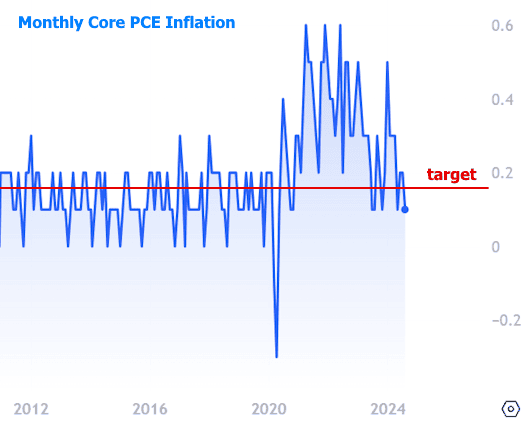

This week’s economic data? Mostly snooze-worthy. Inflation is still doing its best to back up the Fed’s increasing focus on the labor market. Core PCE prices (the Fed’s favorite inflation metric) have been behaving quite nicely, landing below target yet again.

As for that increased focus on the labor market, next Friday brings us the ever-so-important Employment Situation report (aka “the jobs report”). This report packs more punch than any other monthly economic data when it comes to giving rates a nudge—for better or worse. Buckle up!