Alright, let’s dive into the hot topic: mortgage rates. This is a politics-free zone unless, of course, political happenings are really shaking things up in the housing and mortgage world—like right now. No partisan commentary here; we’re just here for the facts.

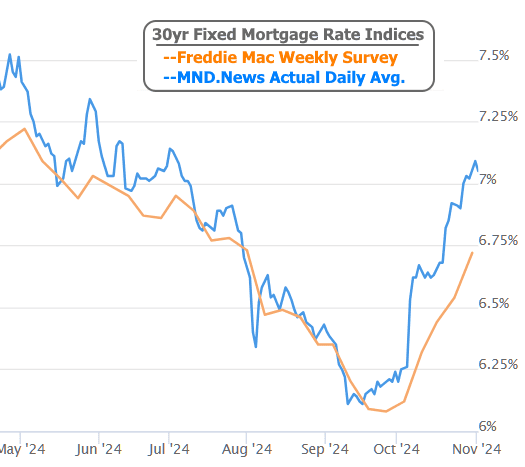

First, let’s check in on where mortgage rates are at. Spoiler alert: it’s not great. Most of the media is quoting Freddie Mac’s weekly survey, which is more outdated than your grandma’s VCR. The real daily averages? Yep, they’re even higher.

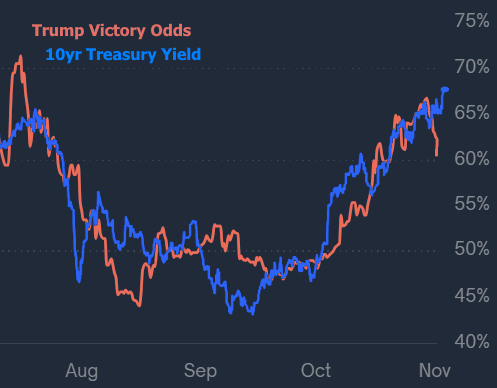

So, what’s the scoop? There’s a noticeable link between various election outcome predictions and recent rate movements. Now, just because two things are connected doesn’t mean one’s causing the other. But a few big-shot investors seem to think a Trump win might mean higher rates, especially if it leads to full Republican control of Congress and the Oval Office.

Now, yes, there’s some correlation here, but it’s not exactly a match made in heaven. And honestly, there’s a bunch of other stuff happening right now that’s definitely moving interest rates too—enough to make you wonder if anyone can really predict what’s going to happen with rates post-election.

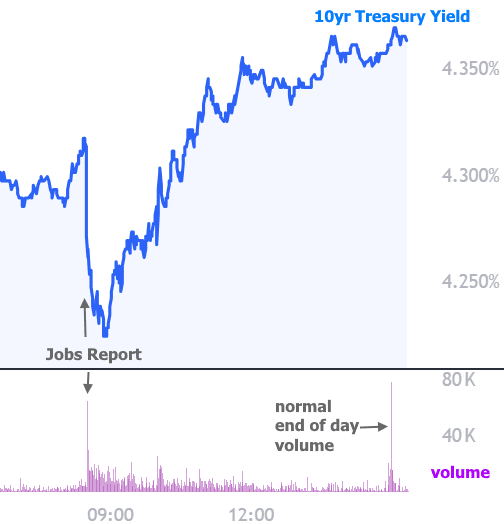

Take Friday, November 1st (the date this newsletter went out), for example. Despite a weak jobs report—a report that usually has rates dancing downward—rates stayed put. Initially, they did take a quick dip, as you can see in the 10-year Treasury yield chart, but it didn’t last long. In fact, the whole reaction was pretty low-key, hinting that the market’s mind was on other things.

And wherever those “other things” are, they don’t seem to follow simple rules. Just for kicks, someone might guess that the non-reaction was due to pre-election jitters. But here’s the kicker: as Trump’s odds were dipping, rates were climbing. Yep, exactly the opposite of what “theories” would suggest.

This doesn’t prove or disprove anything conclusively, though. It just shows us that the bond market doesn’t think in black-and-white. The big takeaway? Pre-election trading isn’t exactly straightforward. But let’s see what we can confidently say about how the bond market’s feeling:

- The rate spike of 2016-2018 is still fresh in investors’ memories, and some can’t help but associate Trump with higher rates.

- Many investors think that either candidate might be bad for rates, given both are expected to keep adding to Treasury debt (a big reason rates rise).

- Harris, as VP, represents more of the same, and that status quo doesn’t do rates any favors.

- Trump, on the other hand, represents the potential for big policy surprises, which could swing rates up or down.

- There’s a higher likelihood of a single-party sweep with Trump, which is often linked to higher rates due to lower hurdles for fiscal changes that increase debt.

And let’s be real: traders aren’t naïve. They don’t think every campaign promise is going to become policy.

That last point is huge. The market isn’t just basing its bets on every word spoken in a campaign. If anything, the recent rate spikes might just be a mash-up of things like:

- October’s economic data (especially the last jobs report)

- Concerns over fiscal plans from both parties

- The usual pre-major-event jitters

One thing worth pondering: if the last jobs report impacted rates so much, why didn’t this week’s? With nonfarm payrolls barely scraping 12k against a forecast of 113k, normally we’d see rates fall. So, why not?

First, as we hinted last week, the market took the payrolls with a grain of salt because extreme weather and temporary factors threw it off. That left the unemployment rate as the key number this time, and it was right in line with expectations. Plus, wages and hours worked were up a bit—not a huge deal, but not exactly helpful for rates.

And here’s where we are: no one’s betting big on rates dropping until there’s a crystal-clear reason for them to do so. So, the election outcome is the first hurdle, and after that, maybe a nice run of weak economic data without any “yeah, but…” factors thrown in.

What can we expect next week? One word: volatility. Rates could swing either way, so if you’re holding out for a drop post-election, brace yourself—you might have a 50/50 shot at disappointment. After all, if traders already knew rates would drop, they wouldn’t be waiting around to make their moves.