The Jobs Report Breakdown

There are two main elements to this report:

- Nonfarm payrolls (NFP): The count of jobs added to the economy.

- Unemployment rate: The percentage of people wishing they were on payrolls.

While the headline number showed 227,000 jobs added, it got a little help from hurricane recovery and striking workers returning to their posts. Basically, it was like giving an actor a standing ovation for a role they almost missed.

Even so, the year’s job growth tells an interesting story. The first half of the year saw an average of 255k new jobs per month, while the second half cooled off to 148k. Not bad, but it’s clear the labor market is starting to chill. Think of it as swapping summer beach vibes for a cozy sweater in autumn.

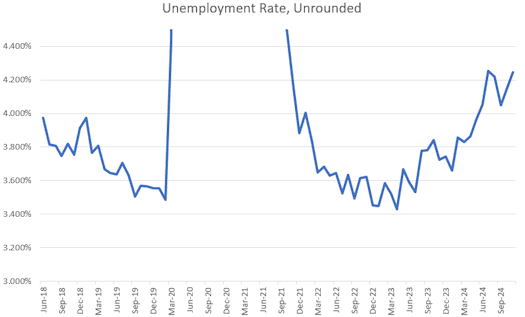

And then there’s the unemployment rate, which came in at 4.246%—rounding down to 4.2% for those headline-grabbing moments. Here’s a visual for you:

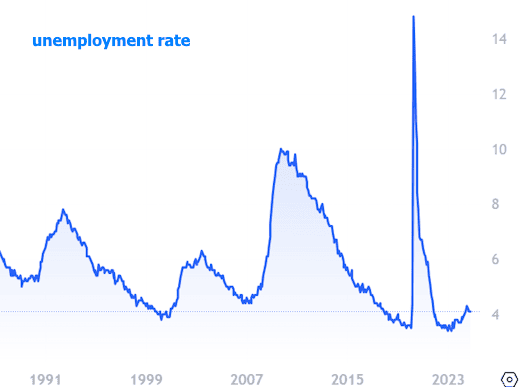

Yes, 4.2% is still low by historical standards, but unemployment rates tend to change course about as quickly as a glacier. Here’s another chart to drive the point home:

The Cooler Labor Market: A Prelude to Rate Cuts?

With the labor market looking like it hit the snooze button, the Fed has already started trimming rates, kicking things off in September. The market, ever the overachiever, tends to predict these moves, so we’ve seen rates trending lower in anticipation.

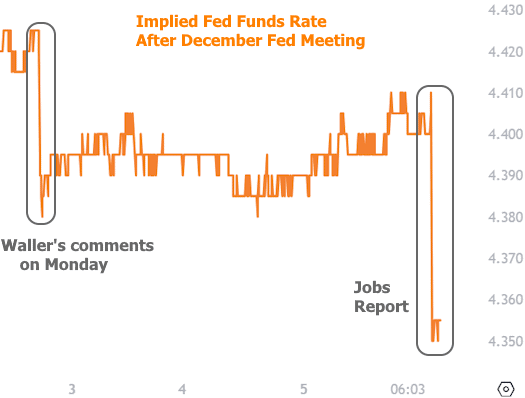

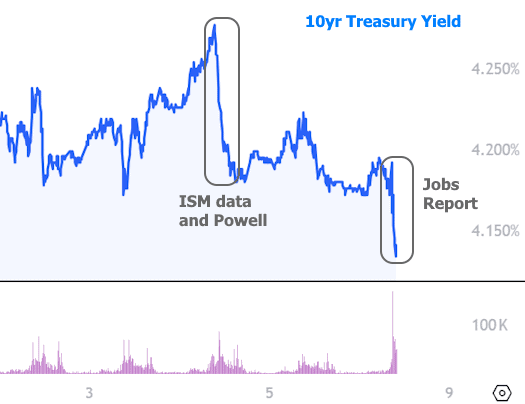

This week’s Fed-related excitement came courtesy of Waller, who hinted at being team “Cut Rates” for December 18th. And let’s not forget our favorite sidekick in the rate-watching world: the 10-year Treasury yield.

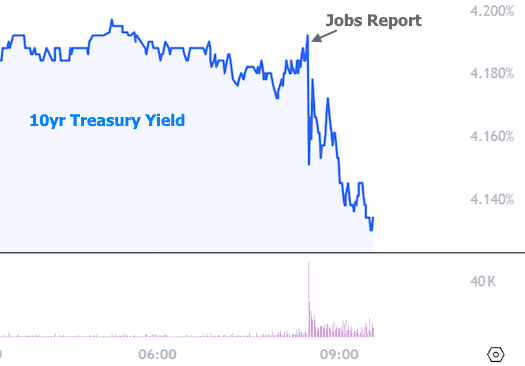

Treasury yields paid more attention to the economic data than Fed banter. Case in point: the weak ISM Services index on Wednesday, which also nudged rates in a friendly direction.

Mortgage rates, meanwhile, are like that kid who copies the smartest kid in class—they don’t always mimic Treasuries perfectly, but they’re heading in the same direction. After the jobs report, the average lender is now offering the best rates seen in over six weeks.

What’s Next?

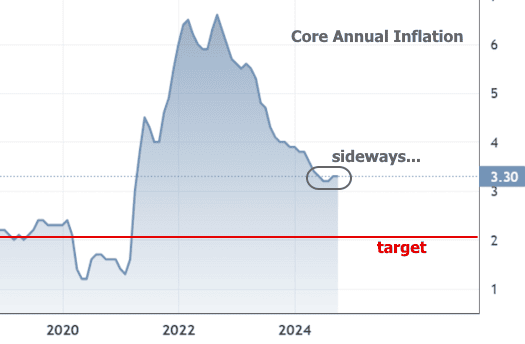

As if this week weren’t exciting enough, next Wednesday brings the Consumer Price Index (CPI)—basically the inflation Oscars. CPI has been showing a lot of progress lately, but recent months have looked a bit…meh. Traders will be watching closely to see if inflation starts behaving or continues to loiter aimlessly.

Whatever CPI reveals, it’ll likely set the tone for the Fed meeting the following week. So stay tuned, because the market will let us know where rates are headed faster than you can say, “Is it time to refinance?”

That’s it for this week, folks. Rates are behaving, the Fed is thinking, and we’re all just trying to keep up.