Last week’s excitement was all about the jobs report, which rudely sent rates on an express elevator upward. This week, inflation data swooped in like a caped hero, ready to either throw more fuel on that fire or douse it completely.

Enter the Consumer Price Index (CPI): the monthly economic report equivalent of the weather forecast everyone actually cares about. Spoiler alert: CPI donned its firefighter gear and got to work.

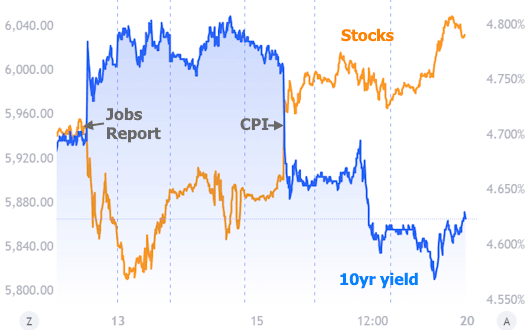

Take a gander at the chart below, showcasing the stock market’s recent mood swings alongside the 10-year Treasury yield (a stand-in for long-term interest rates, including mortgages). Stocks and rates were practically playing a game of “who can be more dramatic” since last Friday.

Now, you’d think stocks would celebrate a strong job market, right? But not so fast. In today’s topsy-turvy financial universe, stocks are fixated on what data means for rates. Strong jobs? Higher rates. Higher rates? Lower stock prices. But CPI this week whispered sweet nothings into the market’s ear, and everyone calmed down.

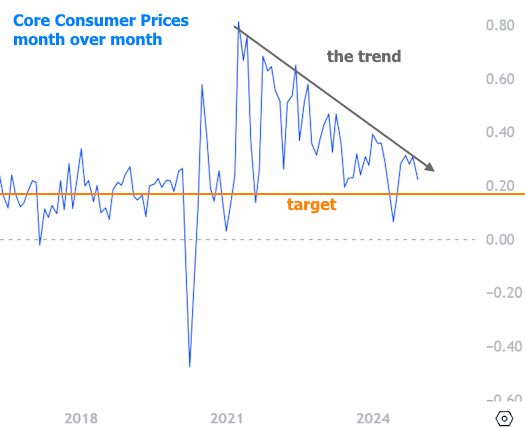

CPI gave everyone a reason to chill because the numbers came in slightly lower than expected. Take a peek at the chart below showing monthly changes in core CPI. See that lovely little dip at the end? It’s like a smooth jazz tune, keeping the trend toward target levels alive.

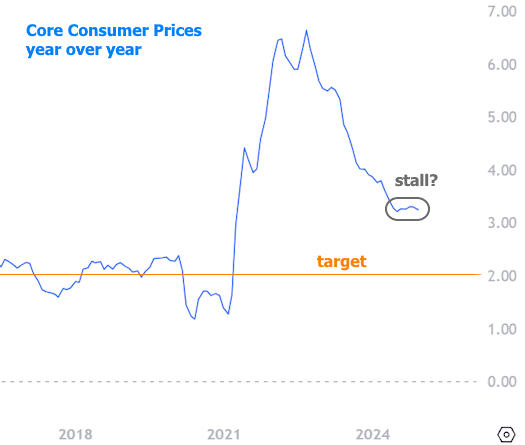

If you’re into the bigger picture, let’s switch gears. Here’s the same CPI data but expressed as year-over-year changes. The magic number here is 2.0%, the Holy Grail for the Fed. While the line had been stubbornly hovering like a drone that won’t land, this week’s report suggested the stall might be just a temporary pause instead of a full-blown U-turn.

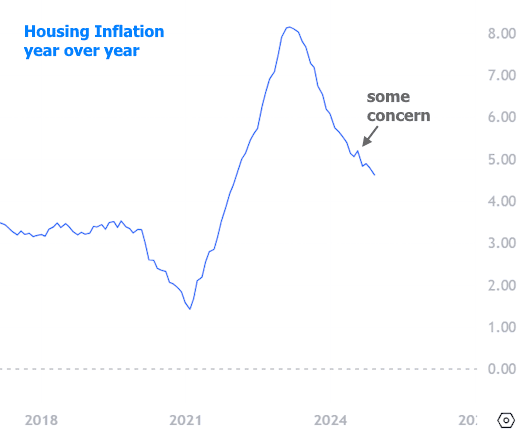

Housing inflation, a hot topic in recent years (pun intended), also decided to join the friendly trend party. Housing metrics had a bit of a temper tantrum recently, stalling and worrying analysts. But the latest data showed housing might just be ready to play nice again.

Now, a quick reality check: inflation is not the same as prices coming down. Think of it as the difference between a speeding car slowing down versus actually hitting the brakes. Prices are still climbing, just not as fast, and that’s exactly what the Fed needs to see to feel confident about future rate cuts.

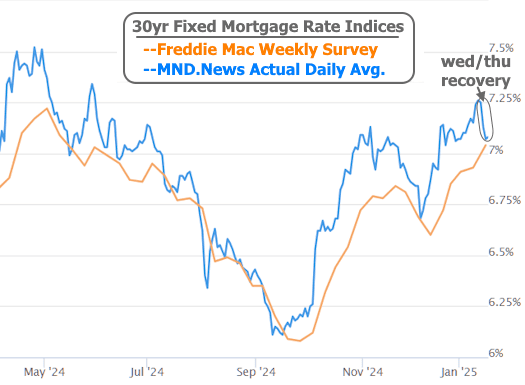

Speaking of rates, the mortgage world heaved a sigh of relief as this week’s inflation data pulled them back from their highest levels since May 2024. It’s a small win, but we’ll take it.

Looking ahead, next week is a short one thanks to the Martin Luther King Jr. holiday. Bonds will dust themselves off and reopen on Tuesday. Keep an eye on political developments, as Monday’s inauguration could toss a surprise or two into the mix. Markets may flutter like a nervous bird, depending on the early moves of the new administration.

But let’s keep things in perspective: the fate of rates ultimately lies in the hands of the next several months of economic data and fiscal policies. So, buckle up, keep an eye on those charts, and maybe keep a firefighter emoji handy for the next CPI report. 🔥🧯