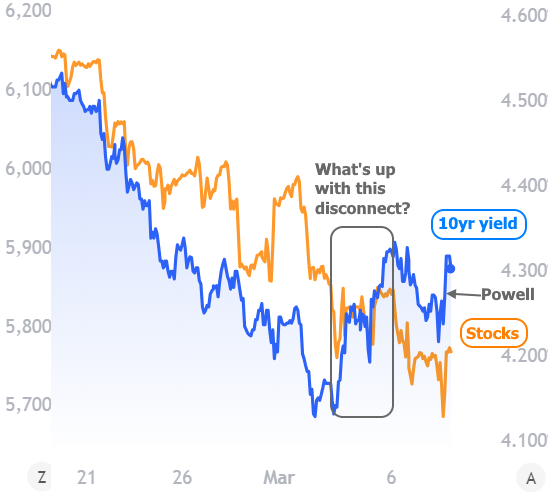

The financial markets have been on a bit of a rollercoaster lately—though, to be fair, they always seem to be. Over the past few weeks, the trend has been great for bonds (which love bad economic news) and not-so-great for stocks (which do not). But this week, something weird happened. The usual pattern broke down, and most Americans have no clue why.

That’s totally understandable because, let’s be real, keeping up with economic data, fiscal updates, and whatever the Fed is up to is basically a full-time job.

Early in the week, some weak manufacturing data gave rates a reason to keep partying. (Fun fact: the worse the economy looks, the better rates tend to behave. Go figure.) But by Friday, rates were suddenly back up to last week’s levels.

And who’s the culprit this time? None other than Federal Reserve Chair Jerome Powell. He gave a speech that basically boiled down to: “The economy is fine. We don’t need to do anything.” Had he sounded a bit more worried, traders might have held rates steady. Instead, they took it as a green light to push them higher.

But here’s the thing—while Powell’s words mattered, they weren’t the real reason rates bounced.

Enter the “X Factor”—and surprise, it’s not even from the U.S.

This chart shows how bonds and stocks were moving in sync (both heading lower), plus the Powell-induced rate jump. But then something else happened—something that didn’t fit the pattern.

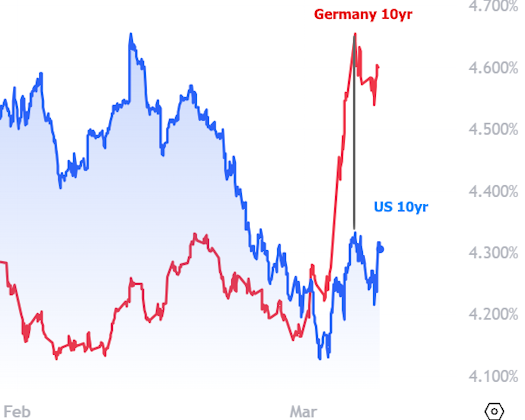

Meet Germany: The Plot Twist No One Saw Coming

It’s been a while since Europe has been a major player in U.S. rate drama, but this week, Germany made a grand entrance. Here’s the quick and dirty version of why:

- Germany has a rule in its constitution that acts like the U.S. debt ceiling—but stricter (because, you know, Germany).

- Historically, Germany loves being fiscally responsible, sometimes to a fault.

- That love of fiscal responsibility recently triggered political drama, including the collapse of their governing coalition (yes, really).

- The frontrunner in the upcoming election has big plans to spend, spend, spend and wants to tweak that strict debt rule to do it.

- More spending = more debt = more German bonds (a.k.a. Bunds) hitting the market.

- More bonds = higher yields (because supply and demand are still a thing).

- And here’s the kicker: German and U.S. bonds have a long history of moving in the same direction, like synchronized swimmers.

So when German bond yields spiked, U.S. rates got caught in the wake.

Here’s what happened when we swap out stocks for Germany’s 10-year yield:

Simple Explanation: Germany Sneezed, and U.S. Rates Caught a Cold

The entire period where U.S. rates “disconnected” from their usual pattern? That lined up perfectly with Germany’s bond yields skyrocketing.

Super simple, right?

To show just how connected they are, here’s a longer-term chart of German vs. U.S. 10-year yields:

And now, let’s compare that to the same timeframe but with U.S. stocks instead of Germany. The correlation is… well, let’s just say it’s a mess.

So… What Happens Next?

For now, this isn’t a major crisis. Rates are still lower than they’ve been for most of the past few months, and this week’s bump is more of an inconvenience than a disaster.

But if Germany actually changes its constitution to allow for more debt and spending? That could cause another shockwave in rates. The tricky part? It’s unclear if or when that’ll happen. Analysts say if they don’t push it through within the next three weeks, it’ll be much harder to pass.

Eyes on Next Week: CPI and the Inflation Battle

Now, back to the U.S. …

Next Wednesday, we get the Consumer Price Index (CPI) report, which is a huge deal for interest rates.

- If inflation heats up again, the Fed might have to rethink any potential rate cuts, and rates could climb even higher.

- If inflation cools off, rates might hold steady or even improve (finally, some good news).

Either way, buckle up—because the market is going to react. And if Germany decides to stir the pot again? Well, at least now you’ll know why.