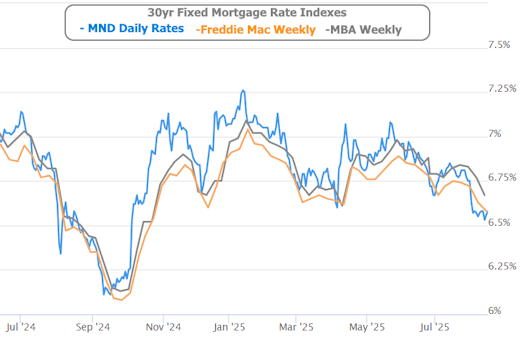

This week, inflation data was the star of the show. One big report sent mortgage rates gliding down to fresh 10-month lows… only for the very next report to yank them back up like a bungee cord.

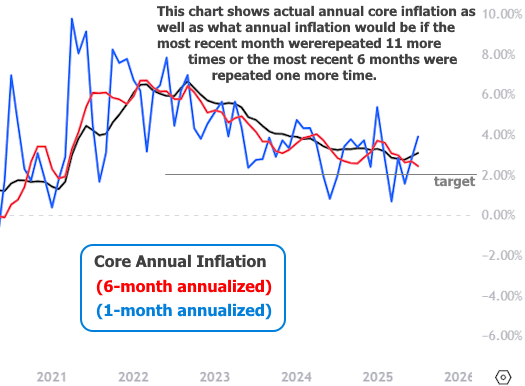

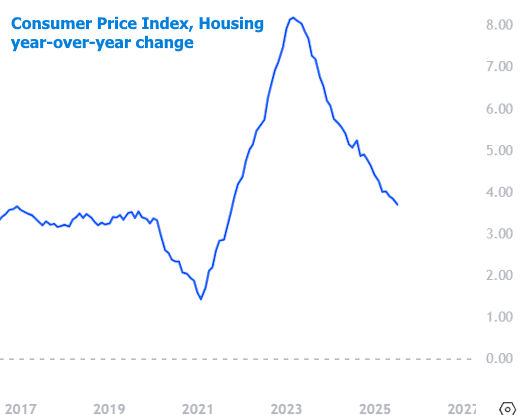

Tuesday kicked things off with the Consumer Price Index (CPI). Even though it landed right on the forecast, the details were friendly enough for mortgage rates. Sure, tariffs caused some price bumps here and there, but housing costs eased up — which meant no scary inflation spike. The markets loved it, and by midweek, September Fed rate cut odds were basically sitting at 100%.

Wednesday was like the calm before the storm. No major reports, no big drama. Rates just lounged around, enjoying the sunshine of Fed-cut optimism.

Then Thursday showed up with the Producer Price Index (PPI) — the wholesale inflation report. And let’s just say it came in hotter than a jalapeño latte. The worry? Tariffs might drive prices even higher down the road. Luckily, some PPI components that overlap with PCE (that’s the Fed’s favorite inflation report, due in two weeks) weren’t as alarming. Still, it was enough to nudge bond yields — and mortgage rates — upward.

Friday’s retail sales numbers? Stronger than expected. Bonds shrugged at first, but as the day dragged on, the mood soured and a few lenders slipped in small rate hikes before the weekend. Even so, rates stayed way closer to their 10-month lows than their highs.

The Big Picture: Fed Expectations Rule the Day

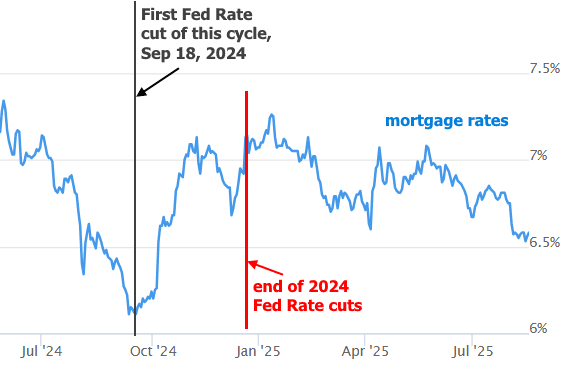

Here’s the funny thing: mortgage rates don’t actually wait for the Fed to cut or hike rates. What really moves them is the expectation of what the Fed is going to do. Think of it like a spoiler: once everyone “knows” what’s going to happen, rates have already reacted. Case in point: late 2024, when mortgage rates hit rock bottom and then bounced higher right after the Fed finally delivered the rate cut.

So, yes — a Fed rate cut at the next meeting is very likely. But no, that doesn’t guarantee mortgage rates will keep falling. The data that follows will decide whether we break into even lower territory or drift back up into 2025’s comfort zone.

Coming Attractions: Fed Minutes and Jackson Hole

Next week, the Fed makes a couple of cameo appearances:

- Wednesday: Fed meeting minutes — basically the “extended cut” of the last meeting three weeks ago. Interesting, but already a little outdated.

- Thursday: The Jackson Hole symposium — where the Fed Chair and friends will give forward-looking speeches. This one matters more, because it’ll reflect the latest inflation twists and turns.

So buckle up — the inflation roller coaster isn’t slowing down just yet.