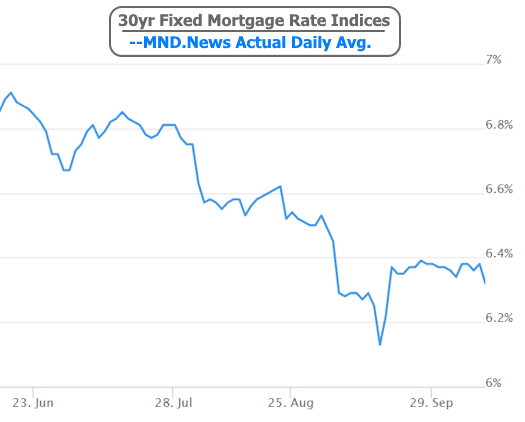

If mortgage rates had personalities, they’d be that friend who’s been sitting on the couch since September 19th refusing to move — not bad company, but not exactly thrilling. For weeks, the average lender has been chilling inside a ridiculously narrow 0.05% range. For context, on September 18th alone (right after the Fed’s big announcement), rates jumped a spicy 0.15%. So yeah — lately, it’s been more “lukewarm tea” than “triple espresso.”

But Friday? Friday decided to break the monotony — at least a little bit. Rates finally wiggled out of their tight range, expanding by… wait for it… 0.02%. Not exactly headline material, but in the world of rates, that’s enough to make analysts drop their coffee cups.

Reason One: The Mini Breakout Heard ‘Round the Desk

Friday didn’t just stretch the range — it ran a mini-marathon through it, going from near the recent highs to hitting new lows in a single day. Imagine your Roomba suddenly learning parkour. It’s not a huge leap, but you definitely notice.

Reason Two: Finally, a Plot Twist!

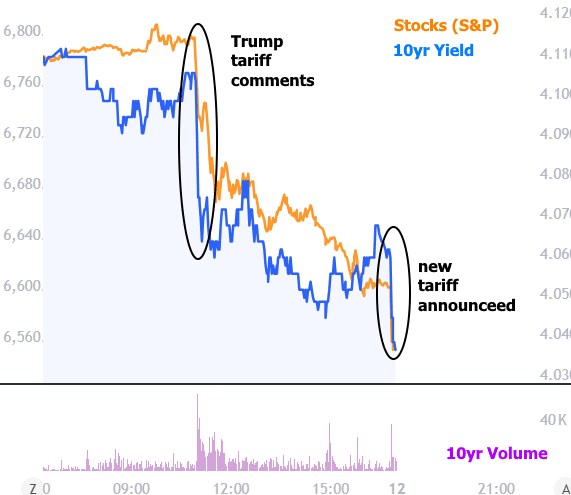

Unlike the last three weeks of snooze-fest stability, Friday’s move had a clear villain (or hero, depending on your perspective). The President made some blunt comments about trade relations with China — basically saying there’s no reason to meet with President Xi and teasing a “massive” increase in Chinese tariffs.

Cue the chaos: the stock market had its biggest sell-off since April, while bond markets threw a little celebration, sending rates lower. It was the financial world’s version of a soap opera cliffhanger — right before a 3-day weekend.

Tariffs: The Love-Hate Story of the Rate World

Tariffs have been the drama queen of rate movements for years. Sometimes they help (economic slowdown = lower rates), other times they hurt (inflation = higher rates). Friday’s drop probably had less to do with the economics and more to do with investors panic-selling stocks and running straight into bonds for safety — which, conveniently, pushes rates lower.

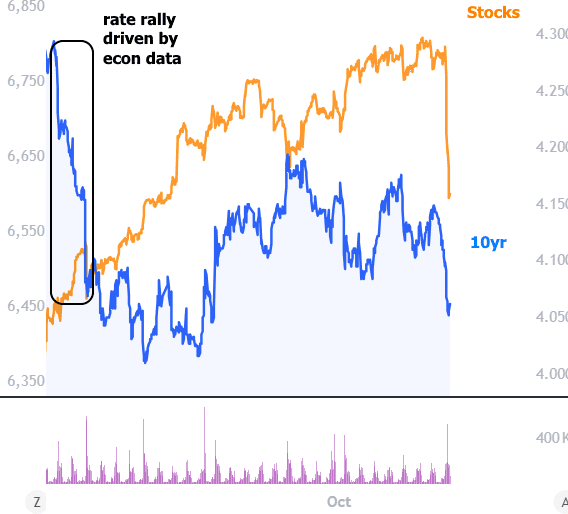

Take a look at how stocks and bonds reacted if we zoom out to the earlier September jobs report. Spoiler alert: bonds handled it better.

So… What Now?

Before you start celebrating lower rates like it’s 2020 again, take a breath. There’s no solid reason to think this momentum will keep rolling next week. The rate world loves economic data, and right now, the government shutdown has that data locked in a vault. Until the jobs report and other key releases come back online, we’re all just guessing.

For now, enjoy the baby step in the right direction — and maybe pour that second cup of coffee. You’ve earned it for surviving another week of “rate watching.”