This week brought the grand return of all the economic data that had been sitting in timeout during the government shutdown. The headliner? The jobs report that was supposed to show up fashionably early in October… but instead wandered in late with a pumpkin spice latte, pretending nothing happened.

Technically, we’re looking at September’s data (so, yes, a little stale), but it still managed to trigger the biggest volume spike in the bond market since the last Fed meeting. The jobs report is basically the Beyoncé of economic reports—when it drops, everybody pays attention.

Big volume usually means big movement in rates… but this time the market shrugged like “eh, I’ve seen worse.” Why? Because the jobs report came with mixed signals.

On one hand: 119k new jobs—way above the 50k economists predicted.

On the other hand: last month’s numbers were revised from +22k all the way down to -4k. That’s not a revision; that’s an identity crisis.

Then we had the household survey—the part that decides the official unemployment rate. In September, unemployment ticked up from 4.3% to 4.4% (exactly what was forecast). Technically, this is the highest reading of this cycle, which should make rates drop like my motivation after lunch.

But wait—plot twist!

Labor force participation also rose by 0.1%. Translation: more people raised their hand and said, “Yes, I am officially looking for a job.” More participants with the same number of jobs available automatically bumps unemployment up.

So that 0.1% increase? Less “doom,” more “math.”

Participation is still a side character in the story—important, but not the main star. The unemployment rate still carried more weight, which is why mortgage rates reacted positively… just not as dramatically as they could have.

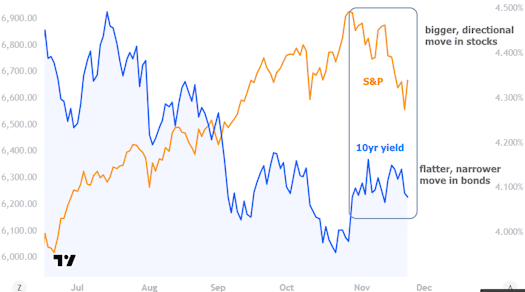

Throughout the week, stocks got slapped around pretty hard, and bonds/rates quietly improved. They’re not always inversely correlated, but when stocks throw a tantrum, bonds tend to stroll in like the calm older sibling. That also explains why Treasury yields moved up after bottoming out Friday morning.

In the bigger picture, stocks have been on a sizable downward correction over the past few weeks, while bonds have been chilling in a tight sideways range—like they found a cozy spot on the couch and refuse to move.

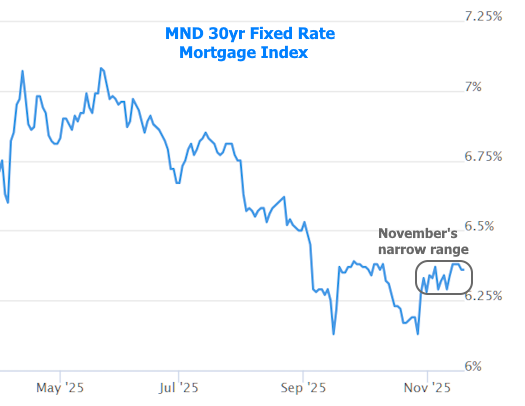

And as usual, when Treasury yields stay stuck in a tight sideways lane, mortgage rates follow the same pattern. Predictable, dependable — like your favorite pair of jeans.

Looking ahead, rates won’t commit to their next big move until more economic data shows up. Problem is, many of the shutdown-delayed reports are now running extra behind. The new release schedules confirm that the important ones won’t arrive before the December Fed meeting.

That means December 10th will be the first Fed announcement in a long time where the Fed could genuinely go either direction on rates. Basically: it’s the Superbowl of ambiguity.

And yes—this also means Fed Day could bring extra rate volatility. Buckle up.