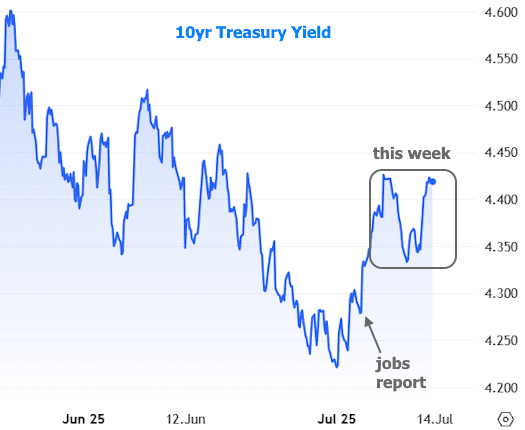

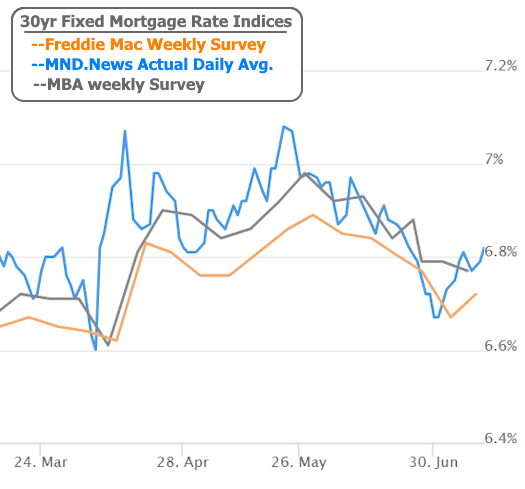

Mortgage rates were living it up through most of June, doing the electric slide and sipping on economic optimism. But then—cue dramatic music—some unexpectedly strong economic data crashed the party like a grumpy neighbor calling the cops at 10 p.m. The result? Mortgage rates sobered up fast and started heading upward.

That buzzkill of a bounce stuck around through the start of this week. After that? Meh. Rates basically chilled on the couch with a bag of chips, going sideways with no major plans.

And honestly, who can blame them? This past week was like an economic ghost town—no big data drops, no spicy headlines, not even a surprise Fed mic drop. Without the usual drama to stir things up, mortgage rates just sort of… lingered.

Still, there was a little movement—some jitters around trade headlines, a few Fed remarks tossed around, and a Treasury auction or two—but nothing that would make the highlight reel. By Friday, rates were right back where they were on Tuesday, like a boomerang with commitment issues.

But don’t get too cozy—next week might bring some fireworks. Tuesday’s Consumer Price Index (CPI) is the next big act, and it could be just as dramatic as a jobs report if it reveals inflation creeping in thanks to tariffs.

Why should you care?

Because inflation is like garlic to a vampire when it comes to bonds. The more inflation, the less bonds like it—and when bonds get spooked, mortgage rates go up. Not fun.

Plus, the threat of tariff-induced inflation has the Federal Reserve nervously holding off on those sweet, sweet rate cuts that everyone’s been hoping for. It’s like wanting to jump into a pool but seeing a suspiciously large bug floating on the surface.

So, here’s the bottom line:

If inflation doesn’t show up in the CPI, the market may get giddy and start pricing in future Fed rate cuts—which could quickly pull mortgage rates back down. (Pro tip: Mortgage rates react more to expectations of Fed moves than the actual Fed moves themselves.)

Of course, if CPI data comes in hot—like jalapeño-hot—mortgage rates could spike again. So, it’s really a coin toss at this point. No crystal ball here. Just know that next week has high potential for data-driven drama.

Stay tuned—and maybe keep both the party hat and the umbrella handy. You might need one… or both.