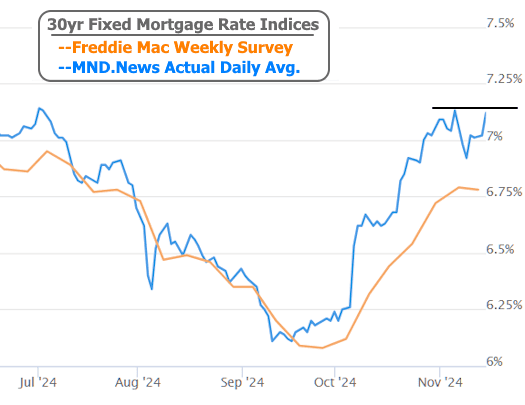

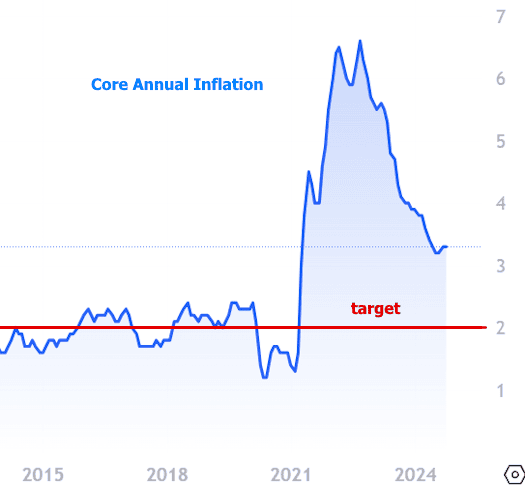

Mortgage rates bounced hard off the long term lows back in September and had jumped almost a full percent by last week. In addition to the elevated levels, there’s been plenty of volatility. Nonetheless, rates managed to avoid breaking last week’s ceiling–even if only just. Does that mean it’s time for hope? Hope is always a fine thing to have, but it’s not a strategy when it comes to mortgage rates. Even if we consider that rates are based on financial markets, caution still makes sense. Some market analysis might suggest this week’s ground-holding in rates is indeed a sign of a potential longer-term ceiling, but other analysis suggests an ongoing uptrend. Neither is right or wrong considering the future can never be accurately predicted when it comes to rates. The mortgage rate chart shows the “lower high” in terms of daily rates. 20241115 NL2.png Because mortgage rates don’t change more than a few times a day, we have to look at bonds to track intraday changes. Using the 10yr Treasury yield as a benchmark, we can see the persistent uptrend in yields. Treasury yields tend to move in the same direction as mortgage rates with almost perfect correlation. If we want to hold out hope for rates to move lower, it would help to be able to pin those hopes to objective developments. On that note, all we have are economic reports and inflation. Simply put, inflation would need to move lower and the economy would need to weaken in order to make a case for meaningfully lower rates. None of this week’s data supports that case. That said, this week’s data wasn’t overly troubling either. The Consumer Price Index (CPI) came in right in line with forecasts earlier this week. Unfortunately, those forecasts weren’t low enough for annual inflation to hit its target. We wouldn’t have expected an annual target to be hit any time soon, but the fact is that monthly inflation needs to average 0.17-ish in order to hit a 2.0% target, and monthly inflation came in at 0.3% at the core level for the third month in a row. The annual chart of inflation makes it seem like progress is stalling, whereas it might be easier to imagine the continuation of a trend toward target levels in the monthly chart. In fact, neither assessment is right or wrong and we’re increasingly see the Federal Reserve acknowledge that. Multiple Fed officials gave speeches and/or participated in Q&A events this week and the tone was markedly different than it was the last time they were out in force. Here are a few highlights, paraphrased: Fed’s Kashkari Confident in path of inflation but don’t want to declare victory May take a year or two to achieve 2% goal If inflation surprises to the upside, that could affect rate cut plans Fed’s Schmid Remains to be seen how much more the Fed will cut and where rates may settle Fed’s Logan Seeing signs that the Fed may not need to cut rates as low as previously thought in order for inflation and job growth to be in balance. There’s some sense of higher inflation risk and some sense the Fed may not cut rates as much Data since the last meeting suggests economy may be stronger than expected Fed’s Powell Economy sending signals that we don’t need to be in a hurry to cut rates Expects inflation to continue toward 2%, but it’s a bumpy path This isn’t necessarily surprising from the Fed, but it’s definitely a change from where their collective heads were at in September. At that time, we’d just seen a few significantly weaker employment reports and inflation data that was more indicative of gradual improvement. Since then, those weak employment numbers have been revised higher and inflation has ticked up. The Fed along with the rest of the financial market is waiting to see if the data will show a big of a resurgence of growth and inflation. If that happens, rates could easily continue to move higher. If data softens again, rates have room to recover to lower levels. Either way, the data will be the determining factor–especially the jobs report in early December.

Mortgage Rates: Bouncing, Wobbling, and Holding Their Breath

Mortgage rates had a bit of a trampoline moment back in September, bouncing off their long-term lows only to catapult almost a full percentage point higher by last week. Not only are rates elevated, but they’re doing the financial equivalent of jitterbugging all over the place. However, there’s a silver lining: they managed to avoid smashing through last week’s ceiling—even if only by a hair. So, should we start getting hopeful?

Well, hope is great for movie plots and lottery tickets, but it’s not a winning strategy for mortgage rates. Rates, tied to financial markets, are as unpredictable as a cat with a laser pointer. Some experts think this week’s relatively steady rates could mean we’ve found a long-term ceiling. Others argue the upward climb isn’t over yet. The truth? Both could be right—or wrong—because nobody’s crystal ball has figured out mortgage rates yet.

Oh, and speaking of rates, let’s take a look at the chart showing the “lower high” in daily rates.

Since mortgage rates don’t update every five minutes, we peek at bonds for intraday vibes. The 10-year Treasury yield is our go-to guy, as it moves in near lockstep with mortgage rates. And guess what? Yields are still trending up.

Now, if you’re holding onto the dream of lower rates (and who isn’t?), you’ll need to root for two things: lower inflation and a weaker economy. This week’s data didn’t exactly scream “party time” for rate drops, but it also wasn’t a total buzzkill. The Consumer Price Index (CPI) landed right on target earlier this week. Unfortunately, “target” isn’t the same as “awesome.” Monthly inflation needs to hit an average of 0.17% to reach a 2% annual goal, and we’ve been stuck at 0.3% for three months running.

Here’s the inflation story in two charts:

The annual inflation chart makes it look like progress is stalling, while the monthly chart hints at a slow crawl toward those 2% dreams. Both takes are valid, and even the Federal Reserve seems to agree. Speaking of the Fed, they’ve been quite chatty this week, and their tone has shifted since September. Back then, weak job numbers and promising inflation data had them a bit more optimistic. Now, it’s a different story.

Here are some Fed soundbites (paraphrased, because nobody wants direct quotes unless they’re Shakespeare):

- Kashkari: “Feeling good about inflation’s path, but victory laps? Not yet. Also, surprises could mess with our plans.”

- Schmid: “Let’s wait and see how much cutting the Fed will actually do.”

- Logan: “We may not need to lower rates as much as we thought to keep inflation and jobs in balance.”

- Musalem: “Higher inflation risks? Check. Fewer rate cuts? Also check.”

- Powell: “No rush on rate cuts. Inflation is like hiking uphill—it’s progress, but it’s uneven.”

The takeaway? The Fed—and the rest of the financial market—is in a “wait and see” mode. They’re holding their collective breath for December’s jobs report to see if the economy is about to roar back or take a nap. If growth and inflation heat up, rates could keep climbing. If things cool down, we might get a breather. Until then, the data will steer this ship—whether we like it or not.