Whether we’re talking mortgage rates or the MVP of the bond world—the mighty 10-year Treasury yield—this past week was not the market’s finest hour. In fact, it was the roughest stretch in recent memory, like the financial equivalent of stubbing your toe on a coffee table… every day… barefoot.

Why the chaos? Well, thank last week’s tariff announcement and all the follow-up drama. That lit the fuse. Since then, rates have been marching higher like they’ve got somewhere to be—despite a list of reasons so esoteric it might as well have been written in ancient Greek.

Now, you’d think inflation data coming in lower than expected would calm things down, right? Like giving the market a chamomile tea and a warm blanket? Nope. Rates just shrugged, said “cool story, bro,” and continued their relentless climb.

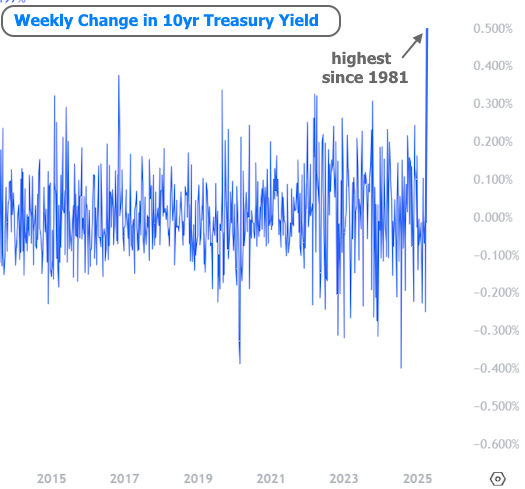

In fact, for 10-year Treasury yields, we haven’t seen a single-week jump this big since… drumroll… 1981. That’s right. We’re talking back-when-your-dad-had-a-mullet levels of rate movement.

So, should we be alarmed? Are we witnessing the start of a global economic plot twist?

Some would say yes, others would say “meh,” and the rest are probably Googling “how to short the market” while clutching their stress balls. Truth is, the answer depends on stuff that hasn’t happened yet. Classic finance.

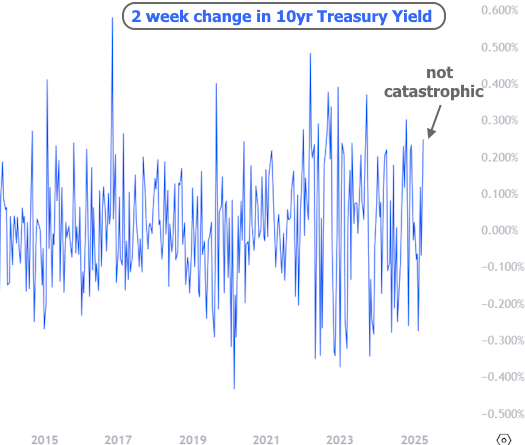

Want some perspective? Let’s zoom out. That same scary chart from above? Let’s stretch it over two weeks instead of one. Suddenly, it feels more like a bad hair day than a financial meltdown.

All this to say: the next week or so could give us more clues on what’s actually happening. For now, though, just know mortgage rates are elevated—like, noticeably. Way more than the average news headline would lead you to believe.

In that chart above, you’ll notice the blue line (actual daily rates) tends to hang out above the other two (survey-based rates). That’s normal. The key takeaway? The blue line moves first—kind of like that friend who shows up early to brunch and claims the best seat—while the surveys lag behind.

Unfortunately, a lot of media outlets treat those weekly surveys like gospel, even though they’re reporting what rates were, not what they are. So if you’re reading “Rates are X% this week,” just know you may be reading last week’s news in this week’s clothes.

But hey, silver lining: rates were actually worse just a few months ago. And we’ve seen 0.50% weekly jumps before without the sky falling. So will next week ease the pain—or twist the knife a bit more?

No one knows. The best move? Buckle up, stay nimble, and keep your eye on the charts. Oh, and maybe keep that stress ball handy—just in case.