Spoiler alert: No one really knows exactly how tariffs will shake up the market just yet. It’s a classic case of “wait and see,” and honestly, the results could go in a million different directions depending on how things unfold.

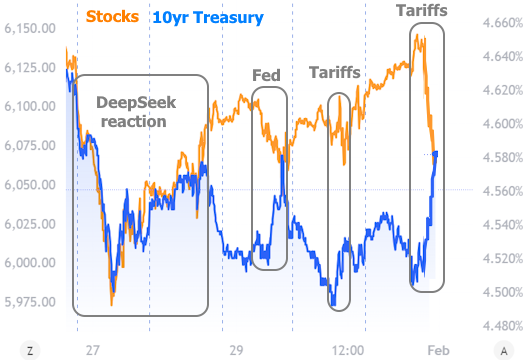

But that didn’t stop markets from jumping at every tariff-related headline this week. In fact, Thursday and Friday’s reactions completely overshadowed Wednesday’s Fed announcement—kind of like when you prepare for a big exam but then everyone suddenly starts talking about a celebrity breakup instead.

In general, both stocks and bonds react to tariffs the same way they react to changes in the Fed Funds Rate: lower is better, higher is worse. Pretty simple, right?

The result? Stock prices and bond yields (a.k.a. “rates”) moved in opposite directions. Each time new tariff news hit, stocks took a nosedive, while rates crept higher. If the news had been good, we’d likely have seen the opposite—stocks climbing and rates dropping like a contestant on a reality show getting booted off in the first episode.

Contrast that with the beginning of the week when markets were fixated on the arrival of DeepSeek, the latest AI wunderkind. Apparently, DeepSeek was built faster and cheaper than ChatGPT but is supposedly just as good. That freaked out investors, who suddenly wondered if domestic AI stocks were overpriced. Panic selling ensued, dragging the whole market down. But where did all that money go? Bonds, of course—proving yet again that in times of turmoil, bonds are like that reliable friend who always has snacks in their bag.

Now, back to tariffs. Friday’s reaction was clearly a bigger deal, but let’s keep things in perspective. In the grand scheme of things, these movements were relatively small. Here’s how this week stacked up against the past few months:

But let’s talk about what we actually know about these tariffs.

For starters, we don’t even have all the details yet. The White House announced plans to roll out 25% tariffs on Mexico and Canada this Saturday, but there are still legal and logistical questions. Some experts think current laws, including the Emergency Economic Powers Act (which sounds like a superhero move but is actually just legal jargon), could limit how sweeping these tariffs can be. Others believe it could all end up in court faster than a neighborly dispute over an overgrown tree branch.

But let’s say, for argument’s sake, the tariffs go into full effect. The big question: Are tariffs good or bad?

Well, that depends. (Annoying answer, we know.) Markets seem to think they’re bad—at least in the short term. There’s concern that tariffs could push prices and interest rates up, but history tells us tariffs are a double-edged sword.

Looking back at 2019, when the U.S. and China were locked in a trade war, the economy slowed down more than inflation spiked. Rates actually ended up moving lower over time, even though traders initially braced for higher rates. It’s kind of like when you expect a punch to the gut but get a light shove instead.

Of course, this time could be different, but we won’t know until the details shake out and we see real economic data. Markets might brace for impact, only to realize the fallout is more economic drag than inflationary surge. Either way, it’ll take months to get a clear picture, and years to fully assess the impact.

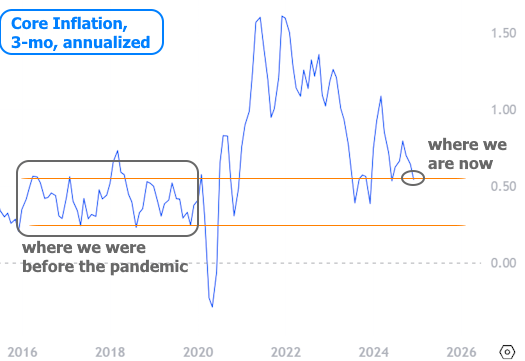

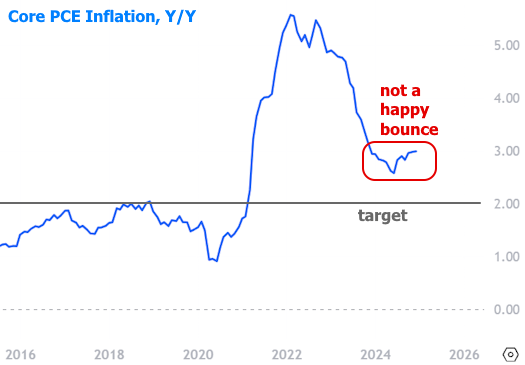

In the meantime, we’re playing the usual game of waiting for economic data to tell us where rates and the housing market are headed. Inflation is still the big thing to watch, and this week’s key report—the PCE Price Index—didn’t give us any screamingly obvious clues. Over shorter time frames, we’re making progress toward the Fed’s target, but it’s not exactly a victory lap just yet.

Looking at a year-over-year inflation chart, it’s clear we’ve hit a bit of a plateau on our way back to the 2.0% target. Sure, some of that decline will happen automatically as higher readings from a year ago roll off the calculation. But this is definitely not the chart the Fed was hoping for when they started thinking about rate cuts in mid-2024.

So, what’s next? More waiting, more data watching, and probably more market drama. But hey, at least it’s never boring!