This week was shorter than your average TikTok attention span, thanks to the Memorial Day holiday—and the event calendar had about as much excitement as a lukewarm cup of decaf. Sure, some earnings releases made the stock market wobble a bit, but mortgage rates mostly chilled out, drifting sideways with a hint of “maybe down a little.”

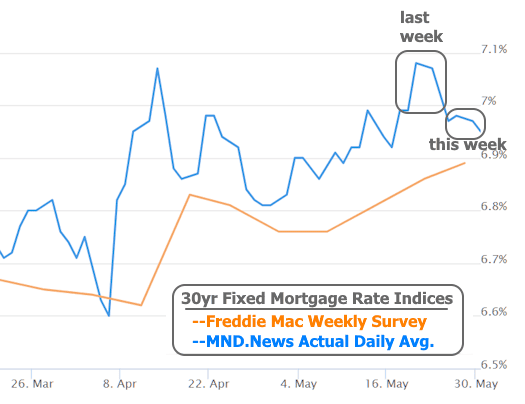

The big drop on Tuesday? That was actually the bond market playing catch-up from last week. Mortgage lenders didn’t rush to adjust rates right before a long weekend (because who does anything right before vacation?), so they waited until Tuesday to catch up to reality.

And here’s the fun part: if you read any headlines this week saying “rates are up,” they’re lying. Well, not lying, but let’s say they’re working off expired milk. Most of those headlines rely on weekly surveys that include last Thursday and Friday’s spicy rate spike. In real time, lenders are actually offering better deals than last week.

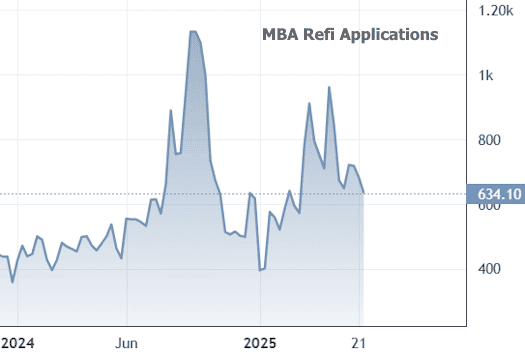

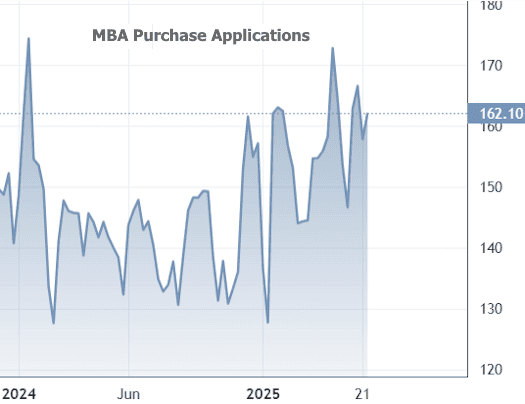

On the housing front, things were… mixed. Refi applications dropped—which isn’t exactly shocking after rates jumped last week. But purchase applications actually climbed a bit, like your hopes on a Monday morning before reality sets in.

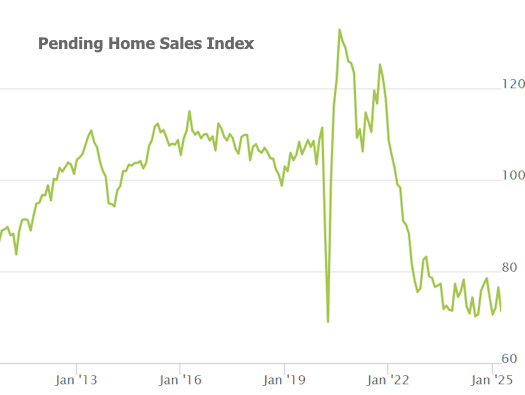

Pending home sales also made some dramatic headlines, but if you squint at the data, it’s really just the housing market playing “kick the can” down the same sad sidewalk we’ve been stuck on for months.

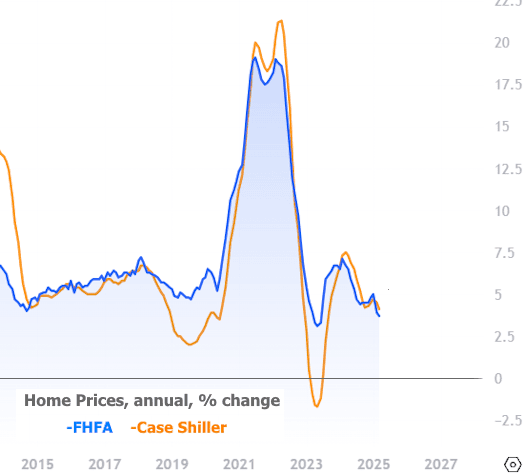

As for home prices, we got new data from Case Shiller and the FHFA. The general trend? Flat-ish but still above zero, which is a win in real estate land. As long as those lines are on the positive side, prices are technically still climbing—even if they’re climbing like a toddler up a slide (awkwardly, and with some assistance).

However, the Case Shiller index (seasonally adjusted, because it’s fancy like that) did show its first monthly dip since early 2023. Not exactly panic-worthy, but something to keep an eye on—like that weird noise your car makes but only when you’re driving with the windows down.

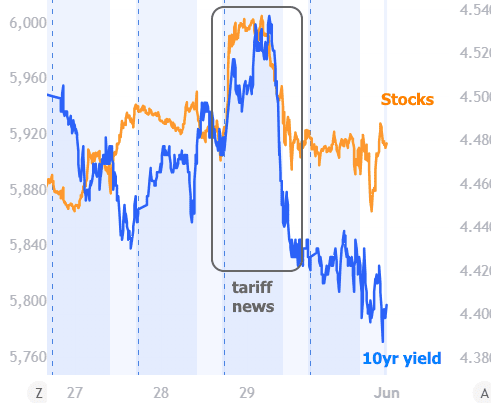

Meanwhile, the stock market had its moment of drama mid-week thanks to a trade court ruling that temporarily blocked some Trump-era tariffs. This sent stocks and bond yields on a caffeine-fueled spike—but that happened in the evening. So, U.S. traders woke up the next morning, took a sip of their overpriced oat milk lattes, and said “nah,” reversing the spike by breakfast.

Turns out, the tariffs are still in effect… at least until further review. The market took this news in stride, and bonds even got a little extra help Thursday morning from lukewarm economic data.

Friday brought some inflation numbers, but they didn’t move the needle much. Everyone’s just waiting to see if the tariffs actually do anything to inflation over the next few months—or if we all just stressed out over nothing.

Looking ahead, next week is stacked like a triple-shot espresso. We’ve got both key Purchasing Managers Index (PMI) reports on Monday and Wednesday, plus the granddaddy of them all: Friday’s jobs report. Sprinkle in some supporting economic characters throughout the week, and you’ve got a market storyline worth tuning into.