Last Friday’s jobs report was like that surprise plot twist in a Netflix show that suddenly makes everything more exciting—it sent the bond market soaring and gave mortgage rates a much-needed glow-up. This week? Well… let’s just say it was more of a “calm beach vacation” than a “rollercoaster ride,” but it helped lock in the good vibes from last week’s action.

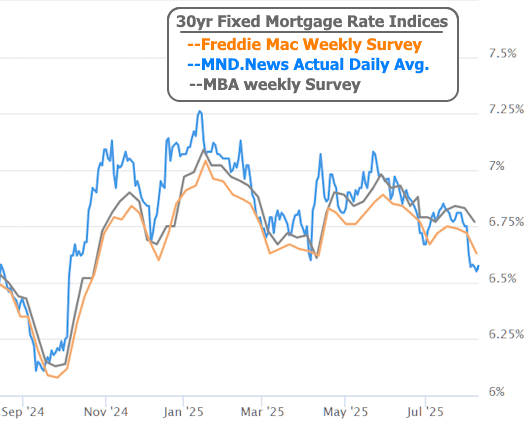

See, the average lender didn’t even fully update their rates after Friday’s rally—kind of like when a restaurant forgets to change the menu prices after a big sale on avocados. But when bonds kept their gains steady into Monday, lenders finally caught up. Boom—lowest rates since October 2024. After that? The market basically grabbed a hammock and took a nap.

Of course, there were a few moments when the script could have gone off the rails—most notably Tuesday’s ISM report, which is like a health checkup for the services sector. Its inflation component hit a new post-pandemic high (bad for rates), but the rest of the report was like, “Hey, the economy’s slowing down a bit.” Traders decided to focus on the slowdown part, keeping bonds and mortgage rates happily parked in their new, lower range.

Other economic updates—like jobless claims—came and went with all the excitement of a paperclip convention. Even a so-so 30-year Treasury auction (normally a party pooper for rates) didn’t mess things up. Overall, the market held its ground like a cat sitting on a warm laptop.

But buckle up, because next week could be a completely different story. Tuesday’s Consumer Price Index (CPI) will give us the next big inflation update, and it might also reveal if recent tariff changes are quietly hiking prices. Oh, and several Fed officials are scheduled to speak—always a recipe for market drama—so we might find out if last week’s weaker jobs data made them more open to rate cuts.

In short: this week was the calm before the storm. If CPI comes in cooler than expected, we could start daydreaming about mortgage rates in the low 6’s (we saw that in September 2024). If inflation pops higher, well… rates might creep up again—but probably not straight back to the 7% zone unless we get a whole string of bad news. One thing’s for sure: whatever direction they move, next week won’t be as sleepy as this one.