Given the number of dramatic headlines flying around, you’d think the market would be in full meltdown mode. But nope—turns out, it’s keeping a level head and sticking to the fundamentals.

This doesn’t mean all the talk about tariffs and economic uncertainty is being ignored. It’s just that traders are playing the “wait and see” game, holding off on any big reactions until they get some hard data to chew on. In other words, they’re basically treating these headlines like that one friend who always says they’re “definitely coming” to your party but never actually shows up.

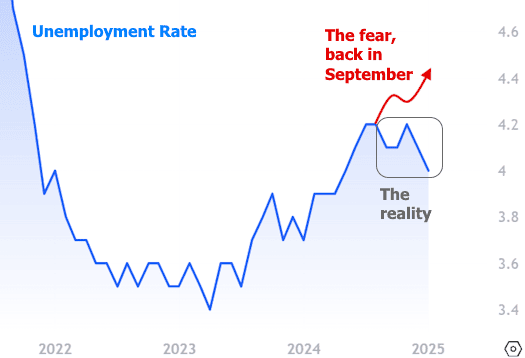

Of all the reports that matter, the monthly jobs report (a.k.a. “Employment Situation”) is still the MVP. This month’s edition showed job creation coming in a bit lower than expected. Normally, that would be good news for interest rates, but the market decided to zig instead of zag this time. Why? Because the unemployment rate stole the spotlight by moving lower, despite an increase in the labor force (which should have theoretically pushed it up).

This was particularly interesting since, back in July 2024, the unemployment rate looked like it was sending out “Hey, a recession might be coming” vibes. Historically, when it starts creeping up like that, it tends to keep going. But instead of following that script, it pulled a plot twist and settled down.

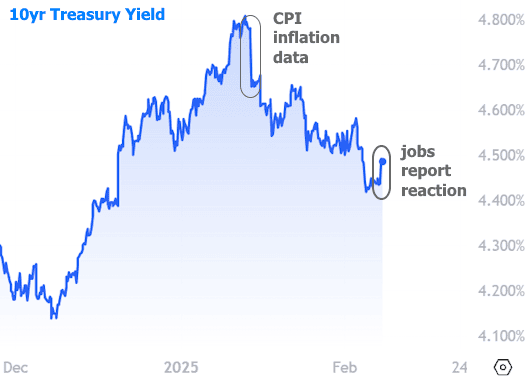

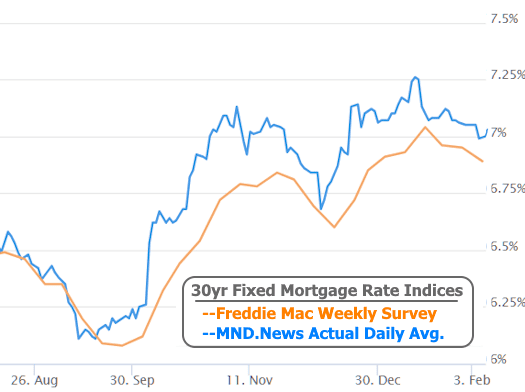

Other bits and pieces of the report suggested a more upbeat economy, but the big takeaway was that interest rates didn’t freak out. If anything, they seem to be hitting a bit of a plateau after weeks of slowly trending downward, thanks to some friendly inflation data. You can see this not just in mortgage rates, but also in Treasury yields (which are like the market’s emotional support animal when it comes to predicting rate movements).

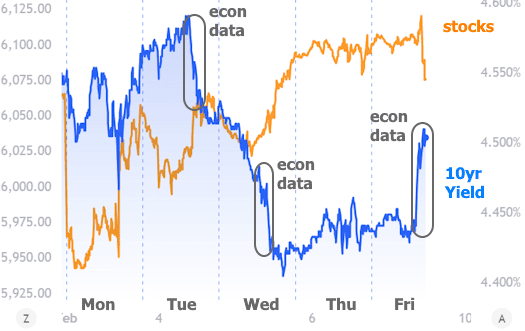

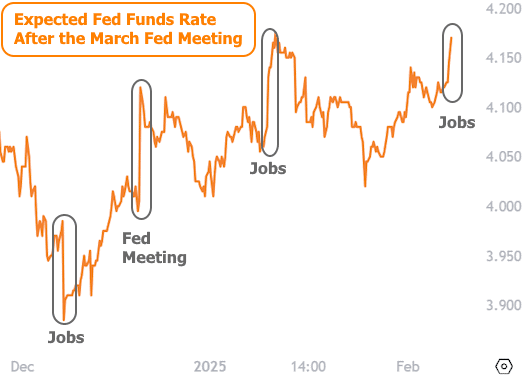

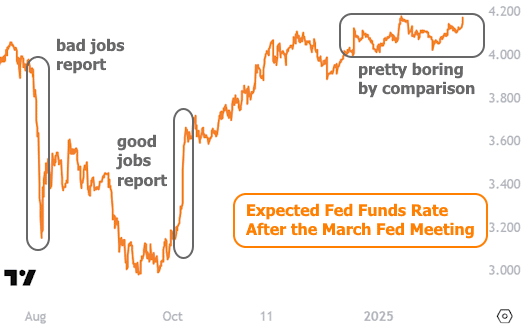

There’s a fun little market truth worth remembering: when you zoom in on short-term data, everything looks way more dramatic than it actually is. It’s kind of like looking at your skin way too close in a magnifying mirror—you’ll see all sorts of “imperfections” that aren’t really a big deal in the grand scheme of things.

Take traders’ expectations for the Fed Funds Rate next month, for example. If you just look at the latest movements, it seems like a rollercoaster. But pull back for the bigger picture, and things look way more stable. (And speaking of which, notice which economic report tends to set the mood.)

If there’s one report that can give the jobs report a run for its money, it’s the Consumer Price Index (CPI). This little guy is the first of the government’s two major inflation reports, and it’s been working its way toward the magic 2% target. That’s great news, but the Fed and traders want to see if the progress will keep going or if it’s going to hit a wall just shy of what’s needed to justify more rate cuts.

As a reminder, the Fed Funds Rate doesn’t directly set mortgage rates, but if CPI shows lower inflation, mortgage rates are almost guaranteed to follow suit. So, all eyes will be on CPI when it drops at 8:30 AM on Wednesday, February 12th. Set your alarms—this one’s worth watching!