If the financial markets were a poker game, traders would be the ones nervously adjusting their sunglasses and constantly shifting their chips—aka their bets on where the Fed Funds Rate will land months from now. These bets change all the time. Like your friend’s relationship status on Facebook circa 2008—expect frequent updates.

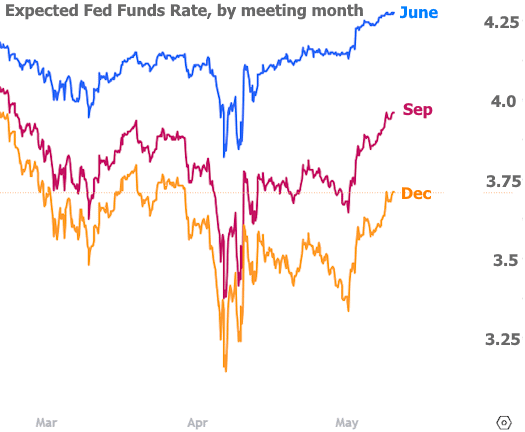

For example, the market’s guess for the June Fed meeting might look very different from its bet on the December one. Why? Because rate changes aren’t dropped like a surprise album—they usually come in stages. If the Fed cuts rates, it’s more of a gentle “tap-tap” than a dramatic free fall.

Then came Trump’s tariff drama. Picture this: markets sprinting to price in quick rate cuts, even for super-near meetings like May and June. But once the “90-day pause” button was pressed, expectations calmed down—especially for those early meetings. Long-term, though? Traders still had a hunch rates would go down.

There was a Fed meeting this week, but it was about as thrilling as decaf coffee. Everyone knew what the Fed was going to say: “Hey, we’re watching the whole trade thing. If it boosts inflation and growth, bad news for rates. If it slows things down, maybe we cut.” That’s Fed-speak for “We’ll see.”

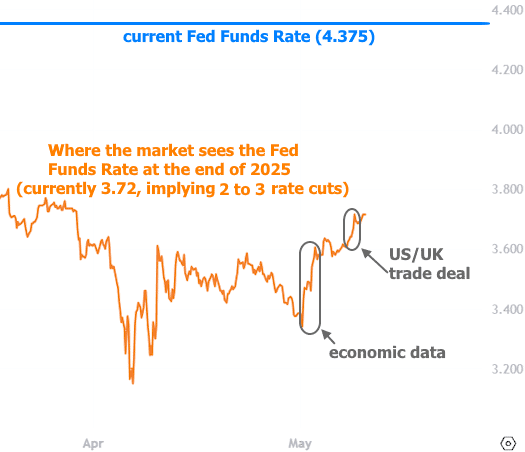

Even if Powell didn’t drop any bombshells, something did shake things up: stronger economic data and a shiny new US/UK trade deal. That combo pushed end-of-year rate expectations above pre-tariff levels. Check out the chart below—it’s all about December’s rate outlook. Just a heads-up: even though expectations rose, they’re still well below current rates, suggesting the market thinks we’re in for 2 or 3 cuts of 0.25% each.

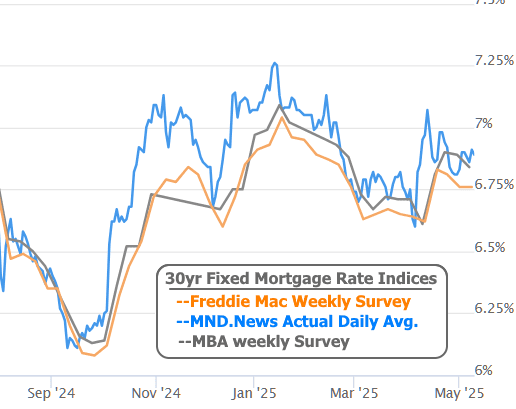

Now, a quick public service reminder: mortgage rates and Fed Funds Rates are distant cousins. They’re in the same family, but they definitely don’t text every day. So while traders are upping their rate forecasts, mortgage rates? Still hanging out on the low side, chill as ever.

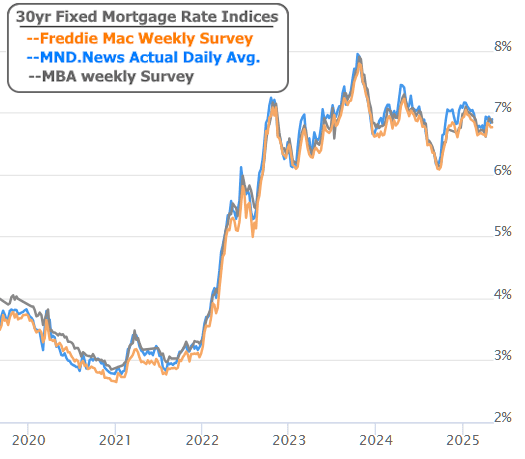

If you zoom out and look at mortgage rates over the past few years, it’s basically been the financial equivalent of waiting in line at the DMV—lots of standing around with not much happening.

Tariffs or no tariffs, we’ve been in a holding pattern for a while. What breaks the cycle? The same old trifecta: economic strength, inflation, and government borrowing needs. Trade deals—especially big ones—can touch all three, which is why markets keep refreshing the headlines like they’re checking on Taylor Swift ticket availability.

Looking ahead, we’ve got April’s first major inflation report coming in hot: the Consumer Price Index (CPI). It’s still too soon to fully gauge the tariff impact on inflation, but not too soon for a sneak peek. If core CPI jumps from 0.1 to 0.3 month-over-month, that would be a “meh, expected” outcome. Anything bigger? That’s when rates might start acting jumpy.

And don’t forget about the US/China trade talks. Weekend negotiations could deliver juicy headlines. Don’t expect a fast wrap-up like we got with the UK, but keep your popcorn handy—this is another potential source of market drama.