The Quirky World of Mortgage Rates: When Up is the New Normal

Mortgage rates took a 5-day joyride to higher ground this week, leaving many scratching their heads. Strangely, this climb wasn’t driven by the usual suspects like hot economic data or sizzling inflation numbers. Nope, it was one of those weeks where rates decided to flex their independence, reminding us that sometimes, they move just because they can.

One of the easiest—and hilariously wrong—assumptions about mortgage rates is that they dance to the Fed’s tune. People love to blame the Federal Reserve’s rate hikes or cuts, but here’s the kicker: mortgage rates and the Fed Funds Rate are like two moody roommates. Sure, they might head in the same direction over a long stretch, but day-to-day, they often do their own thing.

Back in September, we sounded the alarm about rising mortgage rates even as folks eagerly awaited Fed rate cuts. Spoiler alert: rates don’t care about your hopes and dreams. This time around, the situation’s a bit different, but the moral of the story remains: the Fed doesn’t have a magic remote control for mortgage rates.

A Quick Reality Check

The Fed doesn’t set mortgage rates. Let’s say that louder for the folks in the back: the Fed Funds Rate is not your mortgage rate’s BFF—at least not in the short term. Fun fact: the Fed only meets eight times a year, so their rate stays flat for six weeks at a time. Meanwhile, mortgage rates are out here living their best volatile lives.

Why, you ask? Because lending has layers—kind of like an onion or a parfait. Mortgage rates are based on loans with repayment terms stretching 5 to 30 years, while the Fed Funds Rate deals with ultra-short-term loans, often less than 24 hours. It’s like comparing a cross-country road trip to a quick grocery run—they’re both driving, but they’re not the same.

A Picture is Worth 1,000 Words

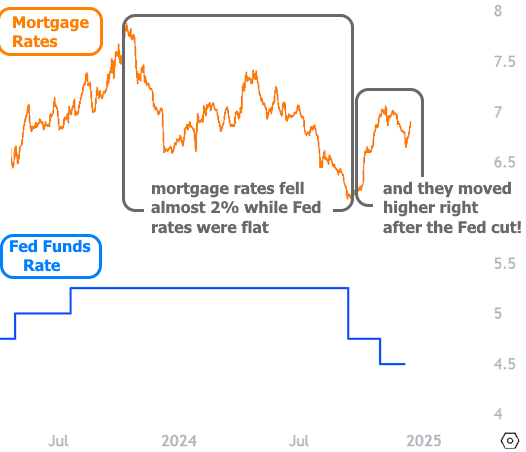

To illustrate this wild relationship, let’s roll the tape on the past year. In the chart below, the blue line represents the Fed Funds Rate (the one the Fed is itching to cut again), while the orange line shows average mortgage rates.

What jumps out? Mortgage rates fell nearly 2% last year without so much as a wink from the Fed Funds Rate. In fact, here’s the real plot twist: the very same day the Fed announced a rate cut in September, mortgage rates decided to start climbing from their long-term lows. Oh, the irony!

No Crystal Ball, Just Chaos

To be clear, we’re not predicting what’ll happen next week—mortgage rates laugh in the face of predictions. What we do know is that the market already expects the Fed to cut rates. If there’s any drama on Fed day, it’ll likely come from the fine print: changes to the Fed’s rate outlook or Fed Chair Powell’s post-announcement commentary.

So, buckle up! Whether you’re watching the Fed or following mortgage rates, remember this: it’s not always about the “why”—sometimes it’s just about the wild ride.