This past week gave us a classic economic plot twist: the strong, flexing-jobs-report hero from last week just got upstaged by this week’s unexpectedly chill CPI report. It’s like watching a boxing match where inflation data throws a surprise uppercut… but the mortgage rate crowd still isn’t ready to throw confetti.

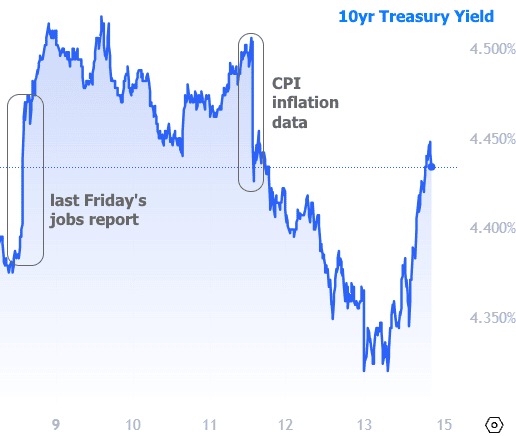

See, interest rates—and their puppet master, the Federal Reserve—are very sensitive creatures. They react to major changes in the economy or inflation like cats hearing a vacuum cleaner. Last week’s jobs report puffed its chest and nudged rates higher. But this week’s CPI? It strolled in cool and collected with inflation numbers lower than expected.

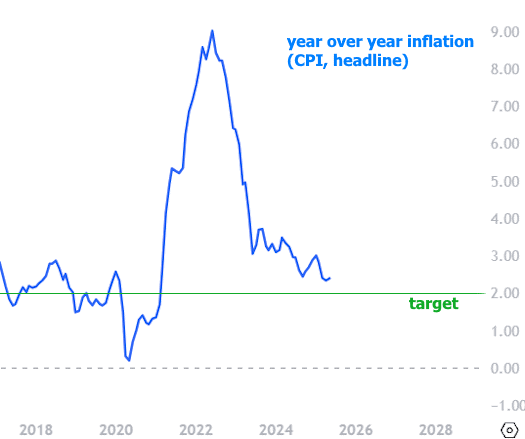

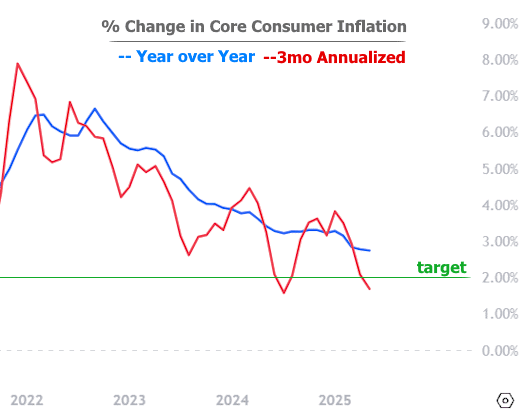

Still, even with that surprise, we’re not exactly popping champagne just yet. Inflation isn’t back at target levels—whether we’re talking the big picture or the “core” CPI (aka the version that politely ignores food and energy, because apparently those don’t count if you’re trying to look calm).

But—and here’s the fun part—if inflation continues at the same mellow pace we’ve seen over the last three months, that core CPI would actually land below the Fed’s target. That’s right, below. Let that sink in like a good rate lock on a Friday afternoon.

Now, interest rates don’t just float around aimlessly. They’re tied to the bond market, and the bond market is like your moody friend who checks every little news update before deciding what to wear. Right now, those bonds are waiting to see if tariffs or trade drama cause more inflation down the line. Until then, even good news is being taken with a healthy sprinkle of skepticism.

Still, this CPI report was juicy enough to erase the sting from last week’s jobs report—for now.

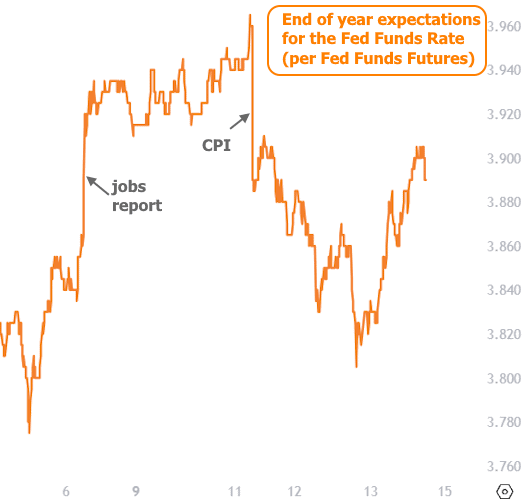

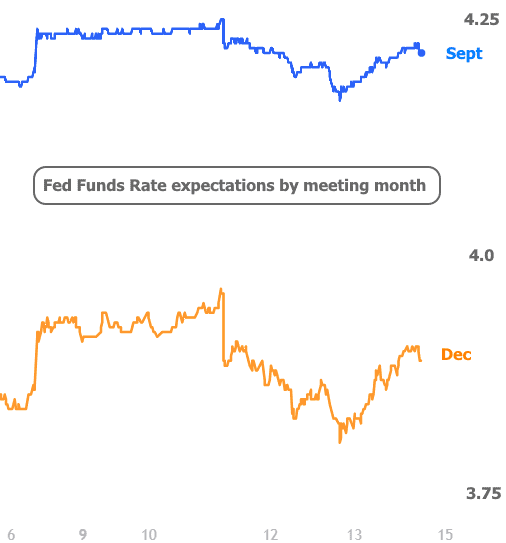

The vibes were so positive, in fact, that traders actually started whispering about the possibility of a rate cut sooner than expected. And when traders whisper, they do it through futures contracts. These things let them bet on when the Fed might finally blink and cut rates. Naturally, the December 2025 odds shifted a bit.

But let’s zoom out for some perspective. That chart only looked at the December Fed meeting. When you add in September expectations, the movement looks less like a market earthquake and more like a hiccup.

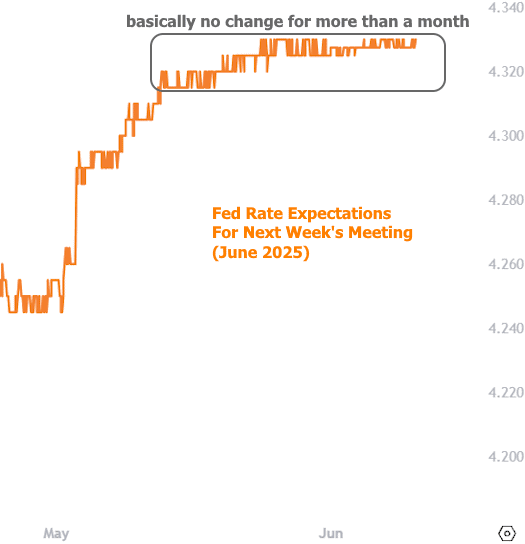

And what about this month’s meeting? Nada. The market has been in the “lol no hike” camp since early May and hasn’t budged. It’s about as flat as a pancake in Kansas.

Bottom line? The Fed’s not cutting rates next week—and the market isn’t expecting them to. The central bank has been clear: they’re waiting to see if tariffs and trade deals actually do anything to inflation. And as long as the job market doesn’t collapse like a Jenga tower, they’re staying patient.

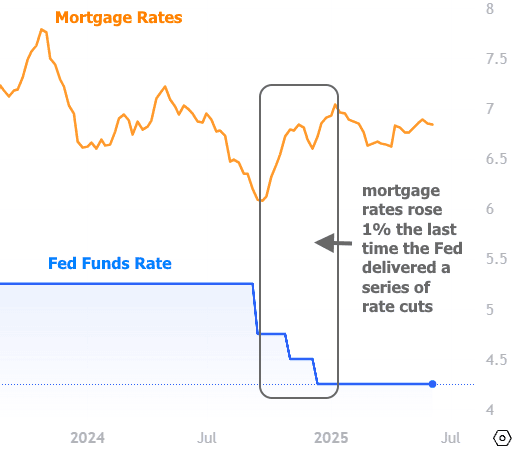

Now, here’s a fun twist for mortgage rate fans: you might think a Fed rate cut is your ticket to better deals, but history has something to say about that. Check out this next chart—it’s a bit of a buzzkill.

Moral of the story? Fed rate cuts don’t always mean lower mortgage rates. Sometimes they’re just a sign that the economy’s coughing—and that’s not exactly great news for anyone buying homes or selling them.

Next week’s big excitement? The Fed’s dot plot! It’s basically the Fed’s vision board: a chart showing where each Fed official thinks rates are going in the future. If there’s going to be any drama, it’ll likely come from that.

So sit tight, stay caffeinated, and remember—just because the CPI calmed down doesn’t mean the Fed’s ready to party.