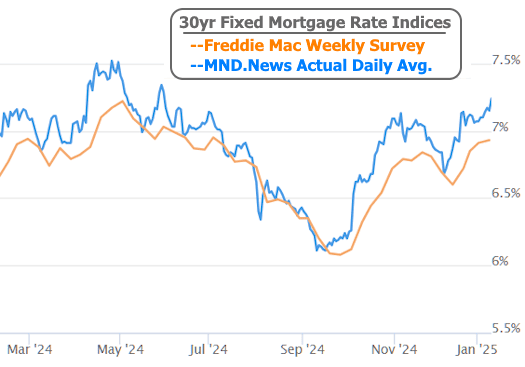

Let’s face it, mortgage rates were already having a bad week. By Wednesday, they were lounging (uncomfortably) at their highest levels since June 2024. But hey, at least things were relatively calm—until Friday morning’s jobs report dropped like a double espresso in the hands of a jittery trader.

Known officially as The Employment Situation, this monthly update is basically the Oscars of labor market data. It’s the report that makes mortgage rates either sing or sulk, and today it decided to crank up the drama.

Jobs Report Breakdown: The Plot Thickens

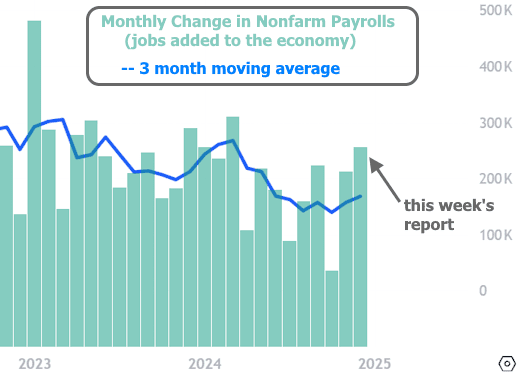

Higher employment often cozies up with higher interest rates, but it’s not the unemployment rate hogging the spotlight here. Nope, the real star is nonfarm payrolls (NFP), which is just a fancy way of saying “How many jobs did we add or lose last month?”

Economists had their predictions ready—160,000 new jobs. Reality, however, threw a curveball: 256,000 jobs!

Sure, that’s a big leap, but believe it or not, early January NFP surprises tend to average about 86,000 extra jobs. So, while this number was a bit of an overachiever, it wasn’t totally off the charts.

Naturally, bonds and rates responded with textbook logic. Cue the average 30-year fixed mortgage rate jumping to its highest level since May 2024. As for weekly rate surveys? They’re still catching up, kind of like that friend who’s always “on their way” but hasn’t left the house yet.

Looking Ahead: CPI on Deck

Next week brings another big economic report: the Consumer Price Index (CPI). This one is like the younger sibling of the jobs report—just as capable of causing chaos but with its own unique quirks.

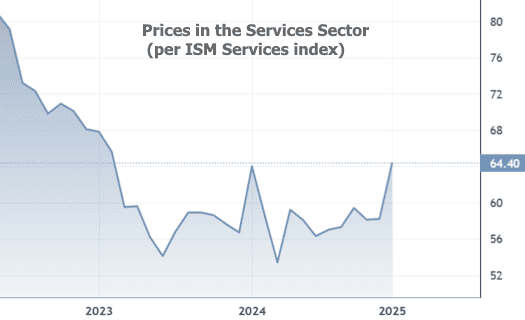

Inflation is still the hot topic, and the jury’s out on where it’s heading. On one hand, recent data is hinting at trouble. For example, the “prices paid” part of the ISM Services Index raised a few eyebrows this week.

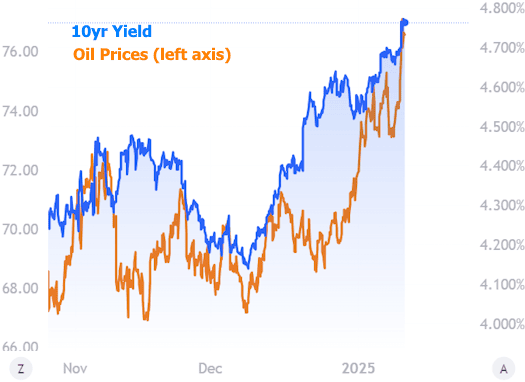

Energy prices have also decided to party like it’s 2022, climbing higher and feeding inflation fears in the rate market.

But wait—there’s a silver lining! The housing component of CPI, aka shelter, has been gently tapping the brakes over the past three months. This is a big deal because shelter makes up a huge chunk of core inflation. It’s been the unsung hero keeping inflation from sky-rocketing back toward the dreaded 2% target.

So, while mortgage rates are currently feeling the heat, there’s hope that cooler inflation data might give them a break soon. Fingers crossed!