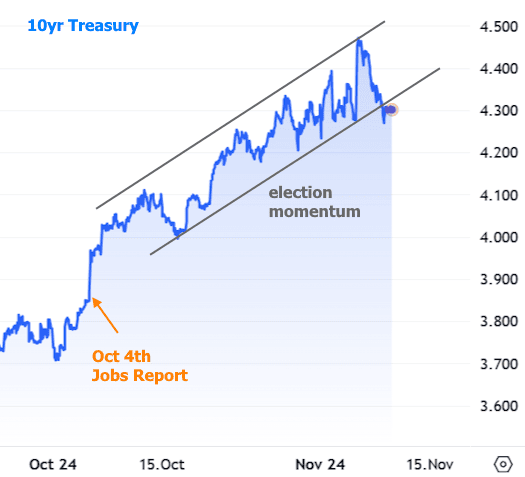

In October, mortgage rates zoomed upward faster than your morning coffee cools down. The climb was partly due to robust economic data, but much of it came from the bond market adjusting to the election chatter. For weeks, we’ve hinted that higher chances of a Trump win might push rates up—and oh boy, did the bond market take that idea and run with it!

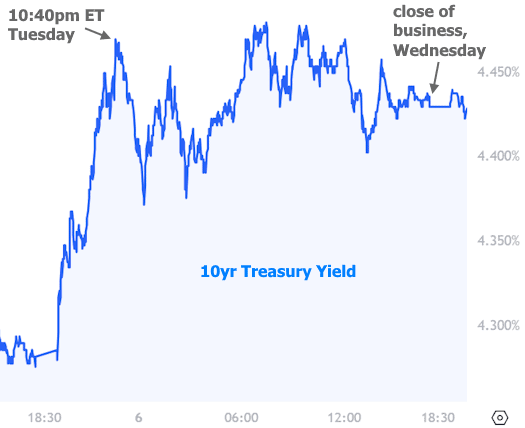

Election night saw Treasury yields spike like they’d just had an espresso shot, and betting sites weren’t far behind. Here’s a chart showing how 10-year Treasury yields went on an all-nighter, moving in sync with the polls.

By 10:40 PM ET, yields were already at levels they’d maintain through the next day’s trading. Markets, it seems, like to stay one step ahead whenever possible, even if it means staying up past bedtime. But remember, just because markets acted fast this time doesn’t mean they have a crystal ball. There have been plenty of times when a surprise throws them for a loop, and they have to pull off some quick moves to recover.

What About the “Red Sweep?”

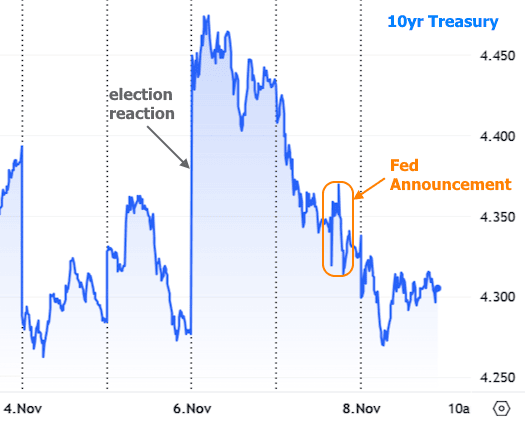

One of the spookier predictions for rates was the chance that both chambers of Congress might go red. Political monopoly, no matter the party, tends to be a recipe for higher rates. By Friday night, though, the House was still playing hard to get—giving rates a bit of room to breathe and recover after that election night spike.

Here’s a broader look at Treasury yields, including the early October jobs report reaction. Notice how rates just kept inching up through the month, topping off with the election surge and then settling back to around 4.3%.

Even if the GOP does end up with full control, it’s likely to be close enough that rates won’t get too spooked over future policies—at least, not yet.

So… What’s Next for Rates?

Politics aside, rates are like a cat with a laser pointer: always chasing after economic data and inflation. The Fed’s recent announcement underscored this focus, cutting its policy rate by 0.25% as expected. But longer-term rates? They barely blinked. By the time the Fed chimed in, rates were already easing up from election night’s surge.

And Mortgage Rates?

Mortgage rates took a brief dip on Fed day, but nope, it wasn’t the Fed’s doing (again, refer to the chart above to see how deeply the bond market correction had dug in by then).

Unlike Treasuries, mortgage rates are based on mortgage-backed securities, not something Uncle Sam can use to cover his bills. So, while the bond market affects both, mortgage rates sometimes dance to a slightly different beat. If, for example, a tax policy leads to less government revenue, more Treasuries might flood the market, which could push their rates up without necessarily yanking mortgage rates along for the ride.

Long story short? Mortgage rates will take their cues from the economy and actual Treasury issuance. Fiscal policy might have its say, but it won’t have the final word.

Looking Ahead to Next Week…

Next week brings a couple of heavyweight economic reports. The Consumer Price Index (CPI) and Retail Sales report are top billing, with CPI especially crucial as an inflation marker. If CPI shows inflation slowing to the calmer levels we enjoyed this past summer, it could help mortgage rates finally find a ceiling after their recent climb.

One more thing: financial markets will be closed on Monday in honor of Veterans Day, so take a break—rates sure will!