It’s that time again… maybe. By Friday, we’ll either be a few days deep into yet another government shutdown (cue the eye rolls), or we’ll be bracing ourselves for the whiplash of the jobs report. Honestly, it’s like choosing between stepping on a Lego barefoot or spilling coffee on your white shirt—neither is fun, but one of them is definitely happening.

Officially called The Employment Situation (which sounds way fancier than it feels), this monthly jobs report comes from the Bureau of Labor Statistics (BLS). If Uncle Sam decides to close up shop for a shutdown, the BLS will also take an unscheduled vacation… meaning no jobs report on Friday.

And that’s a big deal, because this report is the heavyweight champ of monthly economic data. Right now, the labor market has stolen the spotlight from inflation as the leading drama queen of interest rates.

Even when inflation hogs the headlines, the jobs report still manages to swing mortgage rates harder than a toddler hopped up on Halloween candy. Without it, markets are basically driving blindfolded and instead leaning on backup dancers like Wednesday’s ADP employment report.

Sometimes, in shutdowns past, the jobs report still managed to squeak through on schedule. But this time? Don’t count on it. By Wednesday at 12:01am ET, we should know if the curtain is coming down.

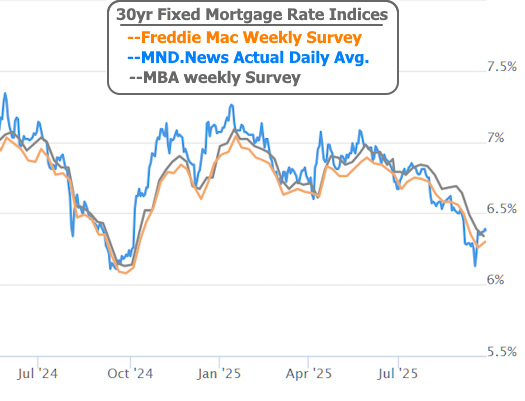

Now, about the current week… let’s just say it was more “meh” than memorable. A bunch of Fed officials gave speeches, but none of them said anything spicy enough to move rates. Thursday’s strong economic data nudged rates up just a smidge, and Friday’s inflation numbers were basically a yawn-fest, coming in exactly where experts expected.

So, average 30-year fixed rates? They barely budged, clinging close to last Friday’s levels like a cat that refuses to get off your laptop.

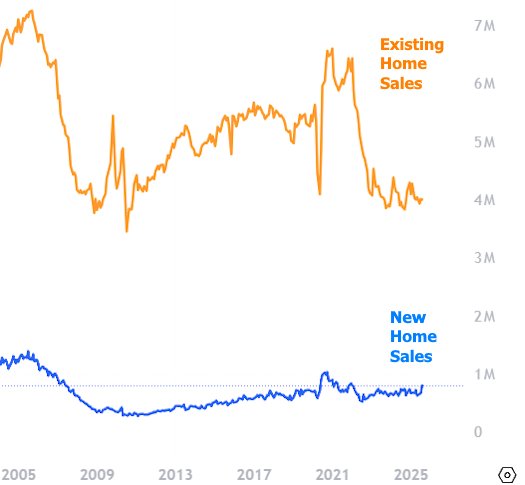

Meanwhile, new home sales shot higher, but don’t get too excited. That number bounces around more than a pinball, and besides, new homes are a much smaller slice of the pie compared to existing homes—which, by the way, are still dragging along at near record lows.

And finally, mortgage refinance applications set a fresh long-term high. But before you pop the champagne, it was just barely higher—and mostly because rates dipped low enough last week to give homeowners that “hmm, maybe we should refi” nudge.