Mortgage rates have been doing a pretty convincing impression of a confused cat lately—pacing back and forth between March’s cozy low-rate zone and the high-strung territory we saw earlier this year. For nearly two months, they’ve refused to pick a side, just loitering in the middle like they’re waiting for a better offer.

With markets still nervously eyeing trade policy drama like it’s a soap opera cliffhanger, all eyes turned to economic data this week to see if it could give rates a much-needed nudge.

As always, the first week of the month came prepared with a blockbuster lineup:

- ISM Manufacturing Index

- ISM Services Index

- Job Openings

- ADP Employment

- Drumroll please… The Big Kahuna: The Jobs Report (a.k.a. the Employment Situation)

Now, normally the jobs report shows up fashionably late on Fridays to shake things up. But every so often, the other reports jump the gun and set the tone ahead of time. This was one of those weeks—until the jobs report came in like a plot twist.

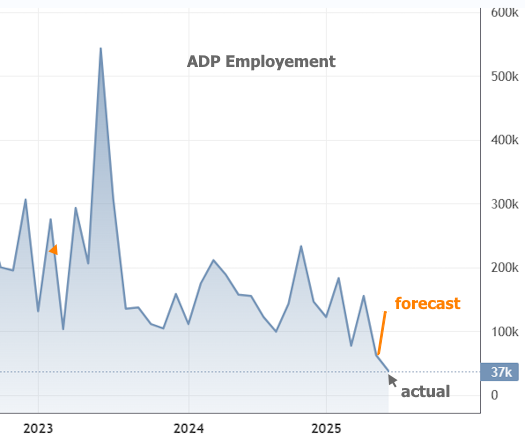

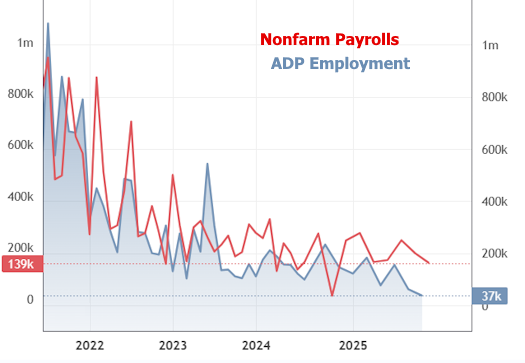

On Wednesday, things started to look a little too good (or bad, depending on your perspective). The ADP Employment report came in way below expectations, basically waving a big red flag that said, “Yo, the job market might be cooling down!”

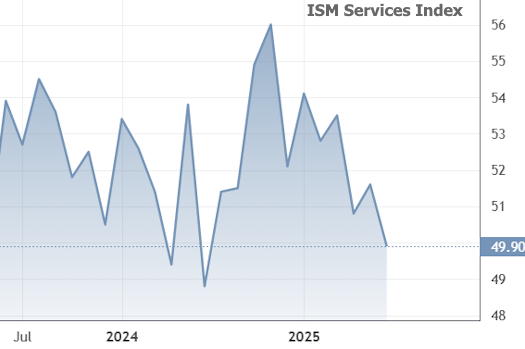

Less than two hours later, the ISM Services Index backed that up, saying, “Yup, things are looking kind of meh.” Cue the dramatic bond market reaction and a sharp drop in yields.

Fun fact: That ADP reading was the weakest since January 2021. And while ADP and the official jobs report don’t always move in sync, a miss that big still makes everyone sit up straighter.

Meanwhile, ISM’s message wasn’t a total shocker, but it didn’t exactly scream “economic strength” either. With both reports chiming in like a gloomy barbershop duo, markets braced for Friday’s jobs report to hit the same sad note.

Buuuut… surprise!

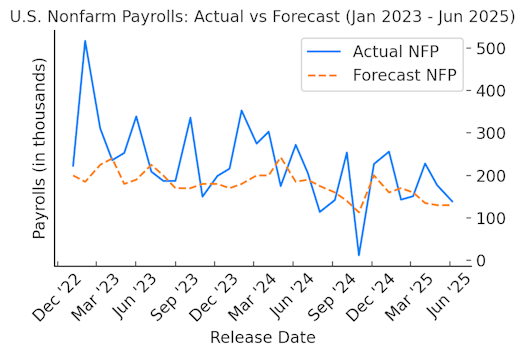

Instead of singing the blues, Nonfarm Payrolls (NFP) came in stronger than expected. It wasn’t a wild overperformance, but given the downbeat setup from Wednesday, even a modest beat was enough to flip the mood.

The bond market was not amused. Yields on 10-year Treasuries (the ones that dance in step with mortgage rates) shot up faster than a toddler on sugar.

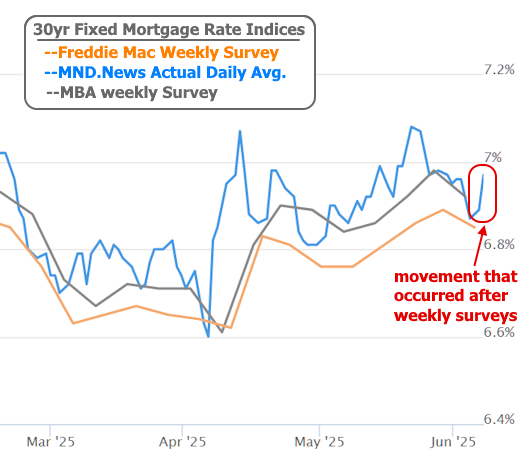

MND’s mortgage rate index (tracking top-tier 30-year fixed rates) bounced back toward 7% after briefly dipping to 6.87% mid-week. If you only looked at MBA or Freddie Mac’s weekly survey data, you might think rates dropped this week—but that’s just because they cut off before the Friday mayhem.

Bottom line: For a brief, shining moment mid-week, rates were lower. But then the jobs report came stomping in, and now we’re back up in the “almost 7%” zone. Again.

Looking ahead, next week brings more economic data—mainly inflation-related—so don’t be surprised if markets take it with a pinch of salt until there’s more clarity on tariffs and government spending bills. Either way, the rate rollercoaster continues, so buckle up.