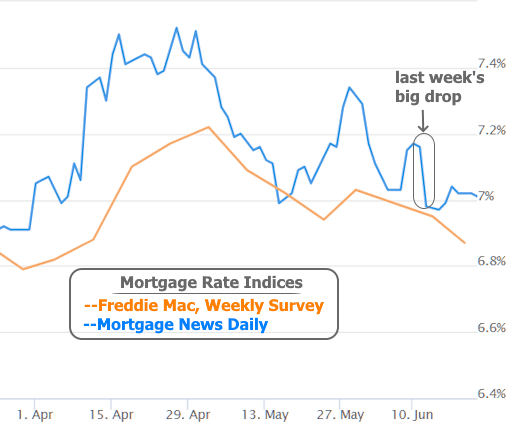

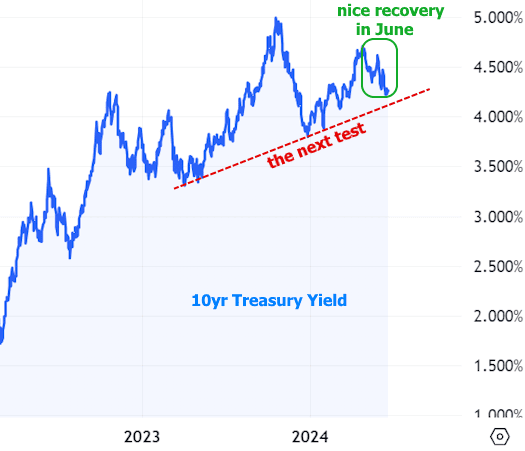

After a rocky start to the year, things began to look up for rates and the inflation outlook in May. June took that improvement up a notch, but this week? Meh, no major shake-ups.

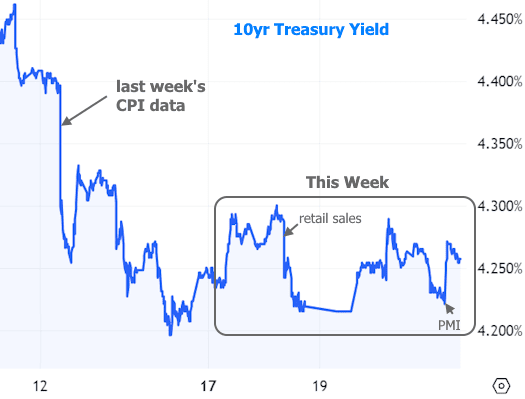

Before the market closed for Juneteenth on Wednesday, the Retail Sales report on Tuesday morning was the hot topic. It came in slightly under the forecast, and last month’s numbers were revised down. Rates reacted by drifting back toward recent lows but didn’t quite dip below them.

Some sources claim mortgage rates are at multi-month lows, but they’re relying on Freddie Mac’s weekly survey, which sometimes has a bit of a “creative interpretation” due to its timing and methods. In reality, both 10-year Treasury yields and mortgage rates have been more like a flat soda: a sideways fizzle rather than a sparkling improvement.

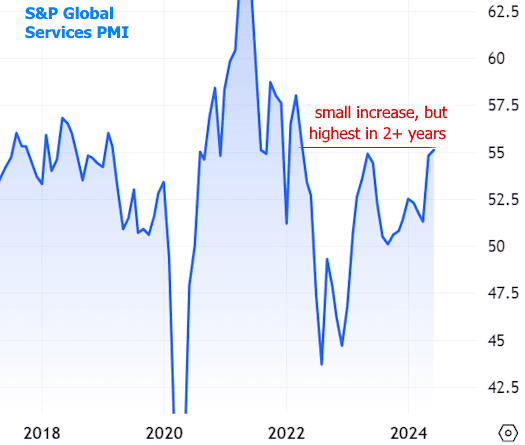

Besides Retail Sales, Friday’s PMI data from S&P Global was the big news, showing the strongest levels in over two years—just barely.

Stronger economic data usually means rates head north. Looking at 10-year Treasury yields as a quick gauge for mortgage rate trends, we see the impact relative to Retail Sales earlier in the week. Neither were as dramatic as last week’s CPI data. They even argued opposite cases, helping rates stay in a low-key range for now.

Basically, most of June’s progress was already baked in before this week started. Rates are now close to a long-term uptrend, which will be tough to break unless June’s upcoming economic data screams economic weakness and lower inflation. But we have a few weeks to wait before most of June’s data starts rolling in.

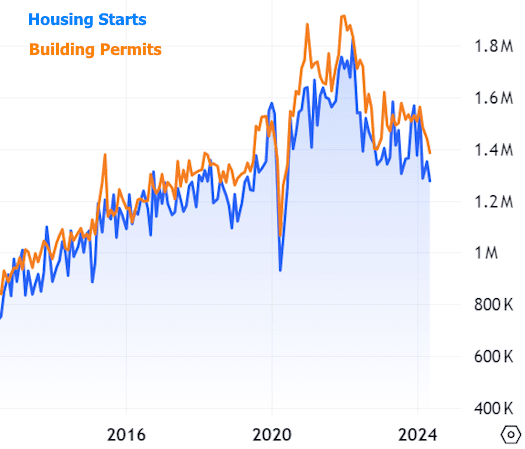

The rest of this week’s data was mostly housing-focused and didn’t really shake up the markets. New Residential Construction is tracked at several stages, with building permits and housing starts (the kick-off to physical construction) being the main highlights. Both have been gently trending lower but are still higher compared to pre-pandemic levels. This week’s update followed that trend.

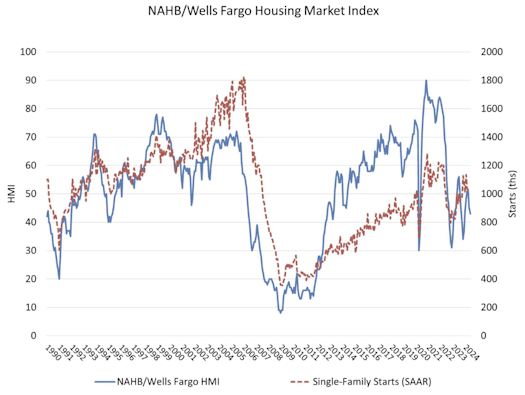

The National Association of Homebuilders (NAHB) released its Housing Market Index, which is essentially a builder confidence report. High rates and low affordability are still dragging down builders, making them cut prices or offer sweet deals.

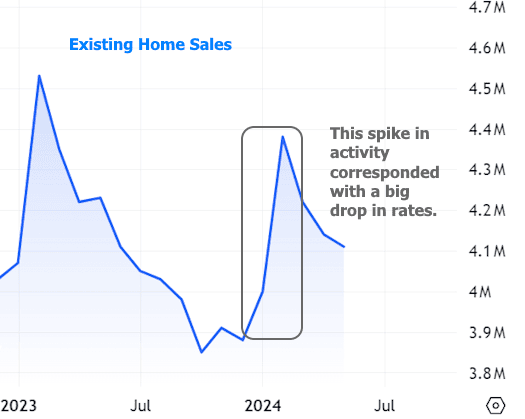

Existing Home Sales are more sensitive to post-pandemic rate swings and have been struggling more than new construction. This week’s update didn’t change much but didn’t throw any surprise parties either.

The juicier bit for home sales is what might happen if rates drop again. The last time rates took a dive, the housing market responded with enthusiasm. Early July’s data will show whether rates can challenge the bigger picture uptrend. If they do, we might see a significant boost in housing activity.