If you’ve turned on a TV, opened a news app, or accidentally overheard your neighbor yelling at their cat this month, you know there’s been some serious market drama ever since the April 2nd tariff announcement. But good news: this week, the markets finally started acting like they took a chill pill.

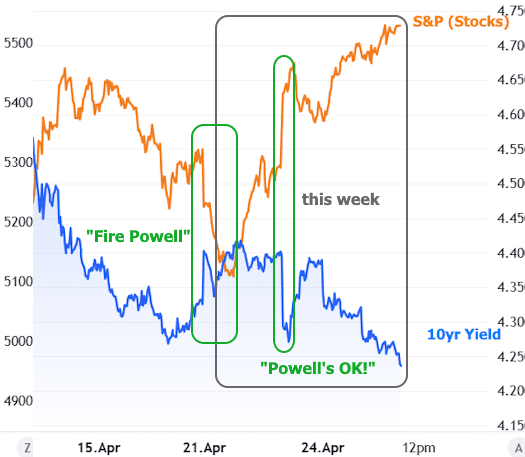

Now, last week wasn’t just tariffs causing trouble. Things got extra spicy when Trump lobbed some choice words at Fed Chair Jerome Powell. Up until then, bonds (and by extension, mortgage rates) were having a pretty good time, maybe even humming a little happy tune.

Sadly, that mood died faster than a party when the DJ plays “Cotton Eye Joe.” Stocks and bonds both took a nosedive Monday morning after Trump doubled down on his Powell criticism.

Then—plot twist!—less than a day later, Trump changed his tune, assuring everyone he had zero plans to fire Powell. Markets, being the emotional creatures they are, immediately perked up. Add to that some surprisingly friendly-sounding news about trade negotiations with China, and suddenly it was high fives all around for both stocks and bonds.

The big fireworks came after Trump’s “just kidding” moment about Powell. After that, with no new tariff bombs dropping, the markets gracefully continued tiptoeing higher. (Reminder: for bonds, “higher” means yields go lower. It’s confusing. We didn’t make the rules.)

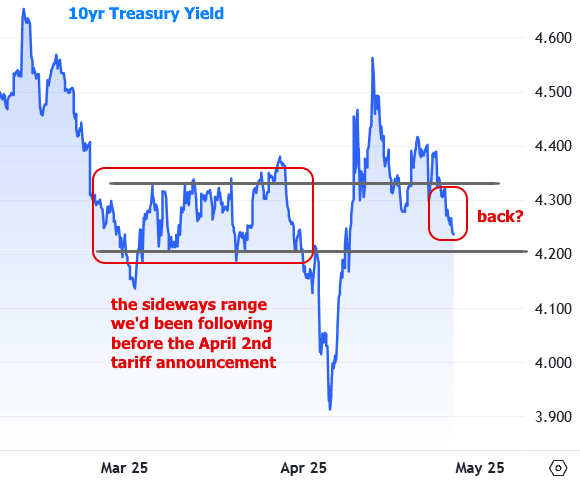

By Friday, the bond market had pretty much pulled a full “round trip”—think of it like getting lost, panicking, and somehow ending up right where you started. Yields were back around where they had been for a solid, uneventful month before all this tariff business blew up.

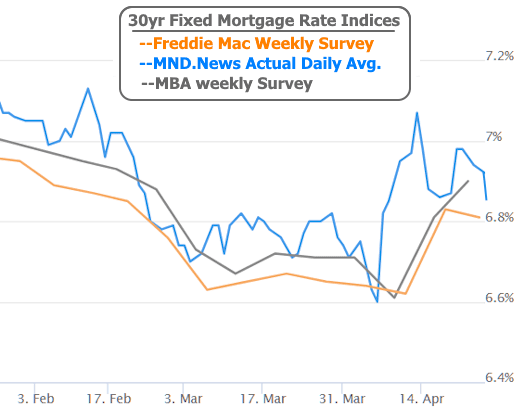

So… are we back? Well, sort of. Technically. But—as always with markets—there’s a catch. Mortgage rates, for one, aren’t quite as “back” as Treasury yields are. (Mortgages are always fashionably late to these parties.)

If you’re looking at weekly survey numbers, you’ll notice a slight lag. If you peek at daily averages from MND, though, mortgage rates are almost keeping up. Think of it like your friend who technically arrives at brunch on time but still needs ten minutes to park.

And here’s another thing: the only thing markets ever know for sure is where they are right now. The future? Still as foggy as your bathroom mirror after a hot shower.

While tariff drama might be taking a nap (for now), the real show is going to be how tariffs impact the economy itself. Spoiler alert: we already caught a glimpse—one of this week’s economic reports (S&P Global’s PMI) showed rising price pressures thanks to tariffs.

Looking ahead, next week’s calendar is loaded like a nacho platter at a Super Bowl party. Every single day has at least one event that could jiggle markets around. The big finale? Friday’s Jobs Report—a.k.a. the Beyoncé of economic data—because when it drops, everyone pays attention, and it can seriously move interest rates.