If you’ve ever watched the bond market and thought, “That makes perfect sense,” you’re either a genius… or you blinked and missed something.

The bond market drives changes in interest rates, and among bond traders, the Bureau of Labor Statistics (BLS) jobs report is basically the Super Bowl of monthly economic data. Normally, this report tells rates what to do.

This time?

Rates said, “Nah.”

Wait… The Jobs Report Was Strong, Right?

Let’s break this down.

- 130,000 jobs created (forecast was 70,000)

- Unemployment at 4.3% (forecast was 4.4%)

If you polled 10 bond traders before the release, 9 of them would’ve confidently said:

“Rates are going up this week.”

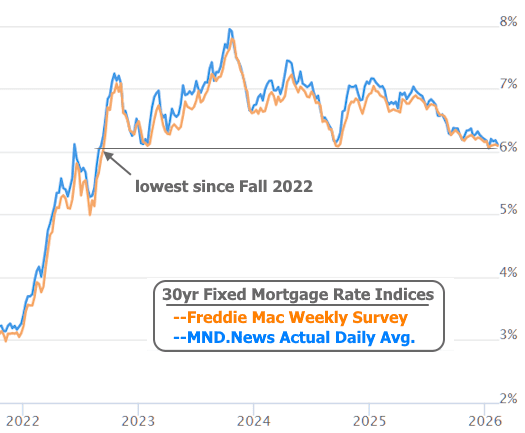

Instead, Treasury yields fell to their lowest levels in months. Mortgage rates followed right behind, landing near their lowest levels since August 2022.

The Immediate Reaction? Totally Normal.

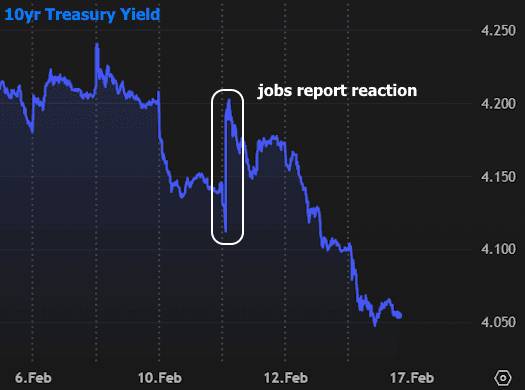

Right after the jobs data hit, rates did spike higher — exactly what you’d expect.

But then something funny happened.

Over the next two days, rates calmly erased all the damage… and then some.

The following chart shows 10-year Treasury yields (which tend to move a lot like mortgage rates) doing exactly that.

Zooming Out: Things Got Wild (In a Good Way)

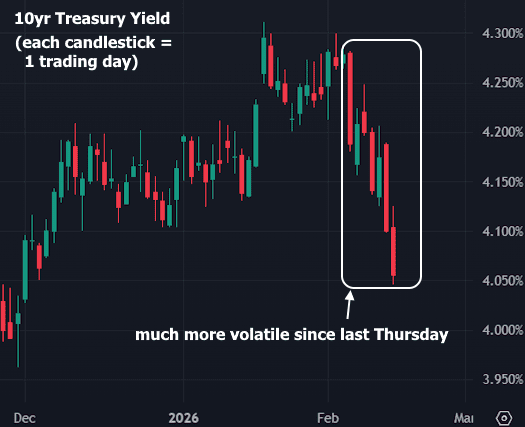

When we zoom out and switch to daily candlesticks (those little bars that show the day’s trading range), we can see just how volatile — and surprisingly rate-friendly — the past week has been.

Translation: big swings, but momentum leaning toward lower rates.

So… Why Did This Happen?

Short answer?

Even seasoned bond market pros are shrugging and saying, “Honestly… not sure.”

But let’s explore some of the more plausible explanations.

1️⃣ Weak Labor Data Before the Jobs Report

Last Thursday delivered three labor market metrics that were quite weak.

Then Tuesday’s Retail Sales report came in much lower than expected.

That combination whispered to markets:

“The economy might not be as strong as headlines suggest.”

And bonds like that kind of whisper.

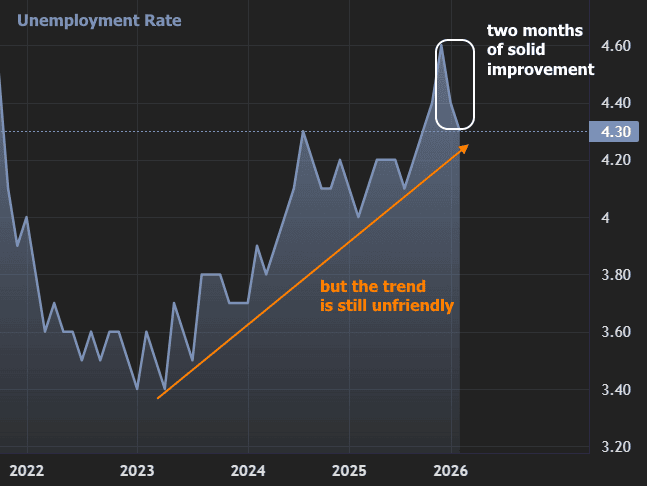

2️⃣ Unemployment Isn’t As Pretty As It Looks

Yes, unemployment was slightly lower than expected.

But the broader trend is still rising — which, ironically, is good news for mortgage rates.

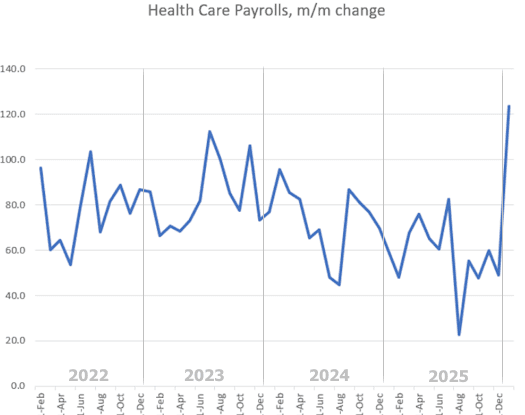

3️⃣ Healthcare Hiring Went… A Little Crazy

Payroll growth looked strong overall, but a huge chunk came from healthcare.

In fact, it was the biggest monthly jump in healthcare payrolls in years — more than double recent readings.

Markets may be thinking:

“That’s nice… but is that repeatable?”

If not, the headline strength may fade quickly.

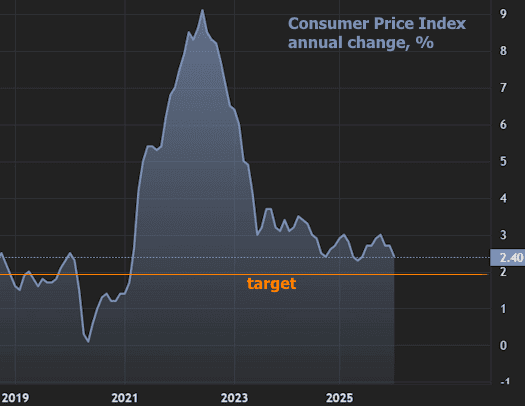

4️⃣ Inflation Helped (Just a Bit)

Friday’s Consumer Price Index (CPI) came in slightly lower than expected.

Inflation matters a lot to rates. And this report was 0.2% cooler than markets expected.

Headline CPI continues drifting toward the Fed’s 2% target.

Not a dramatic shift… but helpful.

5️⃣ Stocks Took a Hit

Thursday also featured heavy selling in stocks and commodities.

Now, falling stocks don’t always mean lower rates. But large stock declines often push investors toward safer assets like bonds — and that tends to lower yields.

Big picture? Investors may be sensing that this phase of stock market expansion is due for one of its periodic “breathers.”

And when stocks take a breather, bonds often catch one.

We’ve seen this before:

Yes, early 2025 volatility was amplified by tariff headlines, but the general pattern is similar.

The Holiday Factor

We also can’t ignore the potential volatility surrounding 3-day holiday weekends.

Markets sometimes reposition ahead of long breaks. Sometimes that adds fuel to moves that were already forming.

What’s Next?

When markets reopen Tuesday:

- Fewer major data releases early in the week

- Several housing-related reports

- Friday brings:

- Q4 2025 GDP

- Personal Consumption Expenditures (PCE) — the Fed’s favorite inflation gauge

If CPI nudged rates lower, PCE could either confirm the trend… or remind everyone that markets still have a sense of humor.

The Bottom Line

The jobs report looked strong.

Rates looked at it.

Rates shrugged.

And now mortgage rates are back near 3-year lows.

Markets don’t always do what seems logical in the moment — but when you zoom out, the broader economic cooling story may still be winning.

Stay tuned.

Because if this week taught us anything, it’s this:

The bond market doesn’t always follow the script.

And that’s what makes it interesting.