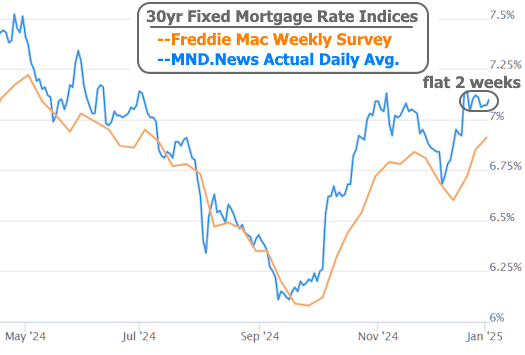

As the world collectively mutters, “Wow, it’s 2025 already,” mortgage rates are still hitting the snooze button. They’ve gracefully cruised through the holiday season without a hint of scandal—a stark contrast to December’s wild rollercoaster. Remember that pre-holiday excitement with a decent rate drop, only to be followed by a sudden spike after the Fed’s rate cut on the 18th? Good times.

December’s calm wasn’t a guarantee, but it’s become a bit of a tradition. With most traders out decking the halls and the economic calendar quiet as a sleeping cat, the stage was set for everyone to take a breather. But next week? Oh, next week’s a different story.

Why Next Week Could Be a Wild Ride

With everyone back at their trading desks and an economic report lineup that’s hotter than a New Year’s Eve countdown, volatility could crank up a notch—or three. Think of it as a turbocharged version of “new year, new drama.”

The star of the show? The monthly jobs report, which drops on Friday, January 10th. In case you forgot, this report has been the main character for rate swings over the past four months. But wait, there’s more! Earlier in the week, we’ll get some juicy economic data to set the stage, and the following week brings inflation’s headliner: the Consumer Price Index (CPI).

Rates and Housing: Still in Limbo

For now, both mortgage rates and housing metrics are like that one friend who can’t decide on dinner—stuck in limbo. We’re unlikely to see any dramatic shifts in the first two weeks of January. So, let’s call this period the appetizer to the main course of significant momentum later in the year.

A Quick Housing Recap: Slow and Steady Wins the Lows

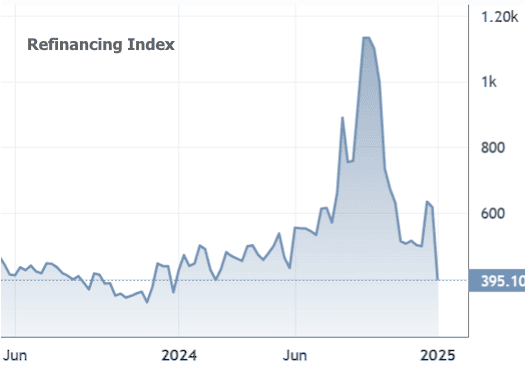

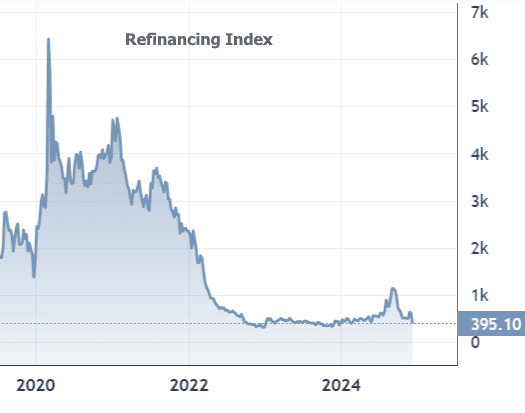

In this week’s housing highlights, the Mortgage Bankers Association (MBA) refinance index dipped back into long-term low territory after a brief holiday hiatus. No shocker here—higher rates during the previous survey window made refinancing less appealing than leftover fruitcake.

And while that chart might look like a scene from a disaster movie, the reality is it’s just a tiny blip in the grand scheme of things.

Meanwhile, the purchase application index has been playing it cool, drifting sideways at those same long-term lows.

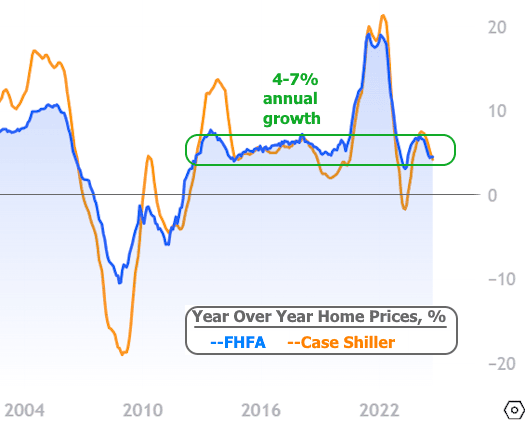

Earlier this week, the FHFA and Case-Shiller home price indices reminded us that home price appreciation has been like a reliable houseplant—steady and predictable. Year-over-year growth is holding steady in the 4-7% range (4.5% for FHFA, 4.2% for Case-Shiller), a comforting constant for most of the past decade.

The Bottom Line

Mortgage rates may have been on holiday, but they’re gearing up for some serious action in January. With traders back, key economic data on the horizon, and a new year’s worth of market antics ahead, 2025 is off to a cautiously optimistic start. Buckle up, folks—it’s going to be an interesting ride!