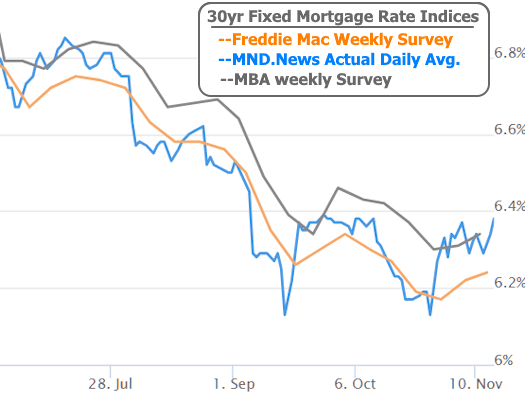

Well, after the longest government shutdown in U.S. history (a streak no one wants to brag about), Uncle Sam finally clocked back in on Thursday. And believe it or not… that little “back to work” moment gave mortgage rates a slight nudge upward. Since rates have been tiptoeing inside a narrow range, even a gentle nudge puts the average 30-year fixed back near its highest point in over two months.

Why Would Reopening the Government Push Rates Higher?

Great question. In normal human terms:

When the economy looks strong → rates tend to go up.

When the economy looks sad and needs a hug → rates tend to go down.

A long shutdown = bad for the economy.

Reopening = somewhat less bad → so rates treat it like good news… meaning upward pressure.

What Else Is Making Rates Cranky?

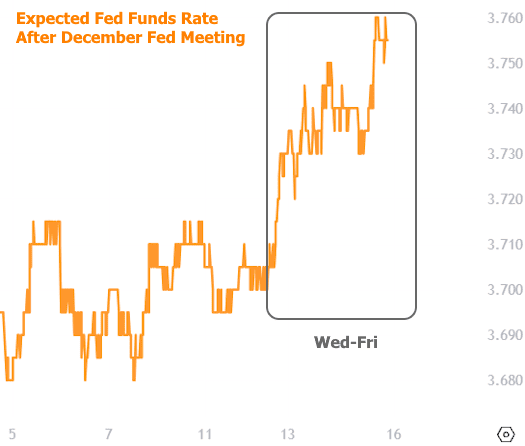

This week the Federal Reserve got together, apparently shared a group chat, and decided to all speak in one voice — which is extremely rare and mildly spooky.

Usually, Fed speakers are like a family at Thanksgiving: everyone has a different opinion, nobody agrees, and somehow the mashed potatoes get political.

This week? Not the case. The Fed was almost too unified… and unfortunately, what they were unified about wasn’t exactly rate-friendly.

How Were Fed Comments “Unfriendly”?

The Fed always juggles two big goals:

- Keep inflation low

- Keep jobs strong

Recently they seemed more worried about the job market — which increased the chance of a December rate cut.

But this week? Suddenly they’re all side-eyeing inflation again like it just stole their parking spot.

Here’s the vibe:

- Cleveland’s Hammack: “Inflation’s going to be spicy for a few years. Also, policy isn’t restrictive enough yet.”

- Kansas City’s Schmid: “Inflation is too hot. Rate cuts won’t fix job market cracks, and might even stir the inflation pot.”

- Atlanta’s Bostic: “No cutting until inflation behaves.”

- San Francisco’s Daly: “Too early to say anything. Don’t ask me yet.”

- Minneapolis’ Kashkari: “Inflation at 3% is still too high. I didn’t like the October cut, and I’m undecided for December.”

- St. Louis’ Musalem: “I supported cuts before… but now? Let’s slow down.”

Translation:

“We’re not cutting rates unless inflation chills out — period.”

And the markets believed them. Strongly.

Here’s the Market’s Expectation for the December Fed Meeting

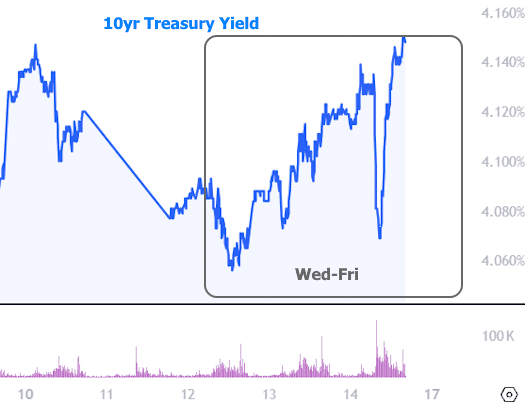

Meanwhile, Longer-Term Rates Were on Their Own Adventure

10-year Treasury yields also climbed Wednesday–Friday. On Friday there was a quick dip (stocks tanked), followed by a quick jump (stocks recovered), proving once again that bonds and stocks act like siblings who pretend not to care about each other but secretly do.

The Result for Mortgage Rates

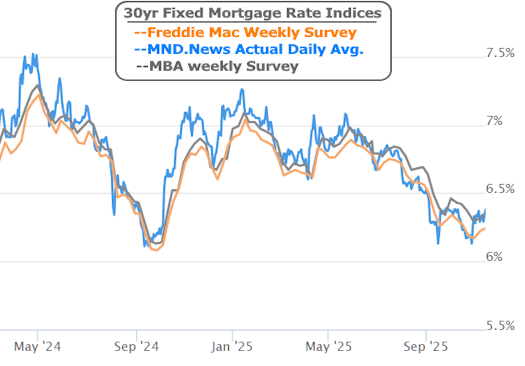

We’re back to the top of the recent 2-month range.

But before you panic — zoom out! In the big picture, the range is still extremely narrow and still decently low.

What Happens Next?

Everyone is now waiting to see how fast the government can crank out all the economic data that was delayed during the shutdown. Spoiler: it won’t all magically appear on time.

We did get a couple of old reports on Friday — basically things that should’ve come out over a month ago. Next week should bring us a revised release schedule, hopefully with major reports landing before the mid-December Fed meeting.

About Those “50-Year Mortgage” Headlines…

Yes, the rumor mill was buzzing this week about Fannie/Freddie potentially introducing a 50-year mortgage.

Here’s what you need to know:

- Nothing is official. At all.

- It might never happen.

- If it does happen, the rate would be higher than a 30-year.

- Payments might look slightly lower, but the total interest over 50 years would be… let’s just say, not cute.

- We won’t know the real impact until markets decide how to price a 50-year loan — if it even becomes real.

Best move?

Don’t lose any sleep over it yet.