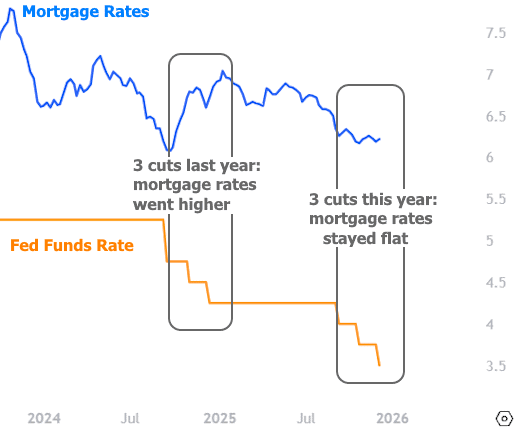

Friends don’t let friends believe the long-standing myth that Fed rate cuts = lower mortgage rates. That myth refuses to die, but here we are again with fresh evidence.

If you’d rather skip the “why” and jump straight to the “what,” here you go:

This isn’t some weird one-off situation. The Fed Funds Rate controls loans that last less than 24 hours. A mortgage, on the other hand, can hang around for 30 years like an unwanted houseguest. Loans with wildly different lifespans tend to do… wildly different things.

Even if we pretend there’s a strong connection between the two, there’s another problem:

The Fed meets 8 times a year. Mortgage rates move every single day.

That means mortgage rates almost always move before the Fed does, assuming the market has a decent idea of what the Fed is going to do next—which it usually does.

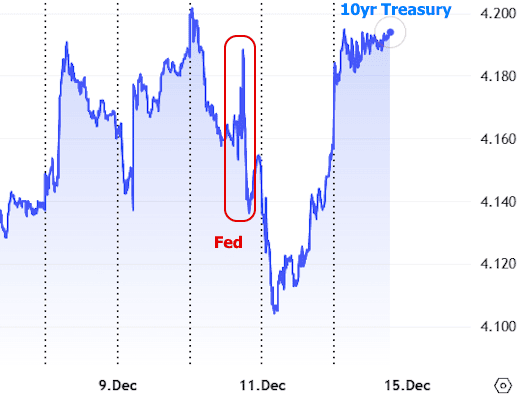

Thanks to very transparent Fed communication and trading tools like Fed Funds Futures, the market has had a high level of confidence about recent Fed cuts. Every cut in 2025 was more than 90% priced in well before the official announcement. This week was no different. In fact, the market’s reaction stayed comfortably inside the normal weekly range for longer-term rates.

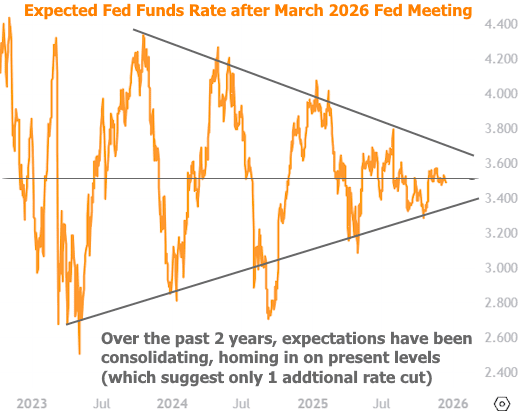

It also doesn’t hurt (or surprise anyone) that the Fed’s policy path is becoming increasingly locked in. As far as markets are concerned, we’re probably looking at one more rate cut by early 2026, and that’s about it.

We’ve been slowly marching toward this realization for years, and especially over the last three months.

Quick note: In the chart below, a value of 3.375 represents one additional cut from current levels.

As expectations for future Fed cuts tighten into a narrower range, interest rates do the same—starting with U.S. Treasuries:

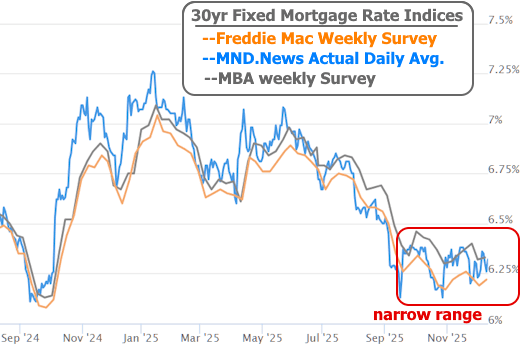

…and continuing right on over to mortgage rates:

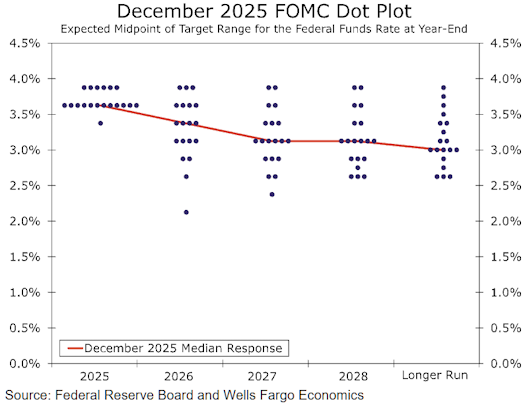

Even the Fed’s own forecasts back this up. At this week’s meeting, the Fed updated its famous “dot plot” (the chart where each dot represents a Fed member’s interest-rate expectations).

Short version:

The median Fed member expects one more cut in 2026, and maybe one more by the end of 2028. That’s not exactly an aggressive rate-cutting spree.

So What Does This Mean for You (and Mortgage Rates)?

Honestly? Not much—at least not yet. Everything discussed so far is already in the rearview mirror. The things that actually matter for rates are the things that haven’t happened yet.

That includes big shifts in:

- Economic data

- Fiscal policy

On the data side, next Tuesday brings the much-anticipated November jobs report (originally scheduled for last Friday, but delayed by the shutdown). If the report shows meaningful labor-market weakness, another Fed rate cut suddenly looks more likely. Longer-term rates would probably move lower in anticipation—though they could still be pushed around by other data.

Case in point: inflation.

We’re still waiting on updated inflation data after the shutdown, and next Thursday brings the delayed release of November’s Consumer Price Index (CPI). If inflation comes in hotter than expected, it could easily offset any rate-friendly impact from the jobs report.

Think of it like two coin flips:

- Two heads or two tails? Rates probably move more decisively.

- One head and one tail? They might cancel each other out and go nowhere.

A Final Note on Fed Bond Buying (a.k.a. “No, This Is Not QE”)

There’s been plenty of confusion about the Fed’s announcement this week regarding bond purchases. Some folks are calling it QE (quantitative easing) and expecting mortgage rates to drop as a result.

Those folks are wrong.

QE involves intentionally flooding the banking system with liquidity to force institutions to lend more aggressively, especially on long-term loans—pushing rates like mortgages lower.

That is not what’s happening here.

What the Fed announced was a long-telegraphed move to prevent liquidity from shrinking too much. Reserve balances have been declining as banks compete to absorb a growing pile of short-term Treasury debt. If reserves fall too far, banks struggle to lend and provide liquidity—leading to higher rates and unnecessary market volatility.

To prevent that mess, the Fed will buy just enough short-term Treasuries to keep the system functioning smoothly.

Yes, this may help prevent rates from drifting higher than they otherwise would.

No, it is not QE.

And no, it should not be expected to push rates lower.

This was something the Fed had been signaling for over a year—and something banks were, quite literally… banking on.

Bottom line: This bond buying is a safety net, not a rate-cutting engine. It’s designed to keep rates from rising unnecessarily, not to send mortgage rates sliding downhill.