Mortgage rates and the Fed Funds Rate: a tale as old as time, or at least as old as economic policy. You’d think a Fed rate cut would be the financial equivalent of throwing a party for mortgage rates, but nope! This week, those mortgage rates took one look at the Fed’s moves and said, “We’re doing the exact opposite.” Classic.

Last week, we predicted: “If anything from Fed day impacts mortgage rates, it’ll be changes to the Fed’s rate outlook or Powell’s press conference zingers.” Guess what? That’s exactly what happened. Buckle up, because this week was one for the rate-rollercoaster history books.

Wait, Rates Went Up After a Rate Cut?

Yep, welcome to the wild world of finance. Mortgage rates don’t exactly hang on every word of the Fed Funds Rate—it’s more of a “casual acquaintances at a networking event” kind of relationship. What they really care about is the Fed’s long-term vibe, not just the short-term moves.

Here’s what went down this Wednesday:

- A Sneaky Sentence Upgrade

The Fed’s policy statement got a small but mighty tweak. They changed “In considering additional adjustments” to “In considering the extent and timing of additional adjustments.” Subtle? Sure. But to traders, this screamed: “Hey, we might hit pause on rate cuts next meeting!” Powell confirmed this during his press conference, leaving no room for second guesses.

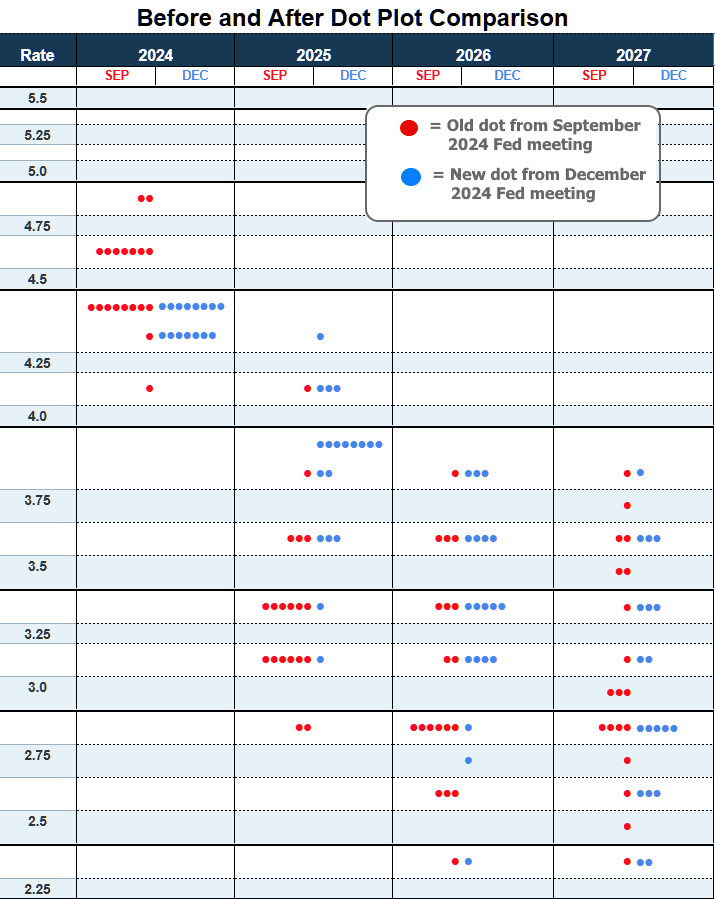

- The Notorious Dot Plot Strikes Again

Enter the “dot plot,” where each Fed member reveals where they think rates will land in the next few years. This quarter’s plot had more drama than a season finale.

Look at the 2025 dots. Back in September, the consensus was that rates would be around 3.25%. Now? Most Fed members think they’ll hit 3.875%. It’s like your boss suddenly deciding deadlines are two weeks earlier—you’re not thrilled. Oh, and 2026 dots also crept higher, but let’s not pile on.

- Powell’s Press Conference Bombshells

Powell kicked things off with a bang, calling the rate cut a “close call, but the right call.” Cue the collective gasp from traders who thought this cut was a done deal. He also mentioned that the Fed is in a “new phase” focused on tackling inflation, with future rate cuts looking as rare as a unicorn sighting.

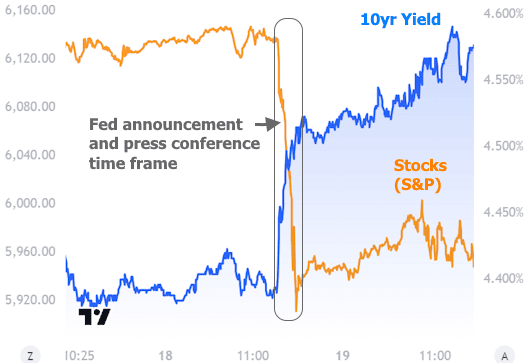

How Did the Markets React?

Spoiler alert: not well.

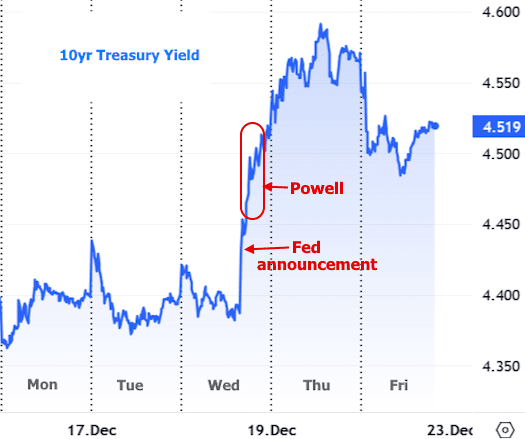

- Treasury Yields Went Full Mountain Climber

- The Stock Market? Less Than Thrilled

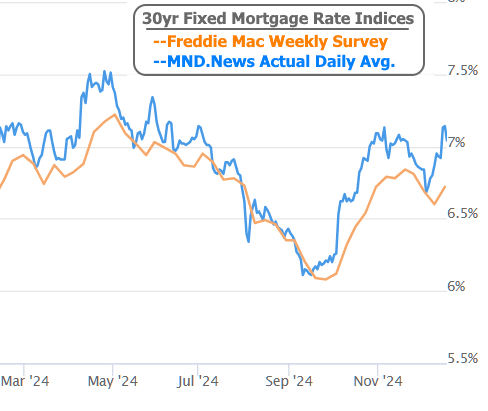

- Mortgage Rates? Back to Early November Highs

Mortgage rates, already on the rise last week, hit the gas pedal and returned to their early November levels. There was a small glimmer of hope on Friday, thanks to a lower-than-expected inflation report (PCE), but don’t break out the happy dance just yet.

What’s Next for Rates?

Now, we wait. January will bring two major players to the stage: the jobs report and inflation data. These numbers will likely decide whether rates keep climbing or finally give borrowers a break.

Here’s the game plan:

- Hotter inflation and economic data? Rates could revisit 2024 highs.

- Cooler numbers? We might finally see rates edge lower.

Until then, keep your seatbelt fastened, because the rate ride is anything but smooth.

And that’s the latest in mortgage rate madness! If you’re feeling dizzy, don’t worry—you’re not alone. Stay tuned for more updates, and may the (financial) odds be ever in your favor!