Let’s get one thing straight: not all rates are created equal. In fact, some rates wake up grumpy, some have trust issues, and others just refuse to move in the same direction as their friends. Why? Because the “underlying bonds, loans, etc.” behind those rates each live on their own timeline.

Think about it — a 7-year loan has a totally different vibe than a 1-day loan. The demand for each can swing wildly depending on the day, the mood of investors, and maybe even whether Jerome Powell had his coffee.

While a 30-year mortgage can last three decades, most fizzle out after about seven years. Meanwhile, the loans tied to the Fed Funds Rate? Those are basically one-night stands — they rarely last longer than a day. So it’s no wonder mortgage rates don’t always sync with the Fed’s moves — they’re just living in different time zones.

The Timing Trick: Why the Fed Can’t Keep Up

Even if mortgage rates did perfectly follow the Fed Funds Rate, timing alone would still mess things up. Mortgage rates are like hyperactive day traders — they can change daily (sometimes multiple times before lunch). The Fed, on the other hand, only adjusts its rate about eight times a year.

That means mortgage rates have about six weeks to obsess, speculate, and overreact before the Fed finally makes a move. So by the time Jerome and friends officially “cut rates,” the mortgage market has already read the spoilers, watched the sequel, and written its own fan fiction.

Investors: The Ultimate Know-It-Alls

Now toss investors into the mix — people who love to price in the future like they’ve got tomorrow’s newspaper. When markets are convinced the Fed is about to cut rates, that expectation is already baked in to the current numbers.

Translation: by the time the Fed actually cuts, mortgage rates have already said, “Yeah, we knew that weeks ago.”

So when everyone expected rates to drop after Wednesday’s Fed announcement — but instead they jumped? The move wasn’t random. The “rate cut” wasn’t new information. It was the press conference commentary that threw the curveball.

Powell’s Plot Twist

At the press conference, Powell hinted (in his calm but deadly way) that another rate cut in December was “far from” guaranteed. The market, which had been absolutely sure another cut was coming, suddenly felt like someone canceled Christmas.

So expectations shifted — fast. The bond market adjusted instantly, and mortgage rates followed suit, rising sharply Wednesday afternoon and continuing the climb into Thursday.

The Proof Is in the MBS (Mortgage-Backed Securities)

Here’s the chart that shows it all. It tracks the bonds that set mortgage rates — and it’s inverted so that the line moves in the same direction as rates.

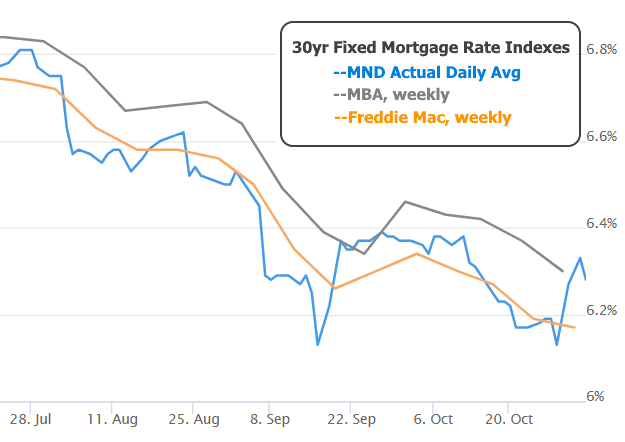

Freddie Mac Missed the Drama

If you saw headlines this week saying “Rates Are Down!” — you can thank Freddie Mac’s timing. Their weekly mortgage rate survey averages data from Thursday through Wednesday, then reports on Thursday morning. Which means this week’s spike missed the cutoff completely.

So don’t be fooled — Freddie’s data was basically a rerun. The real action will show up next week when their report catches up with the chaos.

The Big Picture

Yes, this week’s rate spike was noticeable, but it’s not the end of the world. Bigger, longer-lasting improvements in rates will depend on weaker economic data — the kind that gives the Fed cover to keep easing.

Unfortunately, that’s hard to measure right now, since the ongoing government shutdown means much of the usual data pipeline is clogged. Until that clears, mortgage rates might just hover and sulk, waiting for their next reason to move.