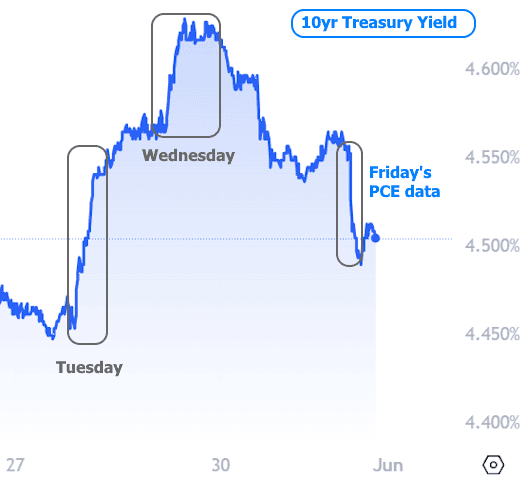

This week started a bit slow since markets took Monday off for Memorial Day. But once the traders were back in action, they wasted no time in cranking up the rates.

You know how people say the bond market can get a bit wacky with wild swings right around a long weekend? Well, Tuesday was a prime example of that with the biggest move of the week, and there wasn’t even any super important data to justify it!

Now, that doesn’t mean there was no data at all. Traders had plenty to chew on from various Fed speakers. The star of the show was Minneapolis Fed’s Kashkari, who basically said he’d need to see “many” more months of good inflation numbers before even thinking about cutting rates. Quite a step up from other Fed folks who usually say “several” months. Way to raise the bar, Kashkari!

In addition to all the Fed talk, we had a jam-packed schedule of Treasury auctions. These auctions are like the bond market’s supply side. More supply usually means lower prices and higher rates. While we knew the supply amount in advance, the auctions still gave us a peek at investor demand. Lower demand at these auctions helped push rates higher at the start of the week.

Things started to look up on Thursday. Not only were the auctions done, but there were also some positive revisions in the quarterly GDP data that gave rates a nudge in the right direction. And Friday’s PCE inflation data added even more momentum to the recovery.

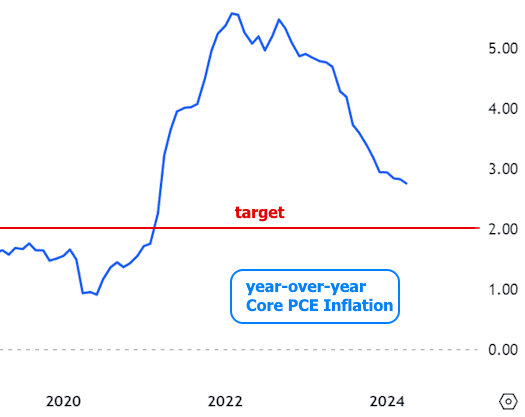

The PCE price index is kinda like the Consumer Price Index (CPI). Both measure inflation, but PCE comes out two weeks later and usually causes less drama. However, the Fed likes PCE better for its 2% inflation target.

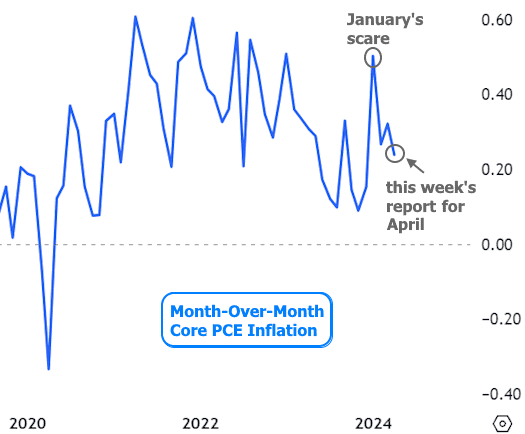

Progress towards the 2% target has slowed but hasn’t stopped entirely. When we look at the monthly data, it’s clear that things were pretty dicey in January. If January’s numbers kept up all year, we’d be looking at an annual inflation rate closer to 6%! Thankfully, February and March were better, but still suggested inflation above 3%. This week’s data for April showed more progress in the right direction after January’s scare.

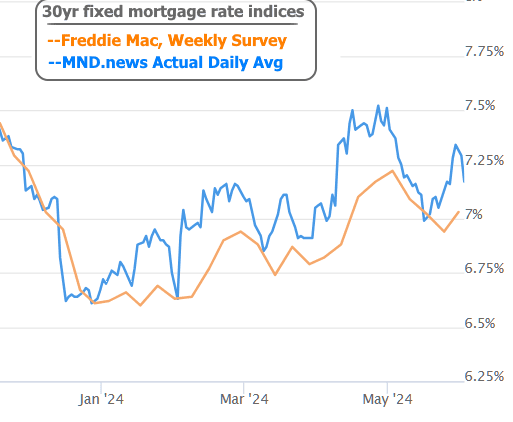

Meanwhile, mortgage rates haven’t chilled out as quickly as the rest of the bond market. Mortgage rate volatility was even crazier because of how the mortgage market is structured. There’s barely any difference between 7.125% and 7.25% for most lenders. So, when rates creep past 7.125%, the next logical jump is to 7.375%, even if the market would typically push them to just 7.25%.

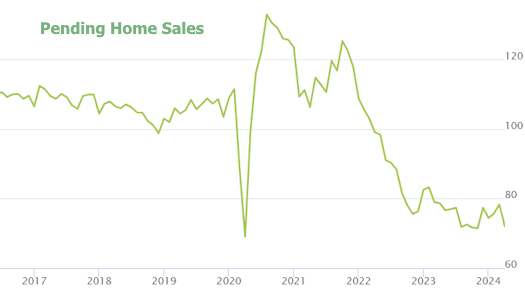

The housing market is still not loving those 7%+ mortgage rates. This week’s Pending Home Sales Index from the National Association of Realtors painted a pretty clear picture of that.

Looking ahead, brace yourselves because the potential for volatility is ramping up. We’ve got several big economic reports coming. Apart from Thursday, every day next week has something that could shake up the markets as much as, if not more than, this past week’s data. Friday’s jobs report is particularly potent, even if it’s not quite on the same level as the Consumer Price Index (CPI) these days.