Every year, the Federal Reserve—affectionately known as “the Fed”—flocks to Jackson Hole, WY, to mingle with central bankers and brainy academics. It’s like a scholarly spring break, but with fewer beach balls and more economic theories. Despite the gorgeous mountain views, these Jackson Hole speeches are usually pretty spot-on when it comes to financial markets, especially when it comes to those pesky interest rates.

This year, the symposium was perfectly timed to let Chair Powell make a grand encore performance following his last big press conference three weeks ago. Rates were already dancing to his tune then, but Friday’s speech had them waltzing with even more gusto.

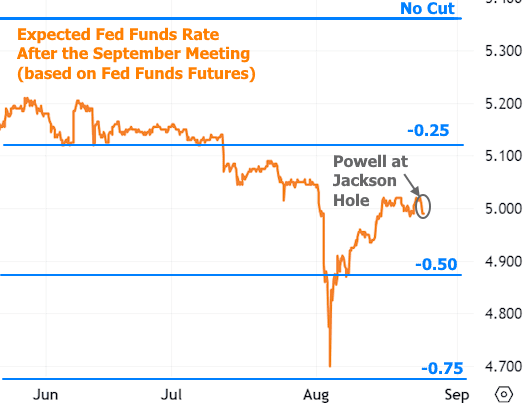

In a nutshell (or should I say, in a very serious, Fed-approved manner), Powell hinted that the plan is to cut rates at the September meeting in about four weeks. The only debate now is whether this cut will be a modest 0.25% or a more substantial 0.50%.

To be fair, the market’s speculation was buzzing after Powell’s last address, with traders briefly dreaming of a 0.75% cut! However, reality hit when economic reports began to suggest otherwise, putting a ceiling on those high hopes.

The past two weeks saw a few economic reports that made everyone pause and rethink their rate-cut fantasies. Powell’s speech set a firm ceiling on rate expectations, making it clear that while rates might drop, don’t expect a financial fireworks display. The chart above shows that the recent excitement is a mere blip compared to the recent rollercoaster ride.

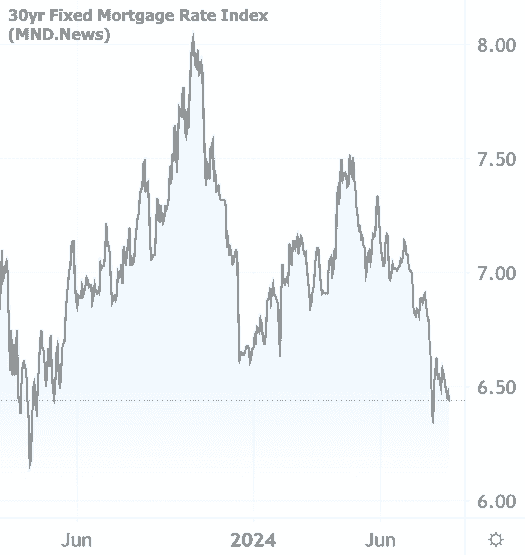

Mortgage rates had a “nice” day, sliding down to their lowest levels in over two weeks. For those who love a bit of pomp, today’s drop marks the 3rd best day in over a year.

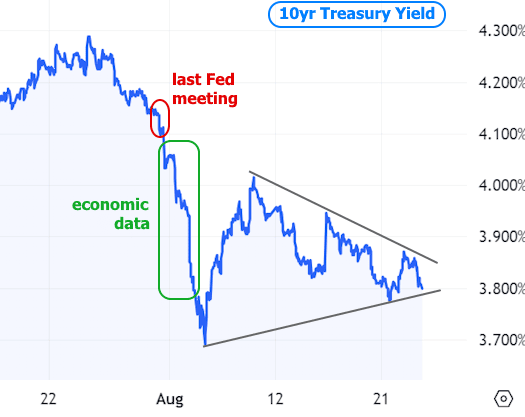

While the present picture might seem clear, remember there’s been a bit of a data tug-of-war. Early August’s weak economic data had rates diving, but later reports flipped the script, sending rates back up. Now we’re in a more tranquil range, as illustrated in the chart of 10-year Treasury yields below.

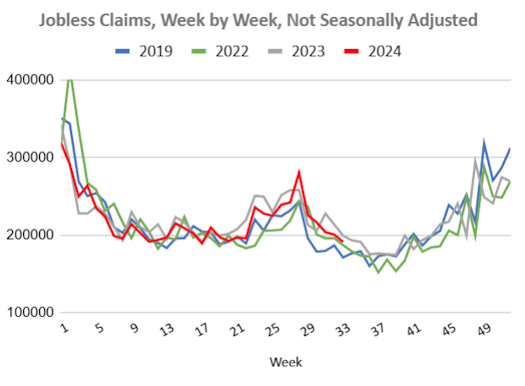

This week’s economic data isn’t pointing to any big drama or downturn. The Jobless Claims report—the most up-to-date labor market indicator—continues its steady trend. For the more aggressive rate cut scenarios to materialize, this red line would need to start breaking away from the pack.

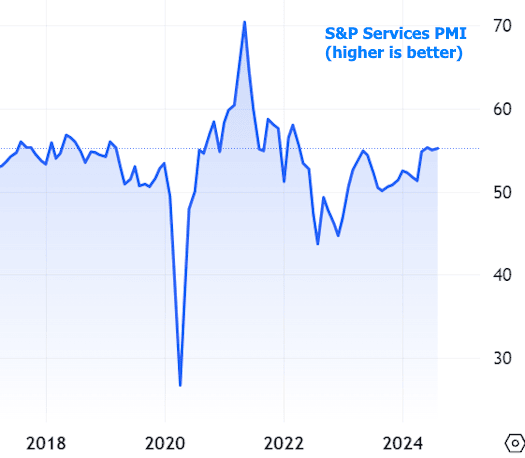

We also saw the Services Purchasing Managers Index (PMI) from S&P Global, which measures economic output. With a reading of 55.2—slightly up from last month’s and near the top of the recent range—it suggests expansion rather than contraction.

Looking ahead, the first two weeks of September will bring more economic data that could fine-tune rate cut expectations. But remember, if the Fed does cut rates, it’ll just be confirming what the market’s already been hinting at. Mortgage rates and Treasuries have already factored in a rate cut, so the economic data needs to avoid sounding too rosy if we want these low rates to stick around.

For any further rate reductions, we’d need to see a more pessimistic economic outlook, but even then, mortgage rates might already be ahead of the Fed’s game.