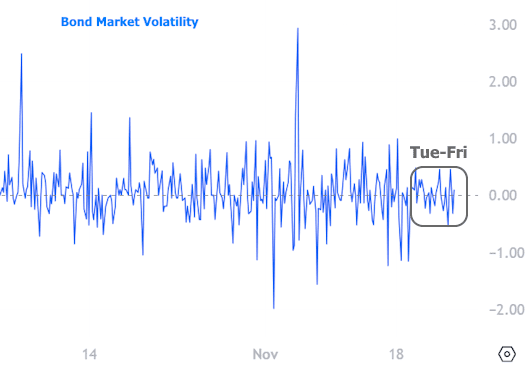

After a rollercoaster ride in early October, mortgage rates have decided to take a breather over the past two weeks. The past week, in particular, has been quieter than a librarian during finals week. In the grand scheme of the past two months, it’s like we’ve gone from a fireworks display to a cozy candlelit dinner. To illustrate, here’s a chart that tracks bond market volatility, the puppet master behind mortgage rate movements.

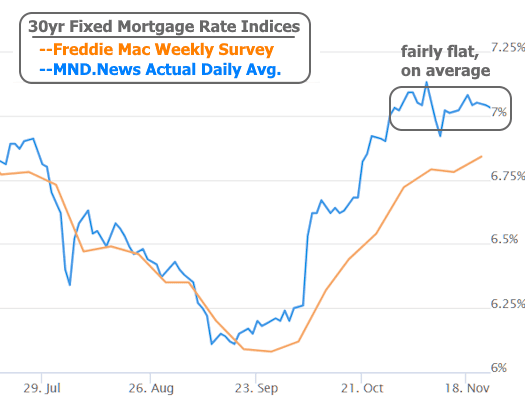

Naturally, with less drama in the bond market, mortgage rates have calmed down too. The average 30-year fixed rate has been as consistent as your favorite sitcom rerun, staying within a narrow 0.05% range and finishing the week exactly where it ended last Friday. Rates are also hovering around the levels we saw in late October. So, if we zoom out and squint a bit, the mortgage rate scene has been more “meh” than “wow” for over a month.

Let’s be real: “flat” might not sound thrilling, but given recent chaos, it’s the best win we could hope for in the short term. To see rates drop significantly, we’d need a pretty compelling argument—think major economic data, like jobs reports or inflation numbers, which are due in the first two weeks of December. Until then, we’re likely to remain in this holding pattern. Although, with next week being a holiday week, there’s always the chance for random market shenanigans. (Who doesn’t love a little unpredictable chaos during turkey season?)

Meanwhile, the broader housing market seems unimpressed with all this mortgage rate plateauing. Metrics like sales and sentiment have been as flat as a pancake—just not the fluffy, delicious kind. Blame rates for that one.

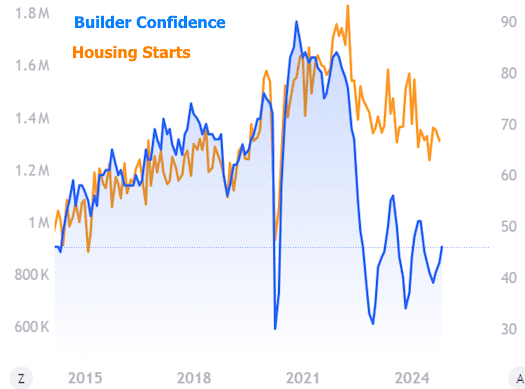

For example, housing sentiment and tangible sales/construction numbers typically go hand in hand like peanut butter and jelly. But over the past two years, that relationship has been more like peanut butter and pickles. This week’s data on builder sentiment and residential construction drives the point home: housing starts are back to pre-pandemic highs, but builder confidence is still nursing its wounds.

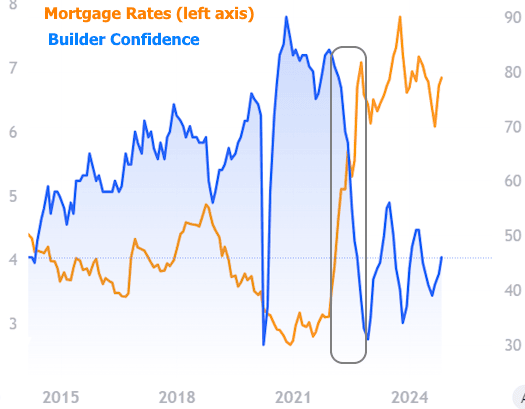

When you bring mortgage rates into the conversation, the mystery clears up. Big spikes in rates align suspiciously well with big dips in builder confidence, like synchronized swimmers who forgot their routine.

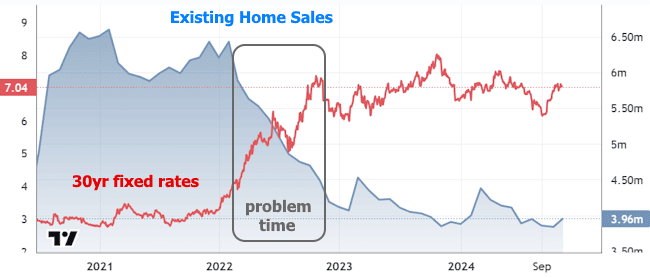

It’s the same sad story for Existing Home Sales, which also dropped by to remind us this week that they’ve been lounging at low levels for two years now.

But let’s end on a hopeful note: long-term charts like this do offer a silver lining. They suggest a pattern consistent with rates hitting a long-term ceiling and housing metrics finding their long-term floor. Of course, there are no guarantees in this game, but hey, hope springs eternal—especially when paired with a steady decline in rates!