h, the age-old confusion: “Wait, I thought the Fed didn’t cut rates—so why are mortgage rates dropping?” Grab a coffee (or a stress ball), because we’re diving into that delightful financial paradox.

After bending over backwards to explain how the Fed Funds Rate and mortgage rates are about as related as cats and cucumbers, we’re now going to eat our words—just a little—and explain how the Fed still managed to nudge mortgage rates lower this week.

Here’s the twist: while the Fed left rates untouched last week (zero drama there), mortgage rates did a little dance downward. Why? Because the expectations for future Fed rate cuts suddenly got a lot more exciting—like when someone whispers “free pizza” in the office kitchen.

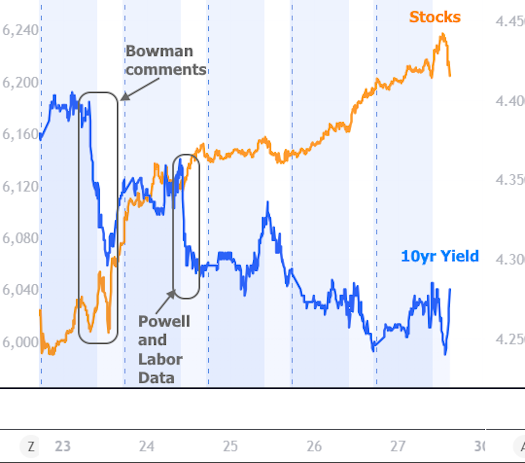

Things started heating up late last week thanks to Fed’s Chris Waller, who casually tossed out the idea that a rate cut might not be so far off after all. Cue investors perking up like meerkats. Then, on Monday, Vice Chair Bowman came in even hotter, suggesting cuts could come as early as July—as long as inflation doesn’t decide to throw another tantrum.

Then came the main event: Fed Chair Jerome Powell’s two-day testimony to Congress. Compared to last week’s press conference, Powell sounded more relaxed—dare we say, chill? Essentially, the Fed’s on standby, ready to slash rates unless tariffs spark another inflation mess.

Bonds and stocks basically threw a party over the news. And just to make things even better, Tuesday brought some weaker labor market data, which is bad for the economy but oddly good for mortgage rates. Go figure.

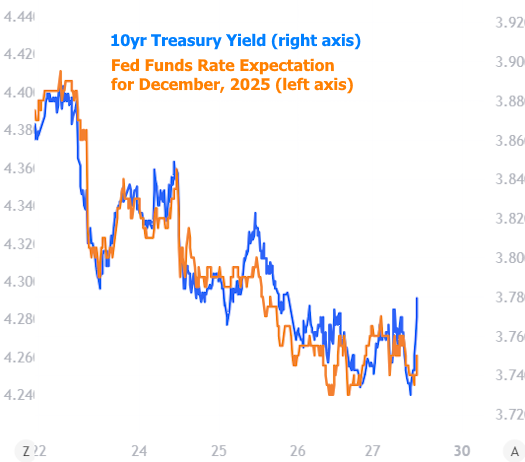

Now, if you’re still wondering whether this whole rate drop is really tied to the Fed, behold: the chart below shows the Fed Funds Futures (where traders bet on future Fed decisions) dancing in sync with the 10-Year Treasury yield (the Beyoncé of long-term interest rates). When they tango, mortgage rates follow.

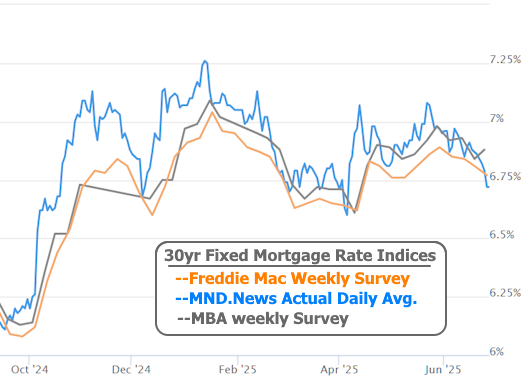

Naturally, mortgage rates followed suit like a well-trained dog. By Thursday, MND’s daily mortgage rate index had slipped to its lowest level since April. You could practically hear homeowners whispering, “Is it refinance season already?”

Looking ahead, a few more good days and rates could be partying like it’s October 2024 again. But don’t pop the champagne just yet—next week’s economic data could either keep the good vibes going… or slam the brakes. It’s a 50/50 coin toss, but hey, that’s finance for you.