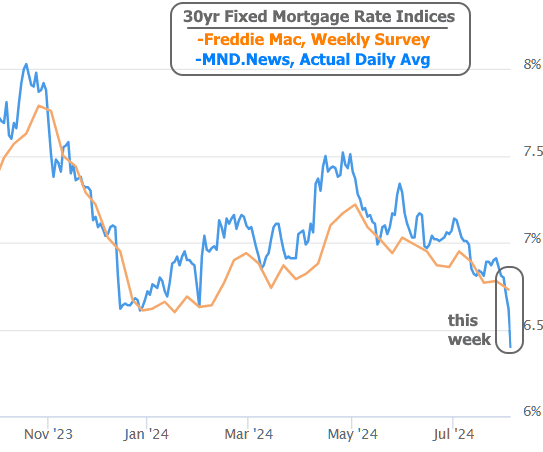

The rollercoaster of events this past week has added a dramatic twist to the ongoing tale of interest rates moving away from the sky-high levels of late 2023. This saga has had its ups and downs, but for those rooting for lower rates, the last three months have been a delightful ride.

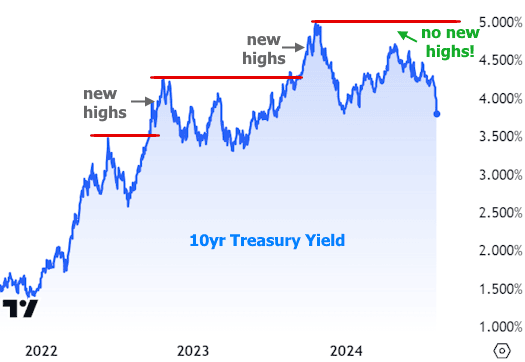

In fact, these past three months have finally quashed what seemed like another “false start” on the journey to lower rates. Looking at 10-year Treasury yields, long-term rates have only made three serious attempts to drop by more than half a percent since they shot up in 2022. The first two attempts fizzled out, leading to new highs. A few months ago, it looked like it might happen again, but we dodged that bullet!

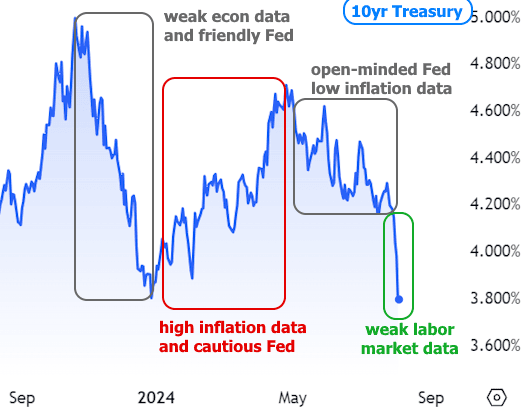

Zooming in on the past year, here’s a rough sketch of the key motivators for these rate swings:

From May through July, there was a cautious optimism thanks to encouraging improvements in inflation data. During this period, the Fed was feeling more and more confident about cutting rates, though it was in no rush due to a still-robust labor market. The Fed echoed similar sentiments this week, but that was before the latest jobs report hit the scene.

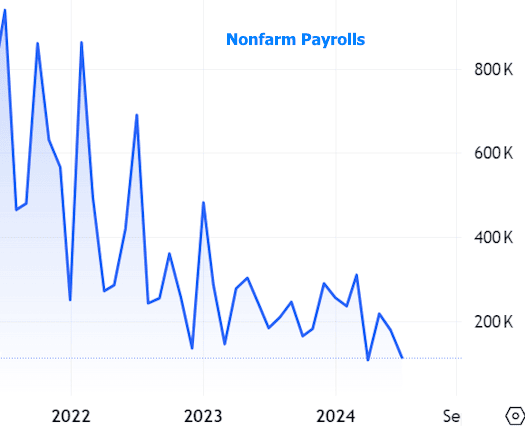

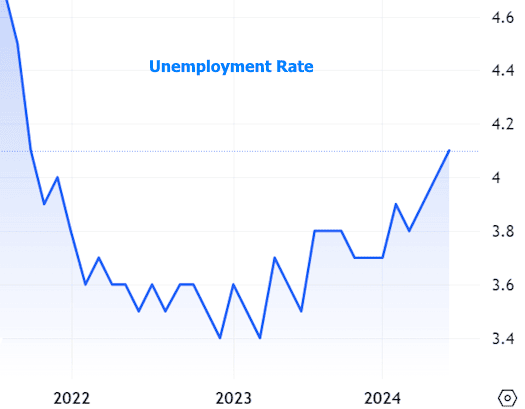

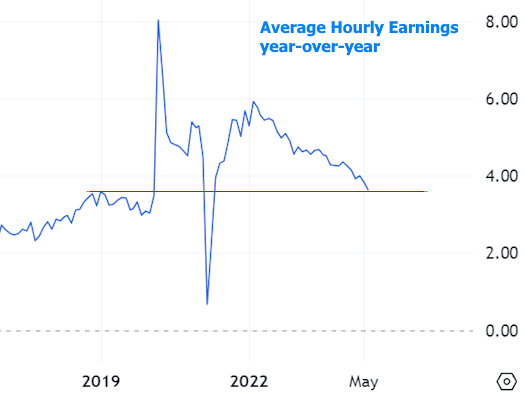

Headline job creation (nonfarm payrolls) fell to 114k in July, way off the forecasted 175k. Plus, the unemployment rate nudged up to 4.3% from 4.1%, and wage growth slipped to 0.2% from 0.3%, with annual growth hitting pre-pandemic levels for the first time since stabilizing at long-term highs.

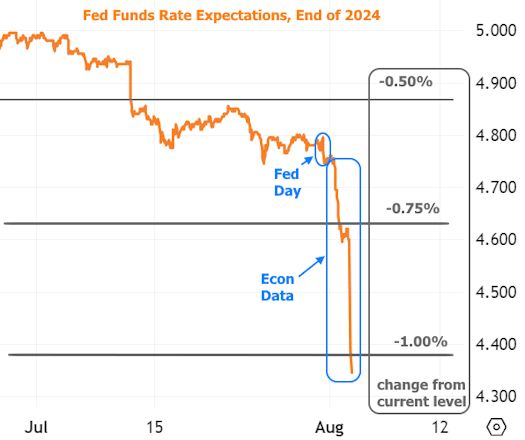

Bonds and rates were already in a good mood thanks to Thursday’s gloomy economic news (higher Jobless Claims data and a weaker ISM Manufacturing Index), but the jobs report turned the rally into a full-blown celebration. Here’s a snapshot of how expectations for the Fed Funds Rate by the end of 2024 looked (Wednesday’s Fed announcement had almost no impact compared to the economic data from Thursday and Friday):

In other words, traders were initially expecting the Fed to cut rates by half a percent, but now they’re betting on at least a full point of cuts. When things like this happen, short-term rates tend to swing more wildly than long-term rates like mortgages. Even so, Friday was one of the rare days in the past 20 years that saw such a significant single-day drop in average mortgage rates.

Now, the million-dollar question: where do we go from here? There’s no crystal ball, and the lessons of early 2024 are still fresh. For rates to improve further, we’ll need a fresh batch of dismal economic data, but there aren’t many blockbuster reports on the immediate horizon. Apart from Monday’s ISM Services Index, we’ll be waiting until the following week for the next installment of the Consumer Price Index (CPI) – the only report as significant as the jobs report these days.

Looking beyond the next two weeks, the next month and a half could be a wild ride. Currently, the market is second-guessing the Fed’s decision to hold steady this week and wondering if they’ll be playing catch-up in mid-September if the economic data keeps heading south.