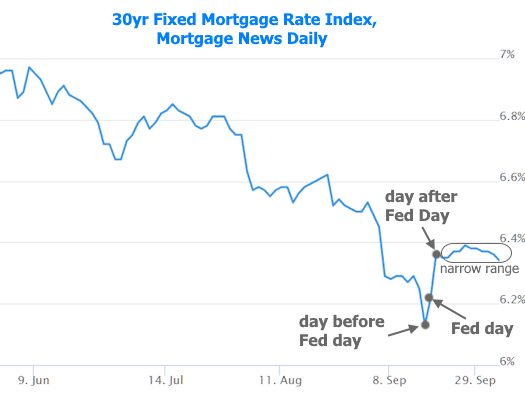

ontrary to what everyone and their financial podcast predicted about the Fed rate cut, mortgage rates didn’t exactly pop champagne and celebrate. In fact, they did the opposite—shooting higher on Fed Day and the day after, just to keep everyone humble. Since then, rates have chilled out, lounging sideways in a calm little range, finally sneaking down to the lower end of that range by week’s end.

This all makes perfect sense when you peek over at the bond market. The 10-year Treasury yield—basically the “celebrity influencer” of the bond world that mortgage rates can’t stop copying—drifted lower through the week, with most of the good vibes showing up on Monday and Wednesday.

Then came Wednesday’s ADP Employment Report, which arrived looking like it had just rolled out of bed after a rough night. It was way weaker than expected. ADP’s report tries to predict what the “official” jobs report (from the Bureau of Labor Statistics, or BLS) will say two days later, but this time it swung and missed—spectacularly.

For September, ADP said jobs actually fell by 32,000. Ouch. And just to twist the knife, it also went back and changed last month’s number from +54,000 to -3,000. These kinds of “whoopsies” from ADP aren’t usually big news, but this one mattered because they recalibrated all their data using the BLS’s official numbers. Kind of like realizing your bathroom scale was lying to you for the past year.

But here’s the plot twist—there wasn’t a BLS jobs report two days later. The government shutdown hit pause on that, leaving markets hanging. If the report had come out and been as bad as ADP’s, rates probably would’ve dropped much more dramatically. Instead, they just kind of shrugged and ended the week barely lower—still inside that same tight, post-Fed range.