The end of October is here — pumpkin spice lattes are flowing, costumes are out, and the Fed is about to make its big announcement. Spoiler alert: they’re cutting rates again. 🎃

And before you start celebrating, thinking this means cheaper mortgage rates… pump the brakes. Many folks make that leap, but sadly, it’s like assuming candy corn counts as a vegetable — it just doesn’t work that way.

To be technically fair, mortgage rates could drop after the Fed cuts rates… but they could also rise. (Fun, right?) History shows us that the mortgage market loves to zig when the Fed zags.

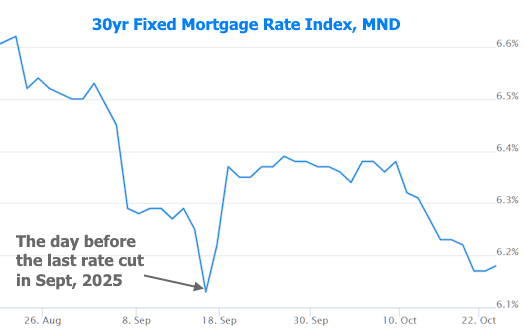

In fact, recent examples show mortgage rates rising right after rate cuts. September 2025 was a perfect “wait, what?!” moment:

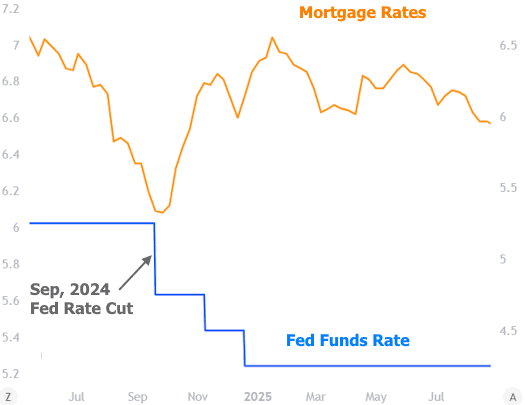

Before that, back in September 2024, the Fed also started cutting rates… and mortgage rates shot up like a toddler on Halloween candy.

Now, to give the Fed a little credit, last month’s mortgage rate bump had more to do with the way they talked during the press conference — think less “reassuring parent” and more “mildly ominous weatherman.” Meanwhile, 2024’s jump was more about the economy itself flexing some unexpected muscles.

Either way, here’s the real takeaway:

By the time the Fed actually cuts rates, the market has already made its move.

The financial world doesn’t sit around waiting for Jerome Powell to ring the bell. Traders have already adjusted based on what they expect the Fed to do — often weeks or even months in advance.

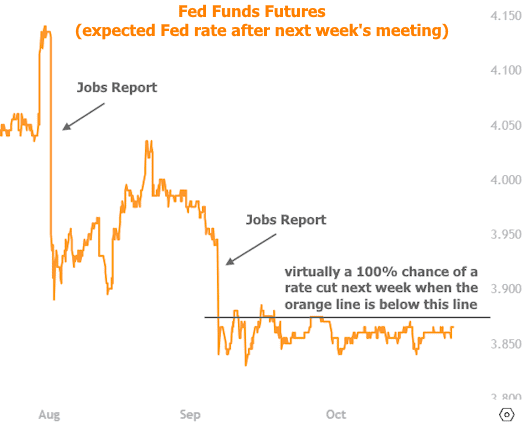

How do they know what’s coming? Well, it’s kind of like a game of Fed karaoke — everyone’s just interpreting the lyrics of recent speeches and humming along to economic data. Plus, there’s an entire futures market that literally bets on where the Fed Funds Rate will land.

Check out this chart showing how confident the market’s been that a cut is coming next week — basically 100% sure since September’s jobs report.

So, what’s the bottom line?

Any boost to mortgage rates from the Fed’s move already happened — way back in early September. Since then, mortgage rates have been dancing to their own tune, driven by whatever fresh economic beats drop each week.

Meanwhile, the Fed only updates its playlist eight times a year, so their “big move” often just confirms what the market already knows.

That said, Fed Day can still shake things up — not because of the actual rate cut, but because of what they say about the future. One wrong word, and suddenly markets are having a full-blown “did-they-just-say-that?!” moment.

So next week, when the headlines scream “Fed Cuts Rates!” just smile, sip your pumpkin spice latte, and remember: mortgage rates might not have gotten the memo. ☕💸