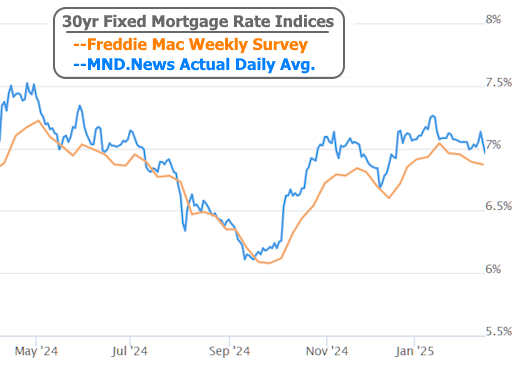

The Unbelievable Tale of Mortgage Rates Dropping to 2-Month Lows Despite Inflation Playing Hardball

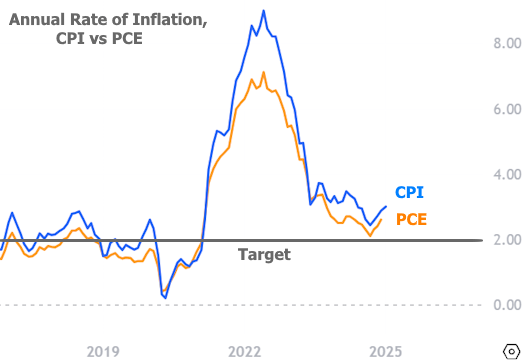

The last two days of this week were about as predictable as a cat deciding whether it wants to go outside or not. As of Wednesday afternoon, mortgage rates were jumping up like a kid on a trampoline after inflation data came in hotter than expected. The Consumer Price Index (CPI), which is basically the scoreboard for how much our wallets are suffering, showed inflation picking up steam much faster than analysts thought.

Now, CPI is a big deal in the world of interest rates—kind of like the final boss in a video game. Right now, annual inflation has been stubbornly hanging out just above 3% instead of continuing its journey down to the Fed’s 2% happy place. Because of that, mortgage rates have been staying higher than they otherwise might be.

If we rewind to September, things were looking more promising. Inflation data was behaving itself, and there were even whispers about rising unemployment, which—strangely enough—is good news for mortgage rates. But just as we were getting comfortable, the economy started flexing again, and rates shot up by about 1% in record time.

But wait—plot twist! By the end of this week, mortgage rates somehow tumbled to two-month lows. How did that happen after the fiery inflation news on Wednesday? Enter the underdog: Thursday and Friday’s economic data.

Thursday came swinging with the Producer Price Index (PPI), CPI’s less-famous cousin. While CPI tells us what consumers are paying, PPI tracks costs at the wholesale level—basically, what businesses are shelling out before passing costs down to us. Normally, PPI doesn’t move markets much, but this time was different because it contained clues about future consumer inflation.

Now, things are about to get even nerdier (but stick with me, it’s worth it). The Fed actually prefers another inflation measure over CPI—it’s called Personal Consumption Expenditures (PCE). PCE is like the Swiss Army knife of inflation metrics: it’s broader, more adaptable, and updates faster to changes in consumer behavior. CPI gets all the attention because it comes out first, but PCE is the true MVP when it comes to shaping Fed policy.

Here’s where things get juicy: PPI contains several components that feed directly into PCE. On Thursday morning, almost all of those components pointed to lower inflation in the near future. This was enough to make economists rethink their forecasts, expecting lower inflation in the next PCE report (set to drop in two weeks). Lower inflation means lower rates, and voila—mortgage rates started falling.

Feeling dizzy yet? Let’s break it down in simple terms:

- There are three key inflation reports: CPI, PPI, and PCE.

- CPI and PPI contain clues about PCE, which is what the Fed really cares about.

- This week’s PPI data hinted that inflation is actually cooling down, even though CPI didn’t.

- Lower inflation expectations = lower mortgage rates.

But the ride didn’t stop there. On Friday, the Retail Sales report added more fuel to the rate-dropping fire. Sales came in way weaker than expected, especially for online spending. (And no, it wasn’t because everyone blew their budget on holiday shopping—this was seasonally adjusted.)

Weaker economic data usually means lower interest rates, because a slowing economy reduces inflation pressures. And sure enough, the bond market took the news and ran with it, sending rates even lower to close out the week.

If you’re keeping score at home, mortgage rates somehow bounced back from a midweek disaster to end at two-month lows, thanks to a surprise assist from inflation’s lesser-known metrics. So, if you were holding off on locking a rate earlier this week, congrats—you might just have caught a break!

Moral of the story? The economy is full of surprises, mortgage rates have mood swings, and sometimes, the underdog data can steal the show.