Mortgage rates took a small step backward this week as the bond market tried to process a mix of geopolitical drama and post-holiday whiplash. After the three-day holiday weekend, traders returned to their desks only to find overseas markets pushing bond yields higher—because apparently everyone decided to be productive at the same time.

One of the smaller culprits came from Japan, where fiscal concerns triggered heavy selling of Japanese bonds. Big global economies tend to move in packs, so when yields jump overseas, U.S. yields often feel the tug. And as usual, higher bond yields tend to mean higher mortgage rates. Nothing shocking there.

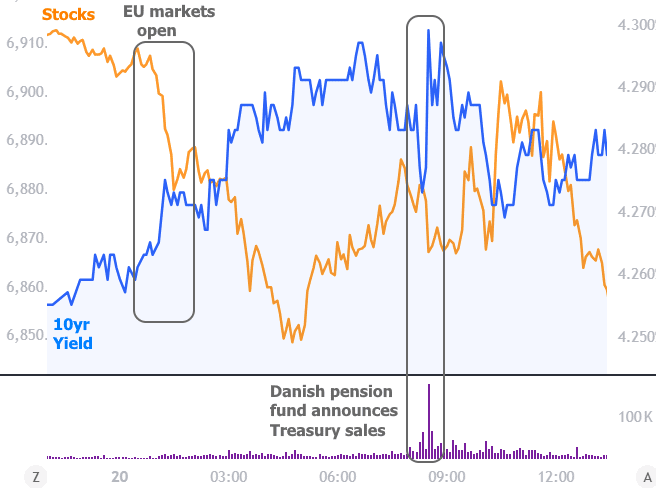

The bigger driver, however, was geopolitical. European markets reacted to an escalation in the administration’s stance on Greenland over the weekend (yes, Greenland). New tariff threats didn’t help, but what really caught traders’ attention was news that a Danish pension fund decided to pull money out of U.S. Treasuries.

Before anyone hit the panic button, cooler heads prevailed. That move wasn’t seen as something the rest of Europe’s money managers would follow, and the dollar amount involved was relatively small. As a result, the 10-year Treasury yield didn’t climb much further.

From there, things calmed down nicely. The bond market eased through the rest of the week, helped by a batch of economic reports that were… well… pretty boring. Some of the biggest reports were also outdated, as agencies continue playing catch-up after the government shutdown.

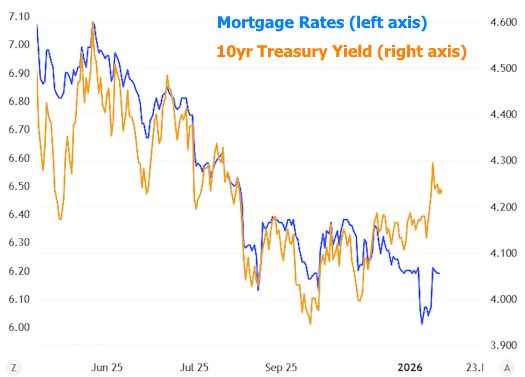

Mortgage rates did feel Tuesday morning’s bond market weakness, with average lenders drifting back toward levels seen before the big rate drop on January 9th—right before the administration announced MBS purchases. That said, mortgage rates are still outperforming Treasuries, thanks to that same announcement (and the fact that actual MBS buying is happening). There’s really no other way to explain the chart below:

In plain English: the MBS buying announcement initially sent mortgage rates sharply lower. This week, it’s acting like a shock absorber—keeping mortgage rates from rising as quickly as Treasury yields.

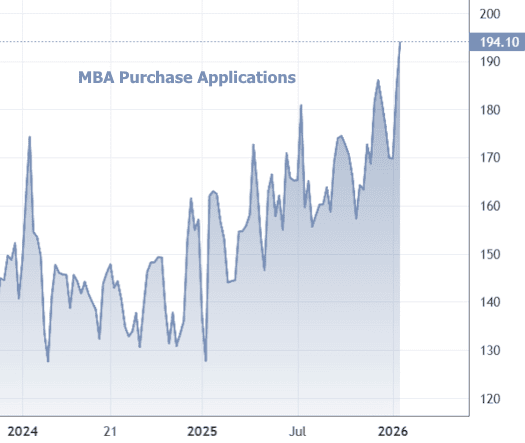

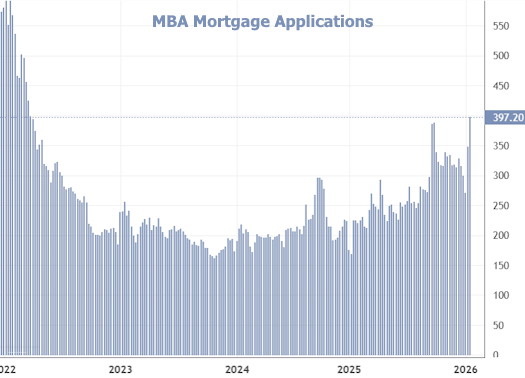

The payoff from that rate rally showed up loud and clear in this week’s mortgage application data from the MBA.

Refinance demand almost always jumps when rates fall, so that part wasn’t surprising. What was notable is that purchase applications also seem to be benefiting. They climbed to their highest level in three years.

When you zoom out, the bigger picture looks even better: overall mortgage applications are now at their highest level in nearly four years.

Looking ahead, next week brings a handful of economic reports—but none with the power to move rates like the jobs report scheduled for February 6th. That makes the upcoming Fed announcement the main event. Markets are pricing in virtually zero chance of a rate cut this time around, but the wording of the statement and Chair Powell’s press conference could still drop hints about what the Fed might do at the next meeting on March 18th.

In other words: no fireworks expected… but everyone will still be watching closely. 👀