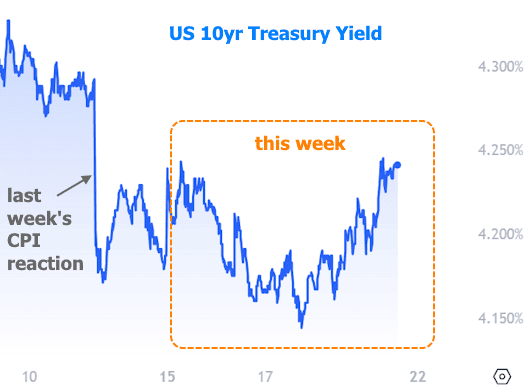

While everyone was glued to the political drama on TV, the bond market and interest rates decided to keep things low-key this week. This time of year, the only excitement in the bond market usually comes from the big economic data drops, and this week was no exception.

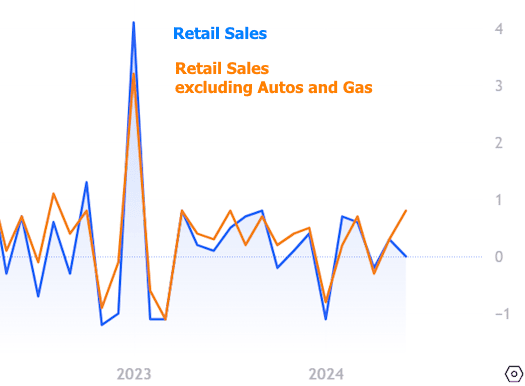

Sure, we had a few economic reports that typically make the market do a little dance, but they must have been wearing lead shoes because nothing much happened. Our best shot was Tuesday’s Retail Sales report. It met expectations overall, but one part of it (excluding autos and gas) hit the highest level this year.

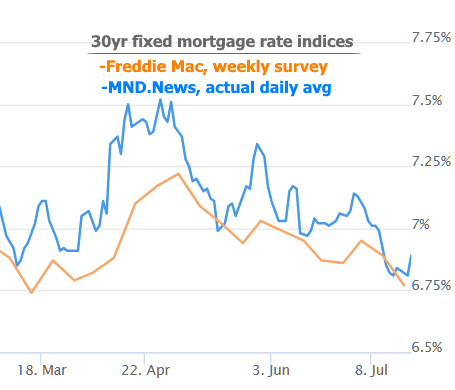

The market did try to get a little wild, with bond yields (a stand-in for mortgage rates) spiking initially, only to chill out and drop to the week’s lowest levels in four months by the end of the day. Rates dipped again on Wednesday before meandering higher as the week wrapped up.

As thrilling as that chart might seem in the short run, it’s a bit of a snooze fest when you zoom out.

No surprise there, given we’re all just waiting for the big news: has inflation cooled enough for the Fed to cut rates, or is the labor market about to surprise us? Those answers are tied to reports that won’t drop for a few weeks.

Meanwhile, a bunch of Fed speakers gave us variations on the same theme: inflation progress is promising, and rate cuts are on the horizon.

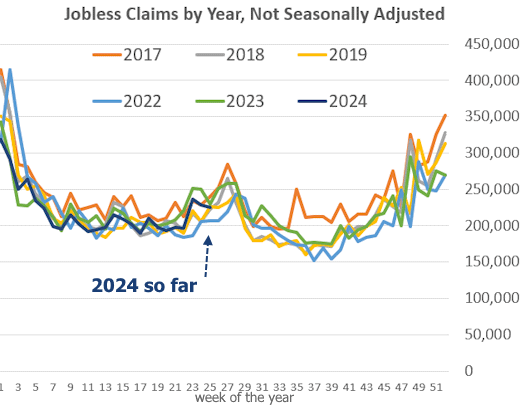

We’re also keeping an eye on other economic reports that hint at the big ones coming in early August. For example, the weekly Jobless Claims data gives us a taste of what the monthly jobs report might say. It’s not an exact science, but any noticeable trend shift tends to get the market’s attention.

And wouldn’t you know it, jobless claims have been creeping up.

This week’s claims were among the highest since last summer and way above what economists expected. But while that chart makes it look like something’s up, the next chart begs to differ. Same data, just not seasonally adjusted.

Seasonal adjustments are like your phone’s autocorrect—mostly helpful, but occasionally in need of correction themselves. Looking at the raw numbers, 2024’s jobless claims are right in line with recent years (minus the pandemic craziness of 2020 and 2021).

So, it’s not a done deal that the labor market is cooling enough for the Fed to fast-track rate cuts.

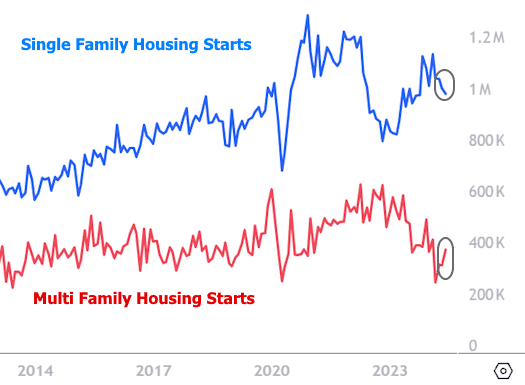

This week also brought some mildly interesting data for the housing and mortgage folks. June’s Residential Construction numbers showed a slight uptick in both permitted homes and those starting construction.

Construction data can be a bit confusing since it lumps single and multifamily projects together, even though they’re telling different stories. Single-family starts are cooling off after a year of improvement, while multifamily starts, which peaked at the end of 2022, have been trending down despite June’s slight rebound.

Despite the general lack of excitement in the data and the bond market, it was a technically intriguing week for mortgage rates—not because they improved dramatically from last week, but because the modest improvement set a new 6-month low. Rates were lowest on Wednesday afternoon or Thursday morning, depending on the lender, but had climbed to the week’s highest levels by Friday.