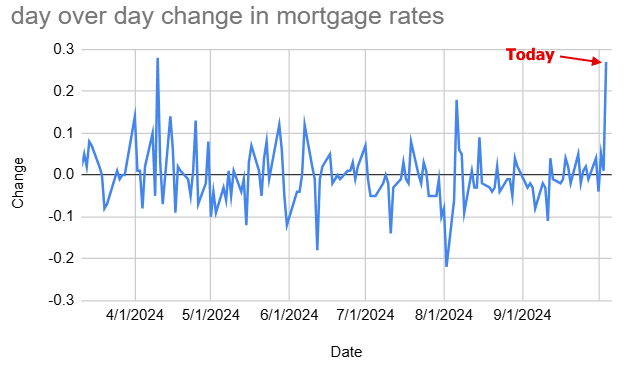

Friday’s jobs report was a high-stakes event. A weak result could have pushed us toward long-term rate lows, but a strong result? Well, buckle up for a rate hike. And, surprise! It was REALLY strong, so rates shot up REALLY quickly.

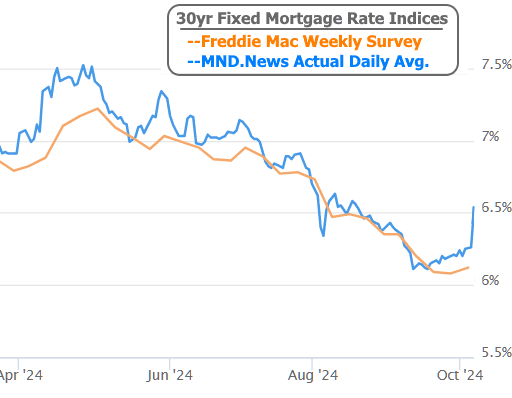

Take a look at the chart below showing how the 30-year fixed rate index moved, courtesy of Mortgage News Daily:

April had one bad day that was a little sharper, but it’s not every day you see a jump of more than 0.2%. But before you panic, things look a tad better when you think about the bigger picture since April.

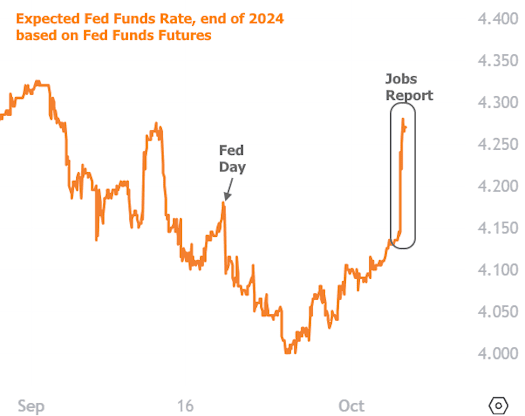

The star of the jobs report? Nonfarm payrolls (NFP)—that’s the count of new jobs created in September. Not only did the 254,000 new jobs completely crush the 140,000 forecast, but revisions to the last two months’ reports also boosted the numbers. This matters because those payroll figures were part of why the Fed decided to cut rates by 0.50% just two weeks ago. While it looked like job growth was slowing down, now it seems a bit more stable (thanks to the fact that the low point from two months ago is now higher than earlier in the year).

Now, let’s play a little “What if?” If the Fed had known about this “higher low” in NFP or today’s 254,000 jobs two weeks ago, would they have been so eager to cut rates by 0.50%? The market doesn’t think so, and it wasted no time adjusting its expectations for where the Fed Funds Rate will land this year.

With rates on the rise these past few weeks and today’s sharp increase, some people are crossing their fingers that next week’s inflation data might stop the climb. Sure, Thursday’s Consumer Price Index might give us a glimmer of hope, but don’t get too excited just yet. Here’s why:

First, the market has moved from fixating on inflation to obsessing over the labor market. Inflation numbers still matter, but they don’t pack the same punch. At this point, the market’s watching inflation mainly for any signs of a bounce.

Second, inflation could still mess things up for rates if it unexpectedly surges. Think of it as a one-way risk: higher inflation would be bad news for rates, but lower inflation wouldn’t necessarily be the knight in shining armor we all hope for.

Next week will also be full of speeches from Fed officials who might give us some clarity on how this blockbuster jobs report changes the game—if at all. Historically, the Fed likes to remind everyone not to overreact to a single economic report, but this one came with significant revisions to previous reports, so it’s tough to brush off.

Looking ahead, rates will depend largely on the economy. Job data may be the main course, but other reports can also influence the overall direction. And remember, as we’ve said in the lead-up to and after the Fed’s rate cut, there are plenty of times when mortgage rates rise after a Fed cut! Whether this continues to be one of those times is anyone’s guess, but for the past few weeks, that’s exactly what’s been happening.