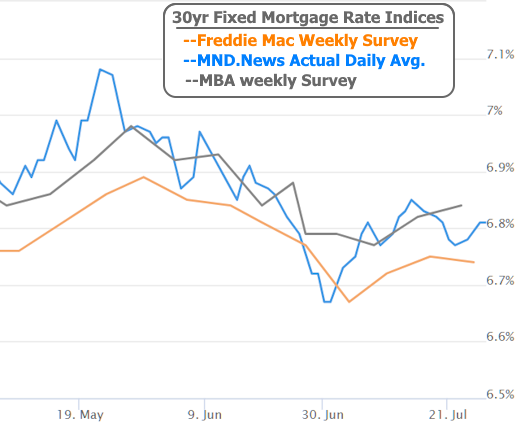

Mortgage rates this week were like a sitcom rerun—same plot, same ending. We ended exactly where we started last Friday. And honestly? Not that shocking. The economic data this week had all the excitement of a lukewarm cup of decaf.

But don’t get too comfy. Next week is bringing the main event: the monthly jobs report. This is the heavyweight champ of market-moving data. It rarely pulls its punches and tends to deliver one of the most action-packed trading days of the entire month. Compared to that, this week’s data looked like the undercard match between two guys who forgot their gloves.

There was a tiny flicker of interest on Thursday with the weekly Jobless Claims data, which came in stronger than expected and nudged rates just the tiniest bit higher—think of it like a hiccup on a rollercoaster. Still, let’s be real: weekly claims data doesn’t have nearly the same street cred as the Friday jobs report, and it’s not exactly a crystal ball for short-term trends.

Meanwhile, the markets were also trying to make sense of whispers about Fed Chair Powell and whether he might be getting the ol’ “thanks for your service” speech a bit early. But Treasury Secretary Bessent and Trump both played cleanup duty, assuring everyone that Powell is staying put—for now.

The latest “drama” is that the Fed’s D.C. offices are getting a major glow-up, and apparently, the price tag ballooned faster than a birthday party gone wrong. Trump toured the place and shrugged it off, saying “it happens.” No calls for Powell’s resignation, just some mild sticker shock. The bond market reacted with a mild “oh, okay” that didn’t ripple enough to change mortgage rates.

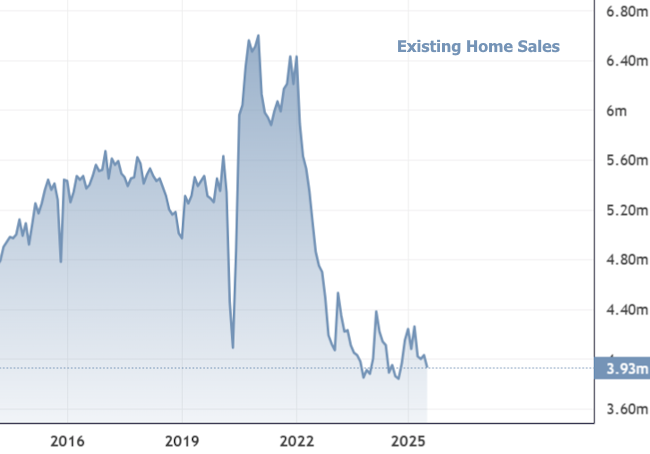

Now for the housing market: let’s just say it’s still stuck in first gear. Both new and existing home sales are going nowhere fast, with affordability and low inventory acting like a big ol’ parking brake.

The one bright spot? Homebuilders are finally getting the memo—lowering prices and adding more inventory like they’ve just discovered how supply and demand works. Home prices are still high, but at least there’s some movement in the right direction.

So what now? For the moment, mortgage rates are doing their best impersonation of a sleepy cat: range-bound and unmoved. But that could change real fast depending on next week’s data.

Before Friday’s jobs bonanza, we’ve got a packed calendar: Tuesday brings Job Openings, Wednesday delivers the first peek at Q2 GDP (no pressure), and Thursday throws in PCE inflation just for fun. Oh, and there’s a Fed meeting too.

Which brings us to the obvious question: will the Fed cut rates next week?

Spoiler alert: Nope.

But that doesn’t mean the meeting isn’t important. By the time the Fed gets around to making its announcement (which happens only eight times a year, like a really exclusive club), the market already has a good idea of what’s coming. What really matters is the language in the announcement and whether Fed Chair Powell gives off “we’re almost there” vibes on potential rate cuts during his press conference.

Still, as much as we love parsing Fed statements like they’re cryptic Taylor Swift lyrics, the truth is—none of it really locks in until we see what Friday’s jobs report says.

So buckle up. Next week could be a wild one.