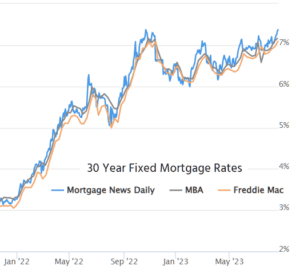

Alright, my dear rate-watchers, let’s spill some tea: “high rates” are as old news as my grandpa’s disco moves. I mean, we were already teasing the clouds with some sky-high rates last week. But this Thursday, we didn’t just touch the sky, we high-fived it! 🚀 Some chatty birds are singing about a 7.09% rate for a 30yr fixed, while others are belting out tunes of over 7.5%. Confused? Me too, but hold onto your calculators because both are right.

Here’s a mini lesson in Mortgage-ology 101: The rate you hear whispered in the corridors (aka the “note rate”) isn’t the whole story. It’s like judging a book by its cover, or a cake by its icing. That rate tells you the interest you’d pay every month, but not the whole shebang.

Now, you know those closing costs that sting like a bee? Some of those are just “prepaid finance charges”, fancy lingo for interest paid in advance.

But here’s a fun twist! What if the mortgage fairy waved her wand and said, “These closing costs are on me!”? Or if a kind builder decided to foot your bill? It sounds free, but remember, there’s no such thing as free lunch… or free cake, unfortunately. 😢 That money’s coming from somewhere.

The plot thickens: The amount a lender can dance off your bill is influenced by your interest rate. A higher rate can mean the lender does more of the paying. Hence, the riddle of why 7.09% might be the twin of 7.5%.

Now, here’s a graph that’d make your eyebrows do the cha-cha:

Okay, moving on! Rates and mortgages are doing the tango these days, and not always in perfect harmony. Sometimes, a higher rate can actually mean the lender pays less of your upfront costs. It’s like expecting a bigger slice of cake but ending up with a crumb!

Now, nerdy glasses on 🤓:

Even if your lender keeps or sells your loan, it has a price tag. More interest = more value. So, a chunky $400k loan at 7.5%? It could be worth about $5000 more than its 7.0% cousin.

But, if you refinance too soon, the lender’s party gets crashed! Imagine them paying $5000 for your 7.5% mortgage, then rates slide down to 6.5%, and you refinance. Suddenly, the lender’s dancing to sad trombone music.

The fear of this party crasher means lenders sometimes play safe and keep their wallets closed. Plus, with more mandatory costs on mortgages (thanks Fannie and Freddie), some loans just don’t let lenders cut you a break.

The juicy gist?

While lenders usually sprinkle some magic dust to give you a higher rate with lower costs, the fairy tales aren’t always real. Sometimes, your only dance move is to pay those hefty upfront costs yourself. Don’t worry, a fairy god-realtor or builder might still come to the rescue! But for the mortgage lenders, we might have to wait for the stars to align.

Stay tuned, rate-aficionados! We dived into the rate ocean last week. Next week, we’ll pull out our crystal balls and peer into the future!

Stay curious and keep dancing! 💃🕺