For weeks now, this newsletter has been trying to sound the alarm, almost like your overprotective aunt who won’t stop warning you about the perils of leaving the house without a jacket. “Mortgage rates could go higher after the Fed rate cut,” we said. “Watch out for that big jobs report,” we added. Well, here we are again, still unable to predict the future (I left my crystal ball at home), but it’s time to issue another warning.

The last five months have been a rollercoaster of volatility in the financial markets, including mortgage rates. But the past week and a half? Let’s just say it hasn’t exactly been a thrilling ride—more like sitting in bumper-to-bumper traffic. But don’t let this lull fool you; November might just hit us with more twists and turns than we’re ready for.

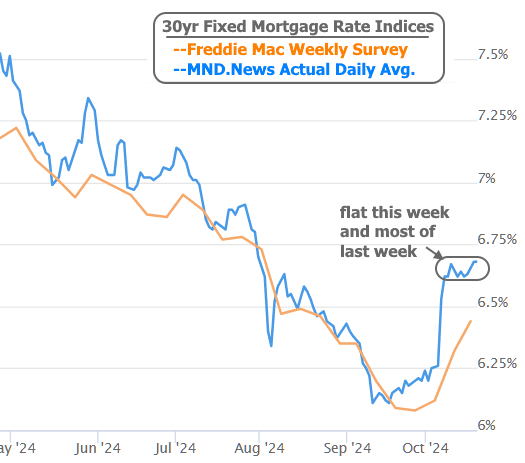

Despite some doom-and-gloom headlines about skyrocketing mortgage rates this week (thanks, Freddie Mac’s delayed weekly index!), the reality is that things have mostly been holding steady since last Monday. That was right after the big jobs report dropped earlier in the month, which gave us a 0.36% spike in mortgage rates. Since then, we’ve stayed within a 0.06% range, according to MND’s daily rate index. Not exactly edge-of-your-seat stuff.

If you were keeping an eye on interest rates and markets between 2020 and 2022, then you’ve already survived some real volatility—like riding a rollercoaster blindfolded. And while potential volatility doesn’t always come to fruition, we need to prepare for the possibility of some serious market upheaval in early November.

The first six days of November are shaping up to be… eventful. Why? Well, not only do we have a presidential election, but we’ve also got another critical jobs report dropping the day after. What could possibly go wrong? And as if that wasn’t enough, the following Wednesday we get the next Fed rate announcement. While there’s a chance the Fed might skip a rate cut this time, that’s actually the least exciting ingredient in November’s volatility cocktail. It’s the jobs report that could really shake things up.

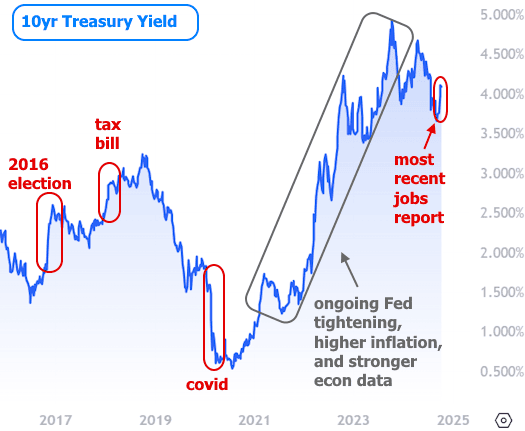

Let’s use the 10-year Treasury yields as our trusty benchmark to refresh our memories on the kind of chaos elections and major policy changes can cause (remember the 2017 tax bill, anyone?).

Back in the day, the election itself wasn’t the biggest source of volatility, but rates did jump over 1%, most of which happened in the first few weeks. So, buckle up, because big moves could be coming in either direction.

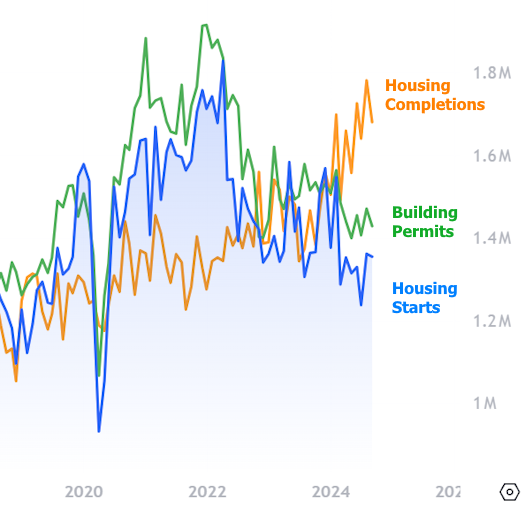

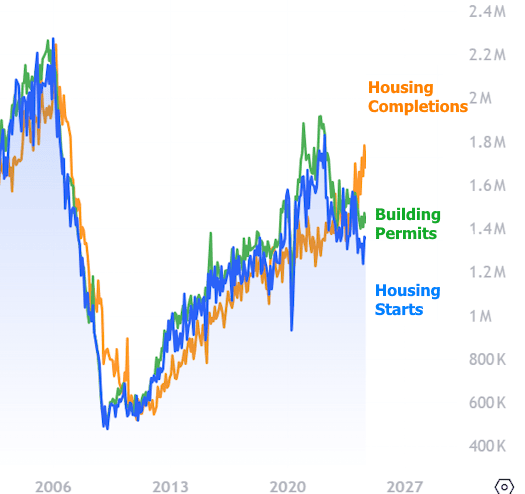

As for this week, well, it was so uneventful that I could sum it up in one word: meh. Still, I’ve got some charts to show you, and who doesn’t love charts? So, without further ado (and without much commentary), here they are:

Above, you can see the 3 main components of the Census Bureau’s new residential construction report. The chart below offers the same information but stretched out over a longer timeline. The only interesting takeaway here is how the construction side of housing can look different depending on whether you’re looking at permits/starts or actual completions.

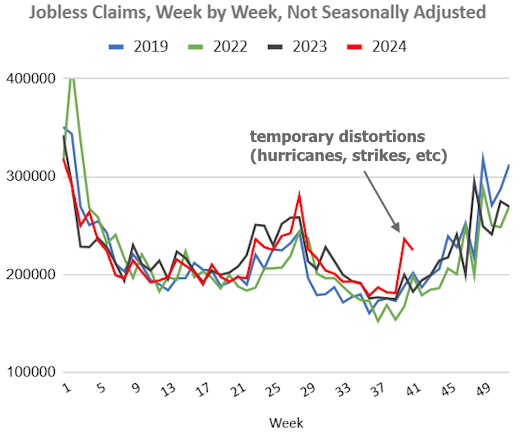

Now, let’s shift gears to Thursday morning’s economic data (the only day this week where anything interesting happened). Jobless Claims remained elevated, which might’ve helped bonds… if it weren’t for the fact that the elevation was temporary. And, just for added spice, traders were expecting the claims to be even higher.

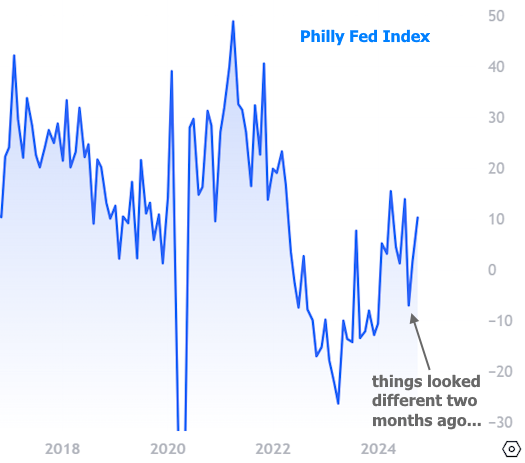

The Philly Fed Index was much higher than expected, which put a little extra pressure on rates, but in the grand scheme of things, it was just a minor blip.

So, there you have it. November might be a wild ride, or it might be like waiting for a rollercoaster that never arrives. Either way, it’s time to prepare for the possibility of some real volatility.