Once upon a time in the land of economics, there was a star performer known as the Consumer Price Index (CPI). This diva of the financial world has a knack for making interest rates jump and jive like jitterbugs. Why, you ask? Well, inflation’s been feeding them energy drinks, that’s why!

But hold your horses! CPI isn’t the only bigwig in town. Enter the Employment Situation, aka “the jobs report.” This cool cat struts in every month, and two weeks ago, it played a major role in the dramatic dip in rates. After that showstopper, everyone held their breath, waiting for CPI’s next performance.

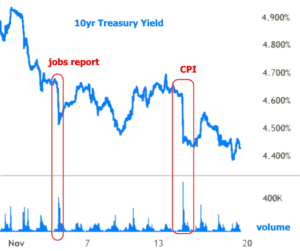

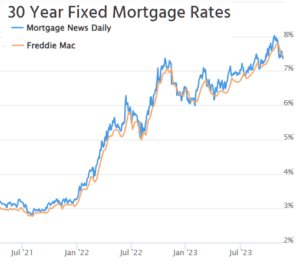

Anticipation in the financial world can be like waiting for your favorite TV show’s season finale – sometimes it’s a yawn, but not this time! Behold, a chart depicting the dance-off between interest rates and 10-year Treasury yields, a tango of financial figures.

Let’s break it down: the CPI didn’t just nudge yields (fancy lingo for “rates”), it threw them into a tizzy, shaking up the trading volume like a martini in James Bond’s hand. And guess what? The CPI wasn’t even trying to be as shocking as the jobs report!

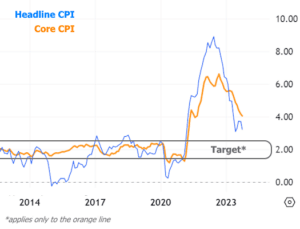

Meanwhile, the Fed’s like a strict dietitian, wanting core inflation (the kind that doesn’t count your snacks and gas) to slim down to a trim 2% yearly. We’re overindulging at over 4% now, but hey, at least we’re stepping on the treadmill.

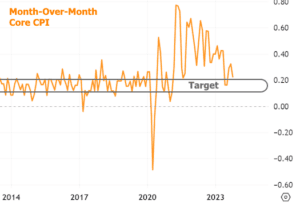

Investors, those bond market gurus, are scrutinizing the month-over-month figures like detectives with magnifying glasses. Imagine if we keep chipping away at core inflation by 0.17% each month – we’d hit the jackpot of 2.0% annually!

We had a fleeting taste of this target not too long ago, but like a mischievous kid, this week’s numbers were a tad over the line.

So, what’s with the uproar in Bondville? It’s a classic case of reality vs. expectations. Traders don’t just sit around waiting for reports; they’re more like fortune tellers, making bets based on economists’ predictions. But when reality struts in wearing an unexpected outfit, the market throws a party (or a tantrum).

The big question: why did the CPI’s latest show cause such a stir? Well, it’s like traders were at a crossroads, ready to sprint in any direction. This CPI was the starting gun for their race.

For those who love a good mystery, dive into the report’s finer details. Check out the housing component – it’s been a slowpoke in the inflation race but is now picking up pace, dropping from a 0.6% strut to a more modest 0.3% jog. Good news for rates!

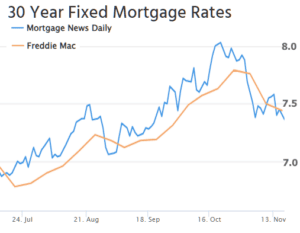

Mortgage rates are now tip-toeing at their lowest since a sunny day in mid-September. But remember, this is just the beginning of a marathon, not a sprint. Our next chart is like a history book, reminding us of past times when rates seemed to turn a corner, only to pick up speed again.

In past episodes, it was a resurgence in inflation and economic growth that flipped the script. The moral of the story? We need more days like this CPI show to really shake things up. The next big act? Not until the first week of December. So, maybe rates will chill out with the drama for a bit.

Stay tuned, finance fans, because in the world of economics, there’s always a twist around the corner!