Last Thursday, the folks over at Mortgage News Daily (MND) dropped an article with a title that basically said, “Hey, mortgage rates are chilling at their low spots, but don’t get too comfy because Friday’s going to be a wild ride.” Spoiler alert: rates did jump, and not just a little hop, but the biggest leap we’ve seen in over a year. It was more dramatic than that plot twist in your favorite binge-watch.

Now, before you start thinking these MND wizards had a crystal ball or got lucky on a hunch, let me set the record straight. Their headline wasn’t trying to play fortune teller; it was more like saying, “Buckle up, we’re in for a ride, and it could go either way.” They knew an economic report was coming that could shake things up, but as to how? Well, that was the million-dollar question.

Enter the jobs report, the star of the show, which turned out to be the plot twist no one (or at least those not reading closely) saw coming. Depending on where you get your mortgage gossip, you might have seen the fallout or blissfully missed the drama.

Freddie Mac, in the meantime, has been doing its thing with a weekly mortgage rate survey that’s about as traditional as pineapple on pizza. Despite having coverage wide enough to make it into your grandma’s newspaper clippings, even some top-tier financial folks are tuning in, despite newer kids on the block being around.

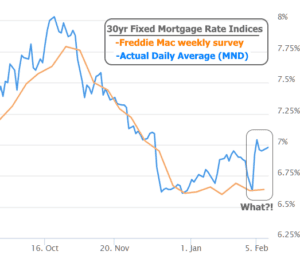

Just a day before the chaos, Freddie was like, “Nothing to see here, folks,” with rates barely budging from 6.63 to 6.64. Their homepage was practically singing “no change” in the mortgage rate choir, with rates floating in that mid-six percent range like a boat on a calm lake.

But then, plot twist! By the time Freddie was ready to sing again, the average mortgage lender was hitting notes higher than last week’s. Borrowers were seeing rates that had jumped up by HALF A PERCENT. Drama, right?

Now, there’s a bunch of ways to try and make sense of this plot thickening. Freddie’s number crunching includes a 5-day average, which, due to some early-week rate hikes, skewed the numbers. It’s like finding out your “average” snack consumption includes that one day you found the hidden chocolate stash.

And oh, look at that flat orange line in Freddie’s chart, pretending like nothing happened since last December. But when you do the math with MND’s daily rates, you find a little inconsistency that’s harder to ignore than your neighbor’s holiday lights still up in February.

Bottom line: that orange line in the chart? It’s looking a bit suspect. Rates have climbed up the ladder since last Thursday and way past December.

In other news, the Federal Reserve members have been on a speaking tour, probably sharing the same script. Their message? “Inflation’s cooling off, but let’s not throw a party yet. We might cut rates this year, but let’s see how the economy plays out.” It’s like they’re all reading from the same bedtime storybook.

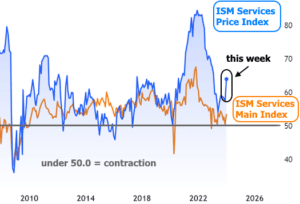

And then there was another economic report stirring the pot, not quite as headline-grabbing as the jobs or CPI report, but still enough to nudge rates a bit. The ISM services index came out flexing, especially the “prices” bit, hinting that inflation isn’t ready to take a nap yet.

So, what’s the deal with next week’s excitement? That’d be the Consumer Price Index (CPI), the other heavyweight report that can make rates dance. Depending on how the core CPI (sans food and energy prices) plays, we might see rates doing the cha-cha in either direction. Stay tuned, because in the world of mortgage rates, it’s always a bit of a guessing game.