Brace yourselves, folks! This week, we played a thrilling game of “Guess What the Fed’s Dot Plot Will Do Next.” It’s like playing darts with the economy, but with less beer and more interest rates.

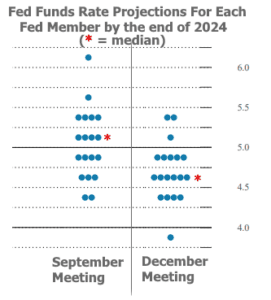

So, what’s a dot plot, you ask? Picture a chart that pops up four times a year, kind of like a financial Groundhog Day, but with less weather forecasting and more economic projecting. These projections are not crystal ball predictions, but let’s face it, they might as well be. They give the market a sneak peek into how the Fed might tinker with short-term interest rates if things go as expected.

The Fed’s latest crystal ball – I mean, dot plot – is all about jobs chilling out a bit and inflation trying its best to hit the target. The dots are basically saying, “If the economy keeps on keeping on, here’s where we think the interest rate party will be.”

Remember the last dot plot from the September Fed meeting? It was like seeing your favorite band’s setlist, but for interest rates. It hinted at rates being 0.50% higher than their June encore. The market didn’t throw roses at that performance. Thanks to some sturdy economic data, those dots pushed interest rates to a high note we haven’t seen in ages.

This week’s dot plot had us biting our nails. We had hints from recent Fed chitchats and moderate economic data, but the big question was: How much sunshine would this forecast bring?

Ta-da! The median Fed member now sees the Fed Funds Rate hitting 4.625% by the end of 2024, a bit less daunting than the 5.125% we saw in the last episode. And boy, did the market do a happy dance when that news dropped!

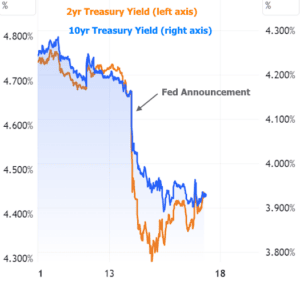

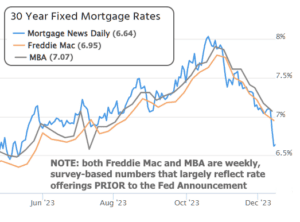

Let’s talk about Treasury yields. The 2-year ones are like the Fed Funds Rate’s best buddies, while the 10-year yields are the cool cousins of mortgage rates. Speaking of which, mortgage rates had a rollercoaster of a week. You wouldn’t know it unless you peeked at daily averages like the Mortgage News Daily index, because weekly surveys are still rubbing their eyes in disbelief at the recent drop.

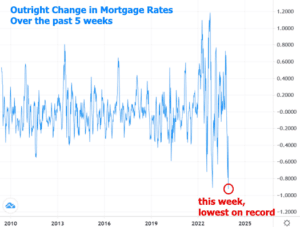

Fun fact: While Freddie Mac’s rate index had its glory days of bigger drops back in the ’80s, the MND index just set a record for the biggest 5-week plunge. It’s like breaking a decades-old high score in a game of economic Pac-Man.

In a plot twist, Fed Chair Powell casually mentioned that rate cuts might be on the table. But, like a strict parent, he reminded us that if inflation throws a tantrum, they might just hike rates again. For now, the Consumer Price Index (CPI) data suggests we’re on the right path, but there’s still a long road ahead.

No new CPI drama until next year, and with other economic data also taking a holiday break, it’s like the market is going into hibernation mode. Rates might do a little dance here and there, but the real action is hitting the pause button until everyone’s back from their festive siestas.